It’s been almost nothing but good times for Meta (NASDAQ:META) investors this year. Fueled by the successful implementation of Mark Zuckerberg’s ‘year of efficiency’ strategy while at the same time displaying back-to-growth credentials, investors have sent shares up by a huge 178% year-to-date.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

So, is it time many to take a step back and pivot to other opportunities? Au contraire, appears to be the opinion of Tigress’ Ivan Feinseth, a 5-star analyst rated in the top 4% of the Street’s stock pros.

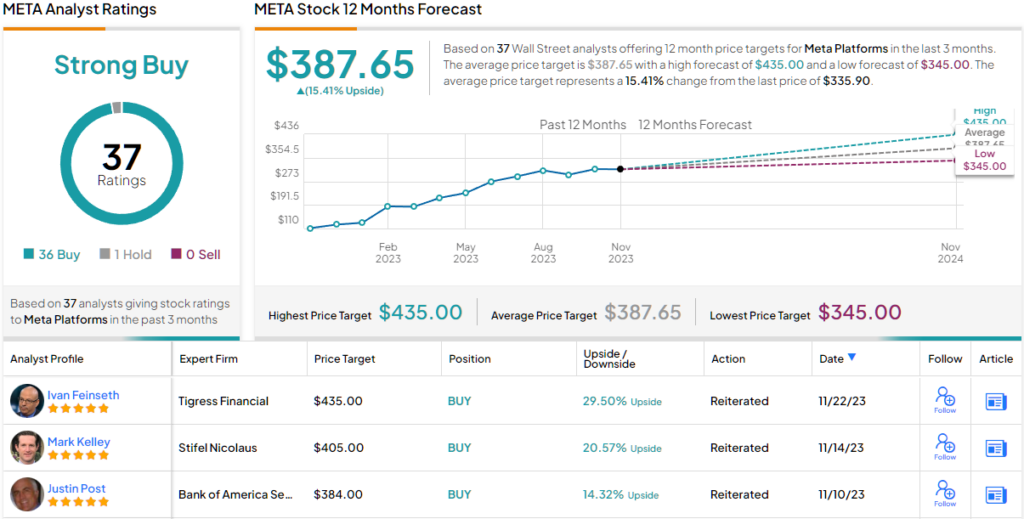

In fact, such is Feinseth’s confidence in Meta’s ongoing success, the analyst recently not only reiterated a Strong Buy rating on the shares but upped his price target from $380 to $435, suggesting the stock has room to climb 30% higher over the coming year. (To watch Feinseth’s track record, click here)

There are different reasons why Meta is poised to keep charging ahead, but chief amongst them is the opportunity afforded by this year’s big buzzword: AI.

As the company keeps on investing and ramping up AI tools and capabilities to drive further engagement and revenue growth, Feinseth sees META as a prime opportunity for capitalizing on the monetization potential of AI.

“META’s AI initiatives will help drive the functionality of its application platforms and help other companies build sophisticated text, analysis, and other outputs to integrate into their applications,” the analyst went on to add. “Increased AI-driven functionality to its apps will give the company’s 3 billion users a better, more advanced experience than OpenAI’s ChatGPT.”

Meta plans to initiate the training of its new AI system, a substantial language model (LLM), early next year. The potency of LLMs tends to rise with the extent of data used in their training. The most robust version of the Llama 2 model, unveiled by META in July, was trained on an extensive 70 billion parameters, which denote the variables in an AI system and indicate its size. With a notable 30 million downloads recorded last month, Llama 2 currently stands as the largest open-source model.

The ongoing expansion of AI capabilities to bolster ads, Feed, and Reels, coupled with increased investments in Meta’s generative AI initiatives, alongside the sustained success of Reels and the introduction of Threads, is anticipated to “drive increased user engagement.” This, in turn, is expected to generate greater ad revenue. Additionally, the combination of ongoing cost management and operational efficiencies could provide “further upside” to Feinseth’s current expectations.

Feinseth’s bullish take gets the support of almost all his colleagues. While one analyst currently remains on the fence regarding Meta’s prospects, all 36 other reviews are positive, making the consensus view here a Strong Buy. Going by the $387.65 average target, a year from now, shares will be changing hands for a 15% premium. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.