Medtronic (NYSE:MDT), Sherwin-Williams (NYSE:SHW), and Emerson Electric (NYSE:EMR) are popular for their solid track record of dividend payments and growth (more than 25 consecutive years). While these Dividend Aristocrats (learn more about Dividend Aristocrats here) are perfect to start a growing passive income stream, TipRanks’ Hedge Fund Trading Activity tool (which offers hedge fund signals based on the latest Form 13-F data) shows that hedge fund managers bought these stocks in bulk.

Keeping track of institutional trading activity can be beneficial for retail investors. Now, let’s zoom in on these Dividend Aristocrat stocks.

Is Medtronic Stock a Buy, Sell, or Hold?

Medtronic stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 8.4 million shares of this global healthcare technology company last quarter.

Recently, Richard Pzena of Pzena Investment Management and Charles Davidson of Wexford Capital LP were among the hedge fund managers who started a new position in MDT stock. Meanwhile, Jean Marie Eveillard of First Eagle Investment Management further increased his position in MDT stock.

While hedge funds have bought MDT stock, Wall Street analysts are cautiously optimistic. On July 18, Robert W. Baird analyst David Rescott initiated coverage on MDT stock with a Hold rating. The analyst expects MDT to benefit from new product launches and the recovery in procedures. However, the analyst expects ongoing headwinds to hurt earnings.

Overall, MDT stock has 11 Buy and four Hold recommendations for a Moderate Buy consensus rating. Moreover, analysts’ average price target of $97.94 on MDT implies 9.61% upside potential from current levels. Meanwhile, MDT stock offers a yield of over 3%, which is higher than the sector average.

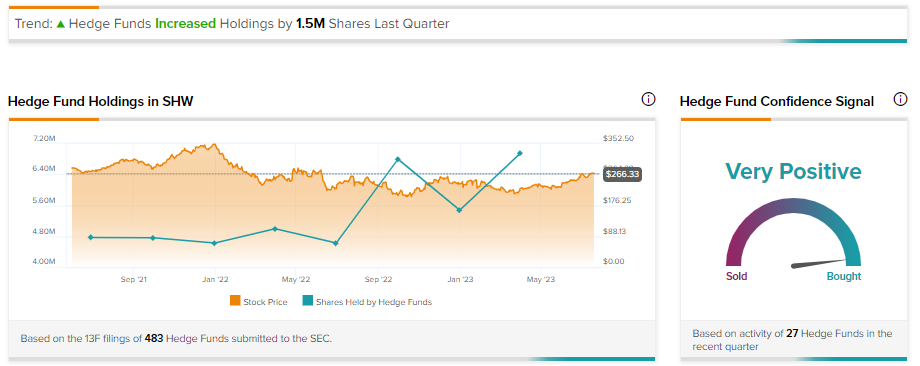

Is SHW Stock a Buy?

Paints and coatings manufacturer Sherwin-Williams has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. Per the tool, hedge funds bought 1.5 million shares of SHW last quarter. Famous hedge fund managers Ray Dalio of Bridgewater Associates and Ricky Sandler of Eminence Capital started new positions in SHW stock.

On July 20, Chris Parkinson of Mizuho Securities increased his price target on SHW stock to $290 from $268 and maintained a Buy rating. The analyst expects SHW to benefit from positive end-market demand and improved price and cost dynamics.

SHW stock has 10 Buy and four Hold recommendations for a Moderate Buy consensus rating. At the same time, the average SHW price target of $268.86 is roughly in line with its current market price. Meanwhile, the stock offers a dividend yield of 0.9%, which is lower than its sector average.

Is EMR a Good Stock to Buy?

EMR stock has a “Very Positive” signal from TipRanks’ Hedge Fund Trading Activity tool. The tool shows that hedge funds bought 3 million shares of this engineering services provider last quarter.

Andreas Halvorsen of Viking Global Investors and Michael Rockefeller of Woodline Partners started new positions in EMR stock. Meanwhile, Lee Ainslie of Maverick Capital added more EMR stock.

While hedge funds increased their exposure to EMR stock, HSBC analyst Michael Hagmann upgraded EMR stock to a Buy on June 15. The analyst sees EMR as an automation pure-play and assigned a price target of $100.

EMR stock has a Moderate Buy consensus rating on TipRanks, reflecting seven Buy and four Hold recommendations. The average EMR stock price target of $101.9 implies 10.9% upside potential from current levels. EMR stock offers a yield of over 2.26%, which is higher than the sector average.