Memory and storage solutions provider Micron (NASDAQ:MU) will report its Fiscal first-quarter financial results on December 20 after the market closes. The company is expected to benefit from the artificial intelligence boom, favorable pricing, and strong demand for its memory and storage solutions. Ahead of the company’s Q1 earnings release, several analysts remain bullish about MU and have reaffirmed their Buy ratings on the stock.

Last month, MU raised its Q1 revenue outlook. It anticipates that revenues will reach $4.7 billion compared to its prior guidance of $4.2 billion to $4.6 billion. Moreover, the company now expects a loss of $1 per share, compared to a previous range of a loss between $0.93 and $1.07.

Overall, Wall Street expects that Micron will post a loss of $1 per share in Q1 versus a loss of $0.04 per share reported in the prior-year period. Meanwhile, revenue is expected to rise by 12% from the year-ago quarter to $4.58 billion.

Q1 Earnings: Here’s What Analysts Are Saying

It is worth highlighting that in the past week, seven Wall Street analysts maintained a Buy rating on MU stock, while one reiterated a Hold.

Among the bullish analysts, TD Cowen analyst Krish Sankar believes Q1 results benefited from demand tailwinds. Further, the analyst finds the valuation reasonable and in line with the historical average.

Another analyst, Ambrish Srivastava of BMO Capital, maintained a Buy rating on Micron and raised the price target to $90 from $80. He expects that the company’s Q1 results will outperform consensus estimates. Furthermore, Srivastava noted that shrinking inventory levels, coupled with stable DRAM and NAND pricing, are positives.

Is MU a Good Stock to Buy?

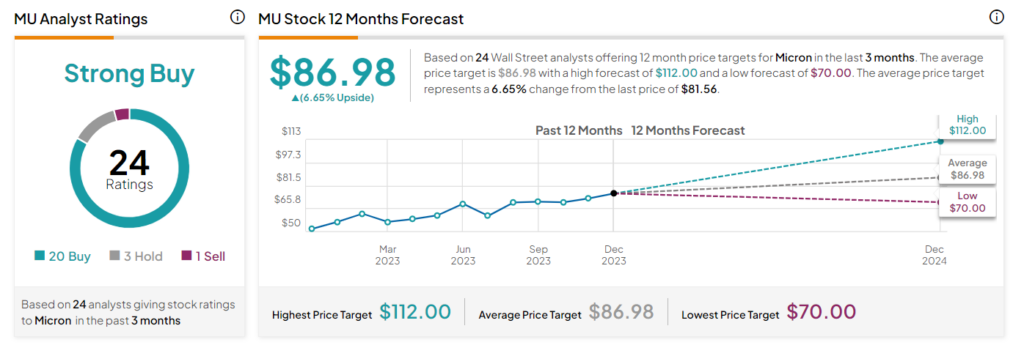

Of the 24 analysts covering Micron, 20 have a Buy rating, three suggest a Hold, and one assigned a Sell rating in the past three months. Overall, the stock comes in as a Strong Buy. Meanwhile, the average MU stock price target stands at $86.98, implying upside potential of 6.7%. Shares are up 62.8% year-to-date.

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in MU stock to move by +/-5.32% after reporting earnings.