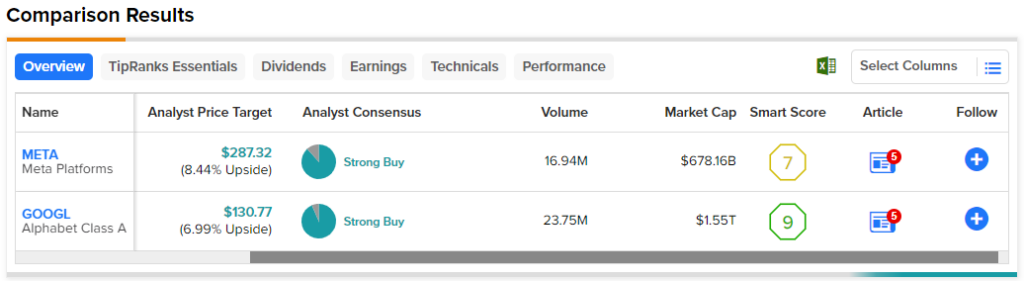

In this piece, I evaluated two Big Tech stocks, Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), using TipRanks’ comparison tool to determine which is better. Meta shares have more than doubled year-to-date, while Alphabet stock is up a “mere” 37%. However, over the last 12 months, Alphabet has only gained 6%. On the other hand, Meta is up more than 40% over the last 12 months.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Of course, Meta Platforms and Alphabet need no introduction and aren’t going anywhere anytime soon. Thus, what’s being considered is whether now might be a good entry point based on the current prices and past trends.

Meta Platforms (NASDAQ:META)

Facebook parent Meta Platforms is trading at a price-to-earnings (P/E) multiple of 33.7 versus its five-year mean P/E of 24.8. In fact, it’s trading roughly at the top of the range of its P/E over that time period — despite its recent struggles. Thus, a neutral view seems appropriate for now.

Insiders have unloaded about $9 million worth of Meta shares over the last three months. Most of those sales were auto-sells, probably part of the executives’ preset trading plans aimed at helping them avoid insider trading. However, looking at where executives set their auto-sell price can suggest at what price they think the company is fairly valued. The most recent sale was from two days ago at around a price of $270. Hedge funds have also been dumping Meta shares, selling about 6.1 million shares in the last quarter.

It’s no secret that Meta Platforms has had a difficult couple of years, despite the tear its stock has been on. The company recently laid off tens of thousands of workers as it struggles to maintain its bottom line. Last year, investors wiped $80 billion off its value overnight following an earnings disappointment.

The company has also been dealing with an identity crisis after changing its name to reflect a pivot from social networking to the Metaverse. Meta Platforms is now shelling out billions per year to develop its metaverse, although it will likely be some time before those investments yield fruit.

Meanwhile, its competitors like Alphabet and Microsoft (NASDAQ:MSFT) are focusing on generative AI (artificial intelligence) instead of the Metaverse, leaving it to play catch-up. In short, at current levels, this doesn’t look like a good time or price at which to invest in Meta Platforms.

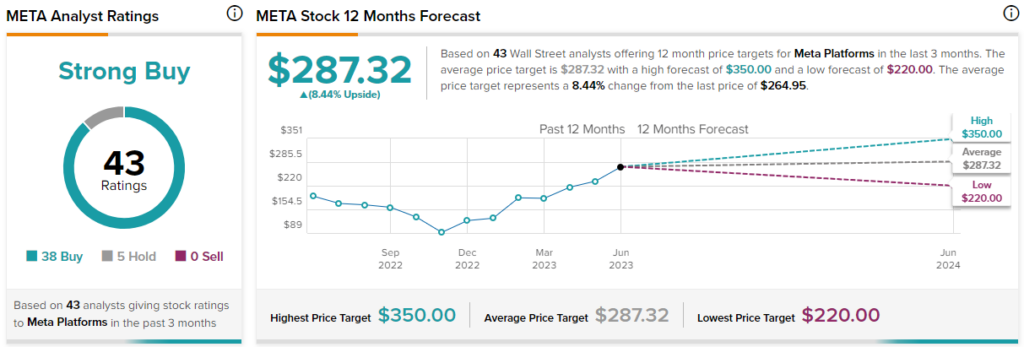

What is the Price Target for META Stock?

Meta Platforms has a Strong Buy consensus rating based on 38 Buys, five Holds, and zero Sell ratings assigned over the last three months. At $287.32, the average Meta Platforms stock price target implies upside potential of 8.4%.

Alphabet (NASDAQ:GOOGL)

At a P/E of 27.9 versus its five-year mean P/E of 29.2, Alphabet looks fairly valued right now. However, the company remains in a solid financial position and should continue growing, helping it recover to its highs near $150/share reached in late 2021. Thus, a bullish view looks appropriate over the long term.

Alphabet has also been laying off workers, albeit at a much slower pace, after announcing 12,000 layoffs in January, amounting to 6% of its global workforce. The company hasn’t ruled out another round of job cuts, but nothing has been announced yet. Meanwhile, other tech behemoths have cut tens of thousands of jobs, suggesting Alphabet may be in a better position.

Like most other tech companies, Alphabet’s operating expenses soared in 2022, climbing to $81.8 billion from $68 billion in 2021. However, the company managed to keep its net income margin steady, at ~21% in 2022 versus 29.5% in 2021 and the low 20% range between 2018 and 2021.

What is the Price Target for GOOGL Stock?

Alphabet has a Strong Buy consensus rating based on 29 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $130.77, the average Alphabet stock price target implies upside potential of 7%.

Conclusion: Neutral on META, Long-Term Bullish on GOOGL

Over the long run, it’s hard to go wrong with Meta Platforms or Alphabet, but over the short run, Alphabet simply looks better at current levels. Several market watchers have noted that large-cap tech stocks are now seen as recession-resistant names due to their staying power, and this seems true of Alphabet.

Although advertising is a cyclical business, I would expect further upside in Alphabet shares in the near-to-long term but little upside in Meta Platforms in the near term due to its current struggles. Eventually, Meta should recover, but its stock has gotten too high too fast, leaving Alphabet in the dust and creating an attractive opportunity in Alphabet stock.