Meta Platforms (META) finished last week with some strength, surging over 7% on a big up day for technology stocks. Though there’s no shortage of issues with the Meta story, it’s hard to overlook the dirt-cheap multiple and continued optimism from CEO, Mark Zuckerberg.

There’s no question that Zuckerberg is incredibly ambitious regarding the metaverse. He changed his firm’s name and growth trajectory to reflect the strengths of his beliefs. Though critics may slam Zuckerberg, given all the controversies involved with his firm’s data collection practices, I’d argue that the risk/reward is looking pretty good for those willing to give the man the benefit of the doubt.

Indeed, Zuckerberg’s reputation with many has taken a hit over the years. Despite his growing unpopularity, with certain investors looking for Zuck to step down, it’s hard to overlook the profound value to be had in the name. Meta is a stock that will always lose in popularity contests. However, in the long run, it may prove tough to stop the robust Family of Apps social-media business, as the firm goes all-in on the metaverse.

Sure, the metaverse seems like just another abstract, money-losing effort that may not pay off for years, if not decades. However, the Family of Apps is more than capable of paying off the lofty metaverse bills. And if the metaverse is ready for the mainstream within the next five years, rather than the next 10-15 years, as some “realistic” folks may expect, Meta stock seems too cheap to ignore at these depths.

At 12.8 times trailing earnings, Meta stock is a value play capable of next-level growth. In the near term, it will continue to be volatile, as investors aren’t fans of Zuckerberg or the trajectory of Daily Active Users (DAUs) over at Facebook.

Many haters want to see Meta fail as it looks to new horizons. However, I don’t think it will, given the turnaround potential in the social-media business and the potential for metaverse efforts to yield fruit quicker than expected. I am bullish on Meta stock.

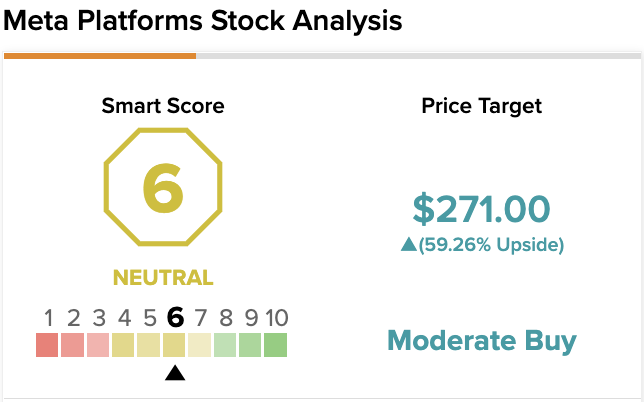

On TipRanks, META scores a 6 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Are Mark Zuckerberg’s Metaverse Ambitions a Tad Unrealistic?

In a recent sitdown with CNBC Mad Money host Jim Cramer, Mark Zuckerberg shed more light on what type of rewards to expect from metaverse efforts. He sees a billion people plugged into the metaverse, spending hundreds each on digital goods and content.

That’s a pretty sizeable total addressable market, with some colossal rewards if consumers open up their wallets on digital goods. If Zuckerberg’s metaverse ambitions come true, Meta will be pulling in considerable revenue, even with a small slice of the metaverse market.

Admittedly, Zuckerberg’s ambitions seem a tad far-fetched to many. It isn’t just about when the metaverse will be ready for prime time, but whether or not the one billion people plug into Meta’s version of the metaverse.

Meta faces some pretty stiff competition in the metaverse, with firms like Apple (AAPL) and Microsoft (MSFT) likely to make a big splash in the areas of augmented and virtual reality.

Should users continue fleeing the Facebook ecosystem, it could prove difficult to gain them back. Arguably, Facebook and Zuckerberg have lost the trust of the average consumer. It will be tough to get it back and may take a lot more than just a name change and commitment to do better.

For now, it seems like many investors are writing off Meta’s $10 billion (and counting) bet. It’s hard to tell how bountiful the metaverse will be, and there’s a risk that it won’t pay off until more than a decade goes by. In a higher rate environment, the market penalizes such lofty spending with uncertain rewards prospects.

Can Reels reel in TikTok Users?

Even if the metaverse doesn’t yield fruit, Meta still has a cash cow in its social-media business. Though there are competitive pressures brought forth by TikTok, Instagram’s Reels seems more than capable of evening the playing field.

This isn’t the first time Meta has had to replicate a social-media innovation. It’s had great success doing so in the past. As the firm continues investing in Reels while enhancing other areas of its Family of Apps, I think the recent slip in the userbase will be short-lived.

How can Reels overpower the sensation that is TikTok? Meta is leveraging the power of AI to better engage users. Such efforts are showing subtle signs of paying off, with around a fifth of time spent on Instagram on the Reels media feed.

Further, a coming recession could cause consumers to spend less time on pricey services like Netflix (NFLX) and more time on free, ad-based forms of entertainment like Facebook and Instagram.

Wall Street’s Take

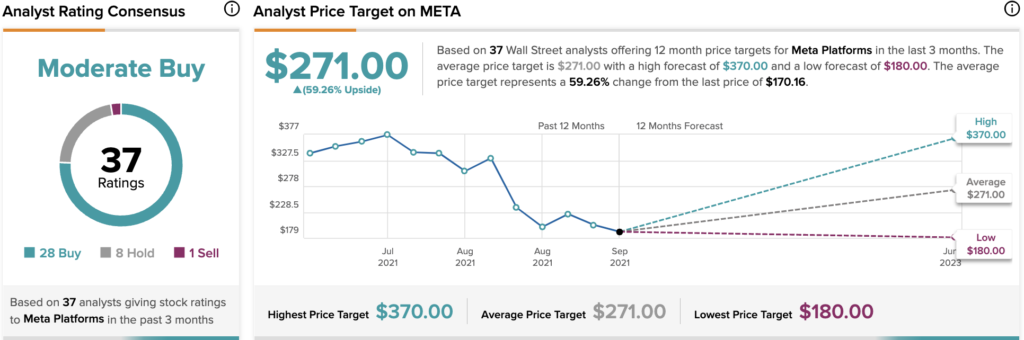

According to TipRanks’ analyst rating consensus, META stock comes in as a Moderate Buy. Out of 37 analyst ratings, there are 28 Buy recommendations, eight Hold recommendations, and one Sell recommendation.

The average Meta price target is $271, implying an upside of 59.3%. Analyst price targets range from a low of $180 per share to a high of $370 per share.

The Bottom Line on Meta Stock

Meta stock seems too oversold for its own good. The social-media business looks recession resilient. As Meta bolsters Reels, I think it can gain the upper hand on rivals like TikTok. Even if the metaverse doesn’t boast one billion users anytime over the next decade, the value proposition of META stock still seems too good to pass up.

Read full Disclosure