McDonald’s (MCD) stock makes for a reliable investment that is likely to keep producing positive shareholder returns for decades to come. However, precisely because investors have flocked to the stock’s relatively more secure investment case lately, McDonald’s valuation has reached rather elevated levels. For this reason, I am neutral on the stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

McDonald’s Corporation doesn’t really need an introduction. It’s relatively safe to assume that most people have had a burger in one of the McDonald’s restaurants at some point in their lifetimes.

The company has active operations in 119 countries, with around 37,552 of its 40,344 restaurants being franchised, representing roughly 93% of the company’s total locations.

This is where the magic of McDonald’s business model lies. The company produces the majority of its revenues from the real estate and royalties its franchisees pay. Thus, McDonald’s is not really concerned about the overall hassle required to actually run its franchised locations. Consequently, McDonald’s cash flows are mostly frictionless and high margin.

These qualities, combined with McDonald’s excellent track record of capital returns and shareholder value creation, have resulted in its stock becoming a prime destination for investors during times of increased uncertainty. This is evident in the stock’s performance over the past year.

Specifically, McDonald’s stock has gained about 8%, while the S&P 500 (SPX) has declined 11% during this period.

McDonald’s Continues to Grow, Excluding One-Off Events

McDonald’s Q1-2022 results came in rather strong, with the company recording revenues of $5.67 billion, 10.6% higher year-over-year. Revenue growth was driven by excellent performance in both company-operated restaurants and franchised restaurants. Specifically, revenues grew 6.5% at company-owned locations and 13.4% at franchised locations.

Further, global comparable sales grew 11.8% due to comparable sales growth across all divisions. International comparable sales strongly contributed to this, as they increased 20.4% for the quarter.

International comparable sales growth mirrored both strong operating performance and the gradual reduction of COVID-related government constraints in most overseas markets.

Net income equaled $1.1 billion or $1.48 per share against $1.54 billion or $2.08 per share in the prior-year period. However, note that these GAAP figures were affected by extraordinary events.

Specifically, excluding the $0.13 per share expense to aid the company’s Russian and Ukrainian operations and a non-operating payment to reserve for a possible settlement regarding an international tax matter of $0.67 per share, EPS for the quarter would be $2.28.

This represents a year-over-year increase of 19% (22% on a constant-currency basis), which is higher than revenue growth, reflecting increased restaurant margins amid economies of scale kicking in.

Dividend Growth Prospects Remain Impressive

McDonald’s has attained the Dividend Aristocrat title. Specifically, the company has hiked its dividend for 46 consecutive years. The last dividend hike this past September was by 7%, continuing the company’s streak since 1976. Notably, this hike implied an acceleration from McDonald’s prior dividend hike of merely 3%, which was the softest hike since 2002.

MCD Stock Appears Relatively Overvalued

In terms of its valuation, McDonald’s doesn’t provide a specific outlook. Thus, I’m utilizing the consensus EPS estimates instead, which forecast $9.88 for Fiscal 2022.

This implies a forward P/E close to 25.5x, which is a quite loftier multiple compared to McDonald’s past decade-long range of around 15-20x. The prolonged valuation expansion was due to declining interest rates over the past decade.

With investors flocking to the stock in the current environment, the premium has lasted. However, with rates on the rise, and the multiple near its highest level in recent history, I believe shares are overvalued and have little to no margin of safety against a valuation compression.

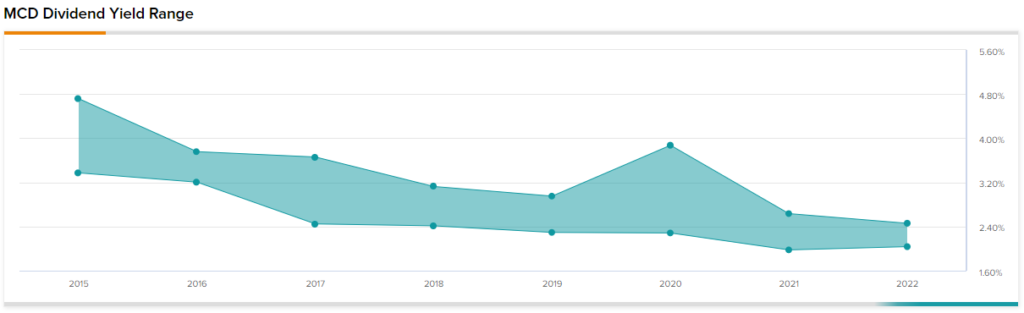

This shortage of a margin of safety is also displayed in the stock’s dividend yield, which stands close to 2.2%. Despite the company’s consistent dividend hikes, the yield is also at the low end of its historical range due to this expansion. Thus, besides a thinner margin of safety, current investors are likely to be subject to softer total return prospects, moving forward.

There is a possibility that the market expects McDonald’s dividend growth pace to remain in the high-single digits following the latest dividend hikes. This could be another reason that investors consider when trying to justify the current valuation.

Based on the consensus EPS estimate and current annualized dividend run rate, the payout ratio stands at 56%. Thus, above-average dividends hikes could be supported. Nonetheless, that’s not a good enough reason to justify such a high premium, in my view.

Wall Street’s Take on MCD Stock

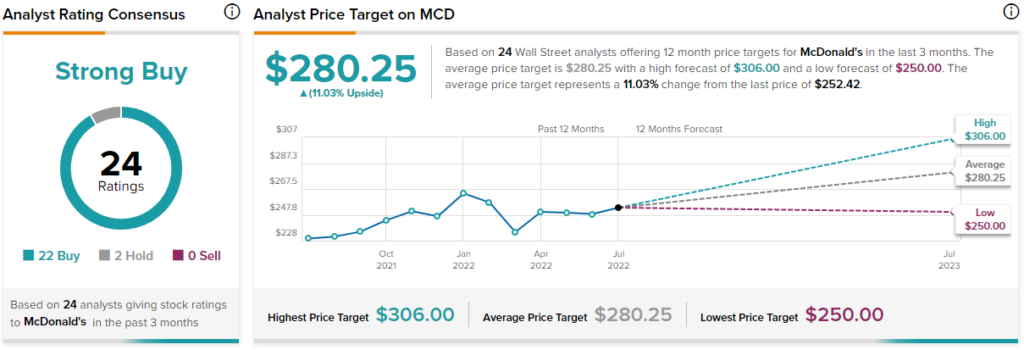

Turning to Wall Street, McDonald’s has a Strong Buy consensus rating based on 22 Buys and two Holds assigned in the past three months. At $280.25, the average McDonald’s price target implies 11% upside potential.

Conclusion – A Reliable Long-Term Investment with Short-Term Risks

McDonald’s remains a reliable company, featuring a genius business model attached to multiple positive qualities. The company’s most recent results exhibited potent growth and comparable sales advancements, illustrating the strength of these qualities in a rather uncertain environment.

Nevertheless, with McDonald’s attracting increased investor interest in the current trading environment, the stock has likely become relatively overvalued.

Consequently, while the stock may make for a fruitful long-term dividend-growth investment, its short-term performance may be negatively impacted by the current premium valuation multiple.