The technology and social media giant Meta Platforms (NASDAQ:META) posted robust Q4 earnings. The company witnessed rapid growth in its revenue and earnings, along with increased user engagement. Further, the company declared its first dividend payout during the Q4 conference call. Given stellar earnings, Meta has successfully positioned itself as a growth and income stock.

Before we dig deeper, it’s worth highlighting that Meta stock appreciated over 109% in one year. Further, it gained over 15% in Thursday’s after-hours trading.

Meta’s Growth Accelerates

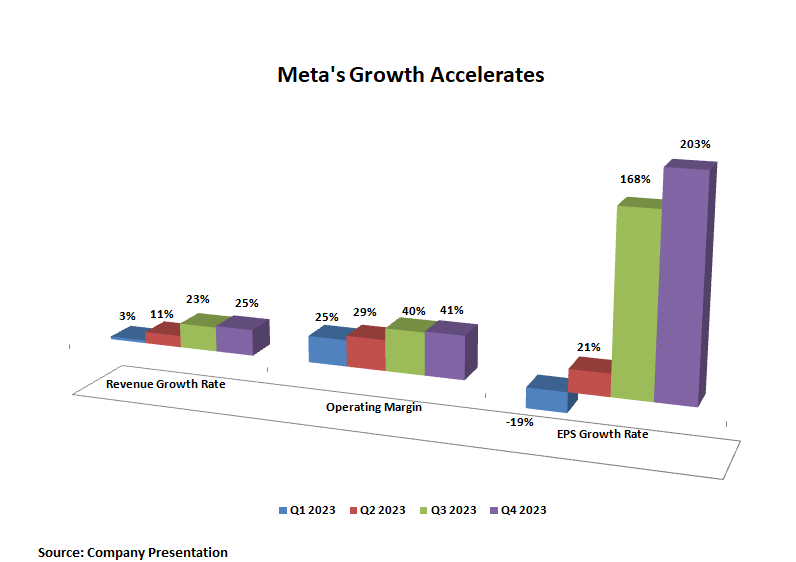

The graph below shows that Meta’s revenue, operating margin, and EPS growth accelerated sequentially. Its ability to drive higher engagement led by reels and video, incorporation of Generative Artificial Intelligence (AI) in its products, and focus on lowering costs led to a solid recovery in its revenue and profitability.

What stands out is that Meta’s year-over-year top-line growth rate accelerated from about 3% in Q1 of 2023 to approximately 25% in Q4. Further, its operating margin expanded from 25% in Q1 to 41% in Q4. Thanks to the higher sales and lower operating costs, Meta’s EPS marked a substantial recovery, from witnessing a decline of 19% in Q1 to growing by 203% in Q4.

Meta is Now an Income Stock

Thanks to its strong growth and expanding earnings base, Meta continues to invest in the business and focuses on returning capital to its shareholders. While the company has historically returned cash in the form of share repurchases, it surprisingly announced its first dividend payout during the Q4 conference call.

Meta announced a quarterly cash dividend of $0.50 per share, payable on March 26, 2024, to stockholders of record as of February 22, 2024.

What is the Prediction for Meta Stock?

Wall Street analysts are bullish about Meta stock’s prospects. However, analysts’ average price target suggests a limited upside potential due to the rally in its share price over the past year.

It’s worth noting that most of the price targets were set before the Q4 earnings report. This raises the possibility that META stock might witness upward adjustments in price targets from analysts due to aggressive investments in AI, promising growth prospects, enhanced revenue and profitability, and the initiation of dividend payments.

With 27 Buys and two Holds, Meta stock has a Strong Buy consensus rating. Analysts’ average price target of $426.11 implies 7.94% upside potential from current levels.

Bottom Line

Meta’s investments in AI to drive user engagement and ad sales augur well for growth. Moreover, the company’s emphasis on optimizing operational efficiency is expected to cushion its margins and EPS, potentially supporting its share price. This is reflected in analysts’ bullish outlook on META stock.