Investing in Dividend Aristocrats can be a sound strategy for income investors. These companies have a track record of increasing their dividends for at least 25 consecutive years, which reflects their financial stability and commitment to returning value to shareholders. Medtronic (NYSE:MDT) and NextEra Energy (NYSE:NEE) are two such stocks. Interestingly, hedge fund managers have been increasing their holdings in these stocks.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Therefore, let’s take a closer look at these two Dividend Aristocrat stocks.

NextEra Energy, Inc.

NextEra, an electric utilities company, has raised its dividend payout for 28 consecutive years, making it a good choice for income investors. Also, the company’s strategic investments in renewable energy support growth in earnings and dividends.

Going forward, NEE anticipates to keep up these strategic investments. This could enable NEE to consistently deliver solid returns, likely making it an excellent dividend stock for long-term investors.

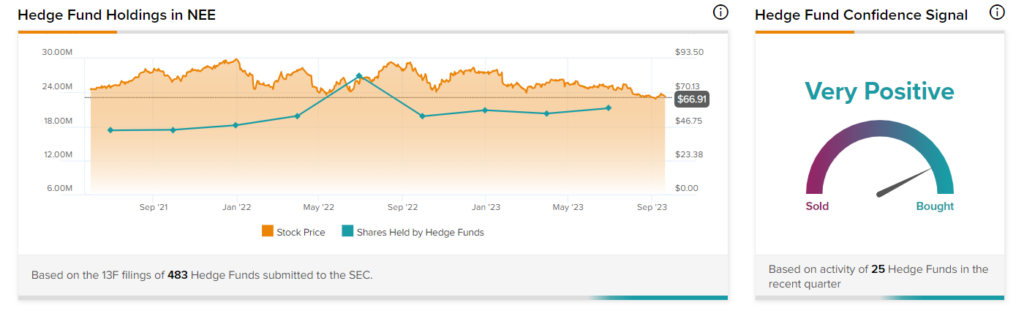

Furthermore, the stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 925,800 shares of this utility company in the last quarter.

Our data shows that Ken Fisher of Fisher Asset Management, Gotham Asset Management’s Joel Greenblatt, and Bridgewater Associates’ Ray Dalio were among the hedge fund managers who increased their exposure to NEE stock.

What is the Future of NEE Stock?

NEE stock has received nine Buy and two Hold recommendations for a Strong Buy consensus rating. The average NEE stock price target of $85.73 implies 25.9% upside potential from the current level.

Medtronic Plc.

MDT has increased its dividend for 46 consecutive years. Easing supply-chain issues, new product launches, and higher demand for medical procedures have been supporting Medtronic’s performance.

In addition, the company is focusing on digital technology adoption and cost-saving measures, with a target of achieving $1 billion in savings by 2025.

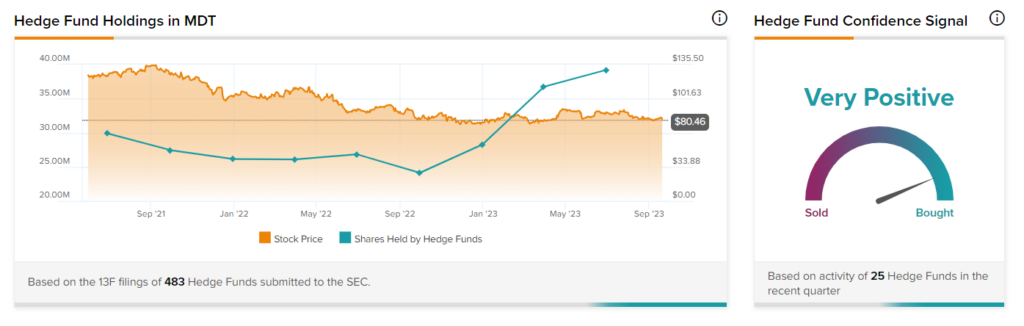

Furthermore, MDT stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 2.5 million shares of this healthcare giant last quarter.

According to the tool, popular hedge fund managers, including WealthBridge Investment Counsel’s Scott Hart and Morningstar Investment Management’s Kunal Kapoor, increased their positions in Medtronic stock.

What is the Price Target for MDT?

MDT stock has received eight Buys, six Holds, and two Sell recommendations for a Moderate Buy consensus rating. Meanwhile, the average MDT stock price target of $94.80 implies 17.7% upside potential from current levels.

The Takeaway

MDT and NEE’s status as Dividend Aristocrats highlights their dedication to providing consistent and increasing dividend payments to shareholders. Such a track record appeals to investors seeking steady income and portfolio stability. Moreover, the positive sentiment from hedge fund managers adds to the overall confidence in these stocks.