Earnings season is upon us, and in this article, I will use the TipRanks Stock Comparison Tool to analyze McDonald’s (MCD) and Starbucks (SBUX) ahead of their earnings reports scheduled for October 29 and 30, respectively. While both chains are facing softer comps this time, a closer look reveals a bullish outlook for McDonald’s, bolstered by its value-oriented initiatives and clear strategies to boost sales. In contrast, I maintain a neutral stance on Starbucks, which is navigating a C-suite transition that leaves its long-term guidance uncertain.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

McDonald’s Latest Earnings Recap

I maintain a bullish rating for McDonald’s, despite a weak June quarter where the company missed both top and bottom-line expectations for the second consecutive time. Earlier this year, McDonald’s noted increased selectivity among consumers, particularly within the lower-income group.

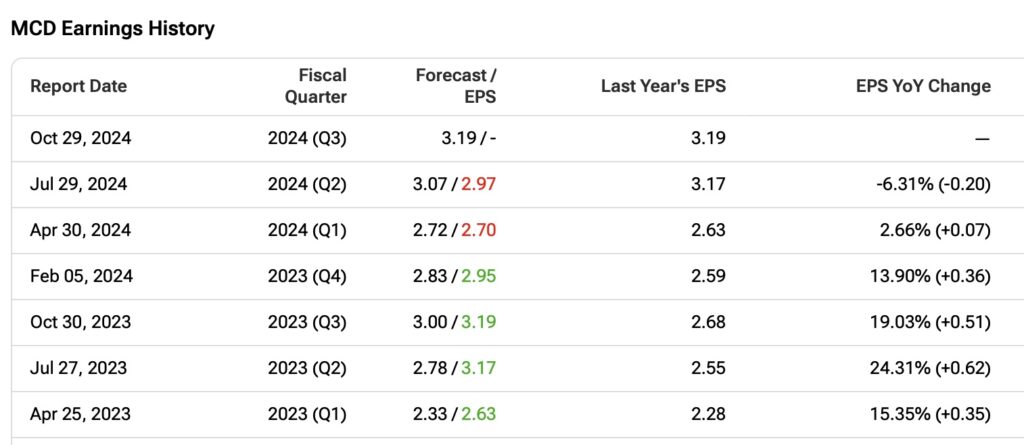

During the second quarter, management indicated that these pressures have deepened and expanded, affecting a broader range of consumers. McDonald’s reported adjusted EPS of $2.97 in Q2, missing estimates of $3.07—its largest miss since January 2022. Revenues were $6.49 billion, below the $6.6 billion forecast. Same-store sales declined across all divisions, resulting in an overall drop of 1%, contrary to expectations of a 0.4% gain. This marked the first decline in company-wide same-store sales since Q4 2020.

Despite the negative Q2 results, McDonald’s stock has risen over 20% in the past three months, outperforming the S&P 500 (SPX). This market reaction is attributed to initiatives aimed at enhancing the perception of “value,” particularly through the $5 Meal Deal, which targets lower-income households. Additionally, the company is innovating its core menu to capture market share in chicken and beef while expanding its loyalty membership.

What to Expect Ahead of MCD’s Q3 Earnings?

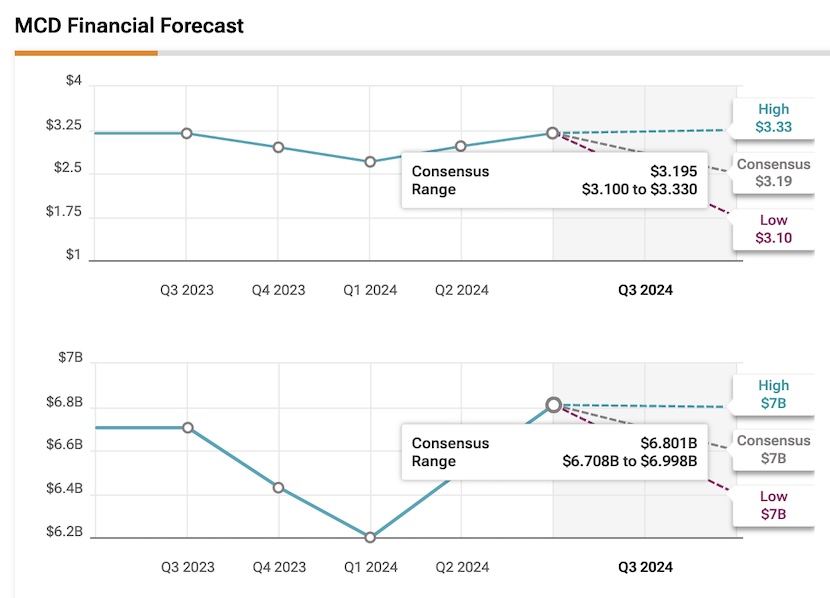

I remain bullish on McDonald’s ahead of its Q3 report. The company will benefit from easier comparisons this quarter, as most Wall Street analysts have lowered their revenue and EPS estimates. To surpass Q3, McDonald’s needs to report over $3.19 in EPS (a 0.1% year-over-year increase) and $6.80 billion in revenue (a 1.7% year-over-year increase).

