Mastercard stock (NYSE:MA) seems poised to sustain its robust growth, as a soft landing scenario seems more likely than ever. The card processor behemoth displayed remarkable resilience in last year’s shaky macroeconomic environment. With fundamental economic indicators pointing toward growing consumer confidence, Mastercard is set to benefit greatly this year. In fact, an acceleration in earnings growth is quite possible in Fiscal 2024. Consequently, I remain bullish on MA stock.

Is a Soft Landing Scenario Possible?

Recently, discussions surrounding the prospect of a soft landing scenario have gained traction. This can be attributed to the Federal Reserve’s actions in recent quarters that appear to be supporting a seamless economic transition.

For context, by “soft landing,” economists and investors usually refer to a smooth transition from rapid growth to a more sustainable pace without a severe downturn or recession. It involves monetary authorities carefully managing their policies, often through measures like adjusting interest rates, to prevent overheating and maintain stability. The goal of a soft landing, essentially, is to avoid a recession while ensuring a more balanced and sustainable growth trajectory.

Following the exuberant growth experienced in 2020-2021, powered by near-zero interest rates and government stimulus packages, concerns of a potential “hard landing” loomed large. The oversupply of money led to rampant inflation, fueling this narrative.

To restore equilibrium, the Federal Reserve took decisive action by significantly raising interest rates. At first, there were fears that this abrupt shift from almost 0% to nearly 5% would trigger a recession. This scenario would have posed a significant threat to companies like Mastercard, whose revenues hinge directly on consumer spending.

Remarkably, the Federal Reserve’s narrative of stabilizing inflation while maintaining low unemployment rates appears to be unfolding successfully.

In December 2023, the annual inflation rate in the U.S. was 3.4%, a notable improvement from the previous year’s 6.5%. Concurrently, unemployment remained at healthy levels, standing at 3.7% in December, only marginally higher than the preceding year’s 3.5%.

Reflecting on my university days, I recall my macroeconomics professor arguing that achieving a steep reduction in inflation without a noteworthy spike in unemployment (given that rising rates typically lead to layoffs as corporations seek to offset higher interest expenses) would be nearly impossible. Yet, against the odds, the Federal Reserve seems to have accomplished this feat.

According to a recent survey conducted by Bank of America (NYSE:BAC) Global Fund Manager in January 2024, 79% of investors anticipate a soft landing or no landing at all, while only 17% expect a hard landing. This represents a notable improvement from the heightened concerns in October 2023, when 30% of investors foresaw a hard landing.

Additionally, S&P Global (NYSE:SPGI) suggests that a soft landing for the European economy remains the most likely scenario in the near term, anticipating rising real incomes due to disinflation and resilient labor markets.

Mastercard’s Growth Momentum to be Sustained

As I mentioned, Mastercard’s financial performance is directly related to the economy’s underlying health, which in turn directly influences consumer spending. With unemployment remaining at favorable levels and inflation easing, consumers have remained very confident in recent quarters, upholding Mastercard’s growth. With interest rates potentially taking place this year, consumers’ disposable income is set to rise further, sustaining the card processor’s momentum.

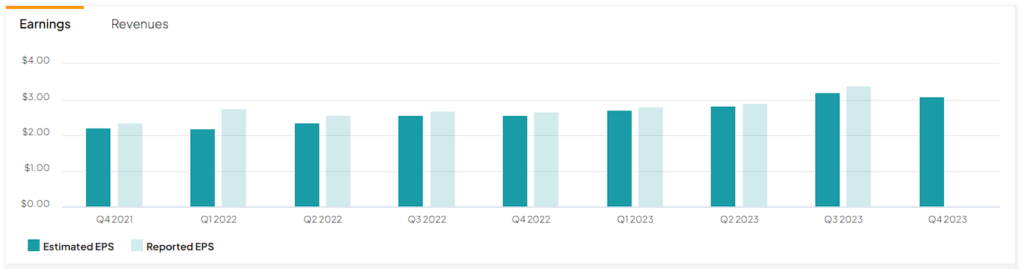

For context, in Mastercard’s most recent quarter (Q3), gross dollar volume grew by 11%, with purchase volume growing 12% on a local currency basis, indicating strong consumer spending. Combined with the company’s asset and cost-light business model, the growing revenue improved MA’s adjusted operating margin from an already impressive 57.7% to 58.8%. Simultaneously, Mastercard bought back stock aggressively, reducing its share count by almost 2.5% year-over-year. Therefore, adjusted EPS jumped by 26% to $3.39.

For Fiscal 2023, Wall Street expects MasterCard to post adjusted EPS of $3.08, pushing its annual result to $12.15. This implies a year-over-year increase of 14.1%. Importantly, Fiscal 2024 consensus EPS estimates point to EPS growth of 16.9%, suggesting an acceleration, mirroring the possibility of the soft landing scenario materializing.

Is MA Stock a Buy, According to Analysts?

As far as Wall