MercadoLibre’s (NASDAQ:MELI) ever-expanding footprint has gradually given way for the company to achieve significant economies of scale, including higher margins and, thus, stronger profitability prospects. Often dubbed the “Amazon of Latin America,” MercadoLibre is poised to maintain its upward trajectory due to the fragmented nature of its operating markets, particularly in the stimulating sectors of e-commerce and fintech.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s latest financial results once again showcased its immense potential, with revenues and net income experiencing a meteoric rise. In fact, MercadoLibre’s Q1 results beat analysts’ expectations across the board and even re-accelerated from recent quarters.

Interestingly, despite these impressive achievements, the company’s shares have been trading relatively flat for several months, suggesting the presence of overlooked upside potential. Accordingly, I remain bullish on the stock.

A Highly-Fragmented Market with Untapped Potential

MercadoLibre’s core investment case remains robust, as, despite the company’s rapid expansion, the e-commerce and fintech industries remain highly untapped in Latin America. With a population north of 670 million and no other company developing an e-commerce, logistics, and fintech network as comprehensive as MercadoLibre’s, the company is well-positioned to completely dominate these fields.

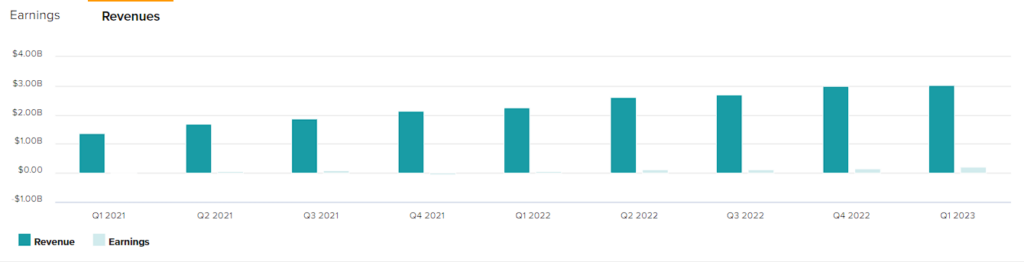

This can already be observed by MercadoLibre’s ability to sustain an unreal pace of growth over an extended period of time. Its five and 10-year revenue compound annual growth rates stand at 54% and 40%, respectively. Yes, this is right; MercadoLibre’s growth has even accelerated in recent years.

You may argue that this is due to the pandemic-driven exponential rise in e-commerce and fintech adoption, but this is only partially the reason. This is proven by the fact that even though the pandemic is far behind us, MercadoLibre’s top line continues to climb higher, showing no signs of slowing down. In its most recent Q1-2023 results, MercadoLibre grew its gross merchandise value (GMV) by 43% on an FX-neutral basis to $9.4 billion.

Items sold on its platform came in at 309 million, up 16% compared to last year-year, resulting in the company achieving record quarterly revenues of $3.0 billion. Not only does this suggest a tremendous increase of 58.4% year-over-year on an FX-neutral basis, but it even implies an acceleration from Q4-2022’s revenue growth of 56% and from its five and 10-year historical averages!

LatAm’s Unbanked Population to Boost Fintech Segment

In addition to MercadoLibre’s rapidly expanding e-commerce division, its fintech division is experiencing a remarkable surge, fueled primarily by the increasing adoption of such technologies among Latin America’s unbanked population.

To put this into perspective, Brazil still has around 10% of its adult population without access to banking services, while countries like Argentina, Honduras, and Bolivia have less than half of their adult population with bank accounts. This presents MercadoLibre with a tremendous opportunity for growth, as evidenced by its sustained hypergrowth in the fintech sector long after its initial launch.

Notably, in the most recent quarter (Q1), MercadoLibre achieved an extraordinary milestone with total payments volume (TPV) of $37 billion, marking an impressive 96.1% increase compared to the previous year. Surprisingly, this growth rate has even accelerated from the already remarkable 81.2% TPV growth recorded in Q1-2022 and the 80% TPV growth reported in Q4-2022, underscoring the absence of any imminent slowdown.

This accomplishment is particularly noteworthy when considering the challenges faced by many U.S.-based fintech companies during the same period due to ongoing market turbulence. For instance, PayPal (NASDAQ:PYPL), a bellwether in the industry, reported a modest 10% TPV growth rate on an FX-neutral basis, primarily due to inflation, resulting in negligible real growth (ex-inflation).

Economies of Scale are Boosting Margins, Profits

Returning to my initial point, MercadoLibre has experienced remarkable growth in both e-commerce and fintech, leading to the emergence of economies of scale. Consequently, this has significantly bolstered the company’s margins and overall profitability outlook.

A noteworthy demonstration of this can be found in the Q1 results, wherein MercadoLibre witnessed a substantial expansion in gross margins from 47.7% to 50.6% year-over-year. This remarkable improvement can be attributed primarily to a 330 basis point expansion related to cost of goods sold, excluding salaries and wages, as well as 300 basis point expansion driven by enhancements in the quality of assets and improvements in credit conditions (provisions for doubtful accounts).

Notably, these developments resulted in a tremendous surge in the company’s operating margin from 6.2% to 11.2%. As a result, MercadoLibre achieved record-breaking quarterly profits, soaring by an astounding 209% to reach $201 million.

Is MELI Stock a Buy, According to Analysts?

As far as Wall Street’s sentiment goes, MercadoLibre features a Strong Buy consensus rating based on seven Buys and one Hold assigned in the past three months. At $1,588.13, the average MercadoLibre stock price target implies 37.7% upside potential.

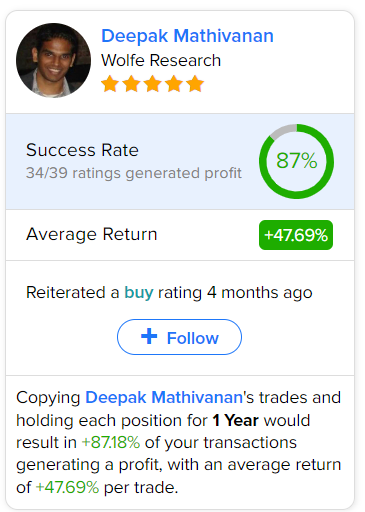

If you’re wondering which analyst you should follow if you want to buy and sell MELI stock, the most accurate analyst covering the stock (on a one-year timeframe) is Deepak Mathivanan from Wolfe Research, with an average return of 47.69% per rating and an 87% success rate.

The Takeaway

Overall, MercadoLibre’s consistently impressive financial results and dominant position in the Latin American e-commerce and fintech markets underscore its immense growth potential. With a fragmented market and numerous untapped opportunities, the company is exceptionally well-positioned to sustain its remarkable success. Furthermore, as MercadoLibre continues to unlock economies of scale, its profits are poised to soar even higher.

On that note, shares have traded flat recently, which may illustrate investors’ hesitance to drive the stock higher given its seemingly-rich valuation. Currently trading at 73 times this year’s projected earnings, this argument appears reasonable at first glance.

However, considering MercadoLibre’s most recent results, there is strong evidence to suggest that a seemingly-high forward P/E doesn’t necessarily imply overvaluation. In fact, with MercadoLibre’s earnings doubling or even tripling on a year-over-year basis, as demonstrated in Q1, a valuation multiple that may seem excessive today could ultimately prove to be offering a compelling investment opportunity today, given the company’s tremendous potential for earnings growth. Accordingly, I remain bullish on MELI stock.