While beating or missing estimates doesn’t always dictate the stock’s movement—as seen in Q2—the positive reaction following that quarter was largely attributed to management’s confident tone regarding their plans to reestablish value leadership. As a result, progress toward these expectations should be the primary factor influencing the stock price.

Additionally, improving transactions and same-store sales, both in the U.S. and globally, is essential. In Q2, U.S. same-store sales declined by 0.7%, whereas growth was expected, and the International division experienced a 1.1% drop in same-store sales. In my view, better performance in these areas could help maintain bullish momentum for the stock.

Is MCD a Buy, Hold, or Sell?

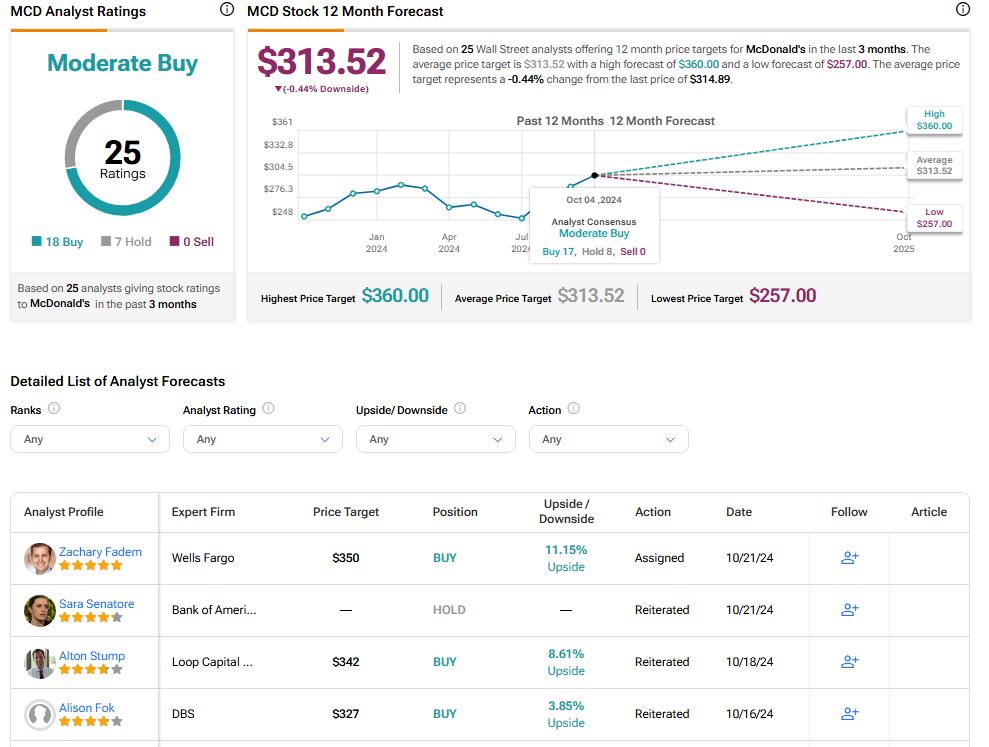

Turning to Wall Street, MCD stock has a Moderate Buy consensus rating. Of 25 analysts, 18 recommend a Buy and seven a Hold, yielding a Moderate Buy consensus. However, the average price target of $313.52 suggests no upside potential.

Starbucks’ Latest Earnings Recap

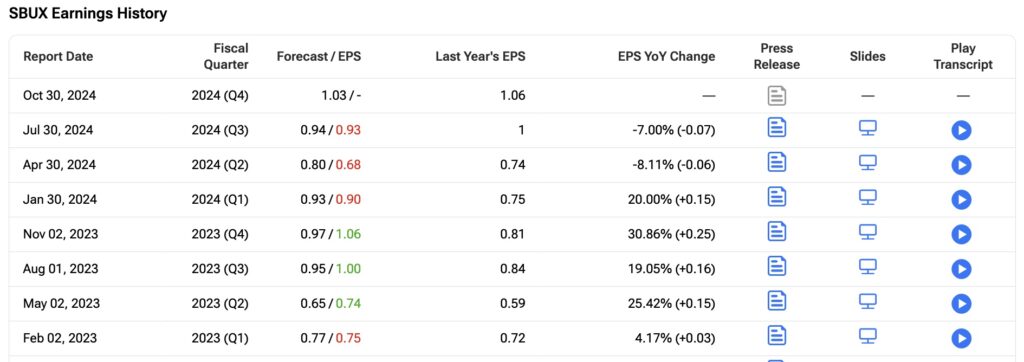

Shifting focus to Starbucks, I maintain a neutral outlook for the company, which has faced significant challenges in 2024, as reflected in its recent results. In Fiscal Q3, Starbucks missed EPS estimates for the third consecutive quarter, reporting $0.93 compared to the expected $0.94, marking a 7% year-over-year decrease. Revenue also fell short of expectations, coming in at $9.1 billion, a 1.1% year-over-year decline.

