Medtronic (NYSE:MDT) stock is currently trading with a historically high dividend yield of 3.4% (near an all-time high) following its prolonged decline of about 40%. The stock had been falling since August of 2021, but it appears to have found a bottom recently. Medtronic is a Dividend Aristocrat, a title given to a company that has increased its dividends for at least 25 consecutive years. However, its dividend growth streak is much higher than 25 years — it has raised its dividends for 45 years.

Given Medtronic’s reputation as a legendary dividend growth stock and its relatively juicy yield, the stock could be an ideal pick for income-oriented investors. Additionally, Medtronic’s relatively inexpensive valuation points toward the possibility of further upside. Accordingly, I am bullish on the stock.

Here’s Why MDT’s Dividend is Attractive

Medtronic’s dividend is attractive for a couple of reasons. Largely, though, it is due to the company’s unequivocal commitment toward growing payouts annually for nearly half a century. Boasting 45 consecutive years of uninterrupted dividend growth, Medtronic has achieved a track record that only a handful of other giants in the sector have managed to match.

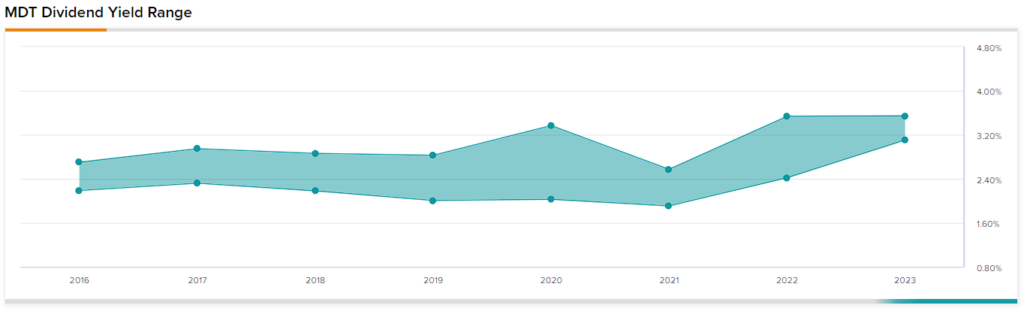

The image above shows that MDT’s yield is historically high right now. The 3.4% yield may not be enormous, and investors can certainly find more attractive yields out there these days. However, it’s still juicy, and the fact that investors can expect annual increases should bolster confidence around the stock and reduce the possibility of a significant downside if the overall market trends lower moving forward.

Dividend Growth Has Slowed, but There’s Room for Increases

One argument against Medtronic’s dividend growth potential is that the pace of its dividend growth has slowed considerably in recent years. To shed some light on this, Medtronic’s five-year compound annual dividend growth rate was as follows in each of these years:

- 19.3% in 2010

- 15.8% in 2013

- 12.2% in 2018

- 8.4% in 2021.

Thus, a multi-year trend of weaker dividend increases has evidently formed. However, there are two points to make here. Firstly, Medtronic’s 7.9% dividend increase in 2022 was mostly in line with the 8.6% and 7.4% hikes in 2021 and 2020, respectively. Consequently, this multi-year trend of dividend growth slowing down may be coming to an end.

Secondly, an ~8% dividend growth rate is still an attractive rate for investors to compound their dividends if it lasts. In fact, Medtronic has enough room both to sustain such a pace of dividend growth and accelerate it. Based on Fiscal 2023 consensus earnings per share (EPS) estimates of $5.28 and Medtronic’s current annual dividend of $2.72, its forward payout ratio barely exceeds 50%.

This implies ample room for the company to sustain high-single-digit to low-double-digit dividend hikes in the coming years without materially increasing its payout ratio, even if its earnings growth stays in the mid-single-digits during this period.

Is MDT’s Recent Financial Decline Concerning?

A concern that investors have lately developed about Medtronic is the expected decline in profitability this year. The $5.28 in projected EPS for Fiscal 2023 may adequately cover the dividend, but it also suggests a year-over-year decline of about 5%.

Medtronic’s fiscal year-to-date results clearly signal this decline. For the first nine months of Fiscal 2023, Medtronic posted net sales of $22.7 billion, down 3.9% compared to the prior-year period. Also, adjusted EPS fell from $4.04 to $3.84 during the same period.

However, in my view, these are minor declines related to currency and other one-off effects, which should normalize from next year. For example, in Q3, the company’s surgical revenues fell by 7% to $2.1 billion. In constant currency, however, the decline was actually by a much smaller 2%. And even then, this decline was due to inflated ventilator sales driven by COVID-19 in the prior year period making for a tough comparison.

If we exclude these effects, as well as lower sales in China caused by the unfavorable impact of provincial VBP tenders (another one-off effect), Medical Surgical revenues actually increased by 3% organically.

Overall, this example illustrates that demand for the company’s products remains rock-solid, and short-term headwinds similar to the ones mentioned should not spur worries. In fact, the previously stronger dollar has already softened, implying that the company will even record a currency reversal tailwind in the coming quarters.

Coupled with Medtronic’s continuous buybacks, and ongoing rate of organic growth, the company shouldn’t have a hard time delivering earnings-per-share growth in the mid-single digits under “normal conditions.”

Is MDT Stock a Buy, According to Analysts?

Turning to Wall Street, Medtronic has a Moderate Buy consensus rating based on six Buys and nine Holds assigned in the past three months. At $92.23, the average Medtronic stock forecast suggests 13.6% upside potential.

The Takeaway

Medtronic’s famed dividend growth streak, high dividend yield (historically), and sufficient room for dividend hikes form a nice blend that income-oriented investors are likely to appreciate.

Additionally, following the stock’s prolonged decline, its now-compressed valuation could also signal the potential for additional upside. Based on the earnings-per-share estimate mentioned earlier, the stock is currently trading at a P/E multiple of about 15.4x.

In my view, this is an attractive multiple to pay for such a high-quality company, even as higher interest rates have indeed increased the rate of return investors require. Hence, further gains following a modest valuation multiple expansion are not unlikely.