Social media behemoth and metaverse pioneer Meta Platforms (NASDAQ:META) isn’t exactly a stock that comes to mind when one thinks of the artificial intelligence (AI) race. Indeed, Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) may be leading the generative AI charge, but Meta is an AI underdog that I think is still worth betting on. Additionally, though Meta probably won’t unveil its version of ChatGPT anytime soon, the firm does have AI tech that’s hard at work behind the scenes.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Meta already has its hands in other pies (mainly the metaverse), but AI will likely play an increasingly important role in the firm’s future. Most notably, integrating AI into the company’s existing platforms could help unlock next-level growth as the company looks to find new ways to leverage its profoundly powerful network.

You can bet that the powerful social media company will benefit from unprecedented network effects as it tests out new innovations.

As a result, I remain bullish on Meta Platforms stock, even though most of the “easy money” has already been made, with shares now up more than 110% since their November 2022 low.

AI: The Glue That Binds Social Media and the Metaverse?

Meta is very busy with the metaverse, spending billions on it to get a head start. After all, the costs of building the virtual worlds of tomorrow do not come cheap! Therefore, adding AI to the mix seems like just another hefty expenditure that’s taking away from the firm’s nearer-term profitability prospects. However, I think the combo of AI, the metaverse, and social media could make for a powerful trio that blends well together.

Not only can AI bets translate into growth that’s not so far into the future (at this juncture, it seems like generative AI is closer to prime time than the metaverse), but AI innovations could also help create the ramp that eventually helps users make the jump into the metaverse. Further, the social-media business could also get a much-needed jolt from enhanced AI capabilities.

Indeed, next-generation AI is applicable to several industries. Though Meta still has its distant sights set on the metaverse, I believe AI could serve as a natural stepping stone for the firm.

Higher Rates Bring Cost Cuts, but Cutting Too Deep Could be Risky

As the prospect of much higher interest rates incentivizes cost cuts and other measures to improve operational efficiencies, Meta is in search of a new balance, just like its FAANG peers. Certainly, cost cuts are to be rewarded by Wall Street. However, FAANG innovators still need to stay on their toes and keep up with technological trends or run the risk of being left behind as market overlap between FAANG companies increases.

With concern that the Fed funds rate could hit 6%, the calls for cuts are getting louder. Activist investors want Meta to pull back on spending, especially regarding the metaverse.

Though Meta has taken steps to respond to the weakening economy, with mass layoffs (more cuts could be coming) and a plan to treat 2023 as a “year of efficiency,” CEO Mark Zuckerberg made it clear that the company’s focus is on “cutting projects” that either “aren’t performing” or those that “may no longer be crucial.” This likely rules out cuts in innovative areas (think AI) where Meta needs to stay on the cutting edge. In fact, Meta CFO David Wehner also talked about Meta’s intent to expand its AI capacity.

Further, Zuckerberg also remarked that cuts made to middle management could help the firm “make decisions faster.” Indeed, streamlining middle management may help the firm increase its agility while decreasing costs. Whether such an effort leads to a “two birds, one stone” type of scenario, though, remains to be seen.

In any case, such comments are incredibly encouraging for investors looking for Meta to stage a turnaround. Cost cuts are on the way, but it doesn’t seem like the cuts will come too deep, with the firm still committed to investing in AI and the metaverse.

Is META Stock a Buy, According to Analysts?

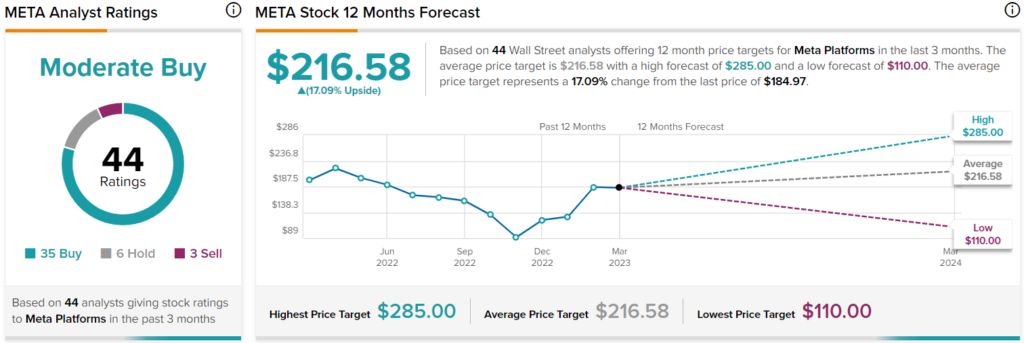

Turning to Wall Street, META stock comes in as a Moderate Buy. Out of 44 analyst ratings, there are 35 Buys, six Holds, and three Sell recommendations.

The average META stock price target is $216.58, implying upside potential of 17.1%. Analyst price targets range from a low of $110.00 per share to a high of $285.00 per share.

The Bottom Line on Meta Platforms

As tech heavyweights clash for a slice of a booming AI market, it’s likely that many firms are feeling conflicted as they look to strike a balance between investing for the future and cutting costs.

At this juncture, I think Meta is in the sweet spot, with a forward-focused Zuckerberg who seems to be playing the long game with the metaverse and other projects “crucial” to the firm’s future growth.

Undoubtedly, profitability is of increasing importance as the Fed stays hawkish. After a year of efficiency, I think Meta can give the market what it wants without compromising on the innovation front.