Moreover, Starbucks’ comparable store sales in North America fell by 2%, with transaction counts down 6% YoY after adjusting for price hikes and sales mix. The company also reported a 4.2% decline in operating income to $1.52 billion. In light of these challenges, Starbucks updated its investors, projecting low single-digit declines in comparable sales globally, with particularly weak performance noted in China. To address these issues, the company plans to increase its store openings, targeting a 12% growth in locations in China by the end of Fiscal Year 2024.

However, poor quarterly results have taken a back seat in recent months, as the company recognized the need to revitalize growth by hiring former Chipotle (CMG) CEO Brian Niccol as Starbucks’ new CEO. The stock has surged more than 27% since its earnings day, largely driven by the change in leadership rather than the latest financial results.

What to Expect Ahead of SBUX’s FQ4 Earnings?

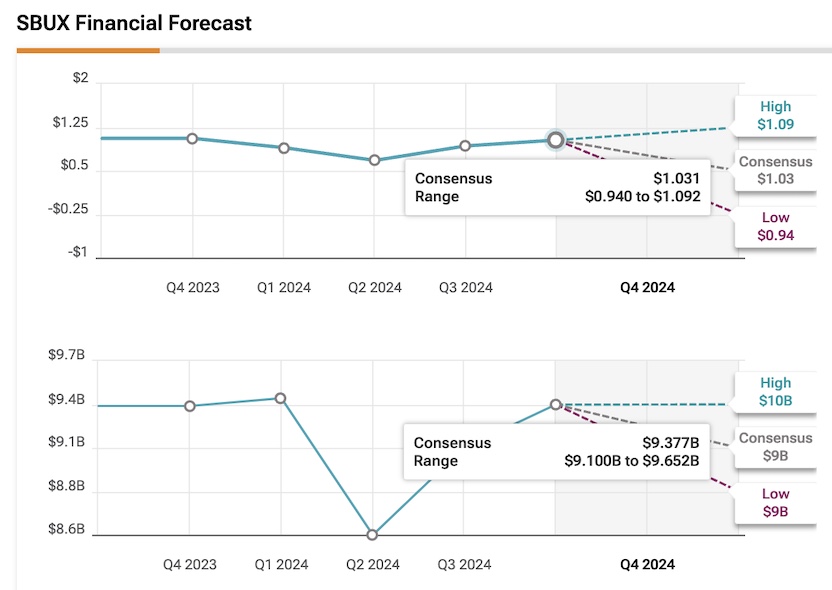

Putting Brian Niccol’s leadership aside and focusing on Starbucks’ upcoming FQ4 earnings, I hold a cautious perspective, even though the company will benefit from easier comparisons this quarter. Over the past three months, a few analysts have lowered EPS estimates, leading to a consensus of $1.03, reflecting a 2.6% year-over-year decline. Similarly, revenue projections have also been revised downward to $9.37 billion, flat compared to the same period last year.

Like McDonald’s, it seems likely that Starbucks can beat expectations across the board this earnings season. However, prolonged challenges are anticipated in FQ4, including weak comparable store sales in the U.S. and further declines in comparable sales in China.

The stock’s key driver may be new CEO Brian Niccol’s initial actions and the company’s projections during the earnings call. Citigroup (C) analyst John Tower notes that long-term guidance may remain uncertain as Niccol might defer a definitive outlook until he better understands the business, likely by the Fiscal first-quarter earnings report. Tower believes the absence of a clear EPS base, coupled with the stock’s recent rise, creates an unfavorable near-term risk-reward scenario for investors, a sentiment I share.

Is SBUX A Buy, Hold, or Sell?

Turning to Wall Street, SBUX stock has a Moderate Buy consensus rating, with 15 out of 24 analysts recommending a Buy, seven a Hold, and two a Sell. The average price target is $100.75, indicating an upside of 4.46%.

Conclusion

I see McDonald’s as the better buy heading into its earnings report, with a strong chance of beating expectations due to lower comps and effective value-focused initiatives. On the other hand, while Starbucks will also face lower comps in FQ4, anticipated declines in comparable store sales and a leadership transition could impact its long-term guidance, resulting in a more cautious outlook ahead of its earnings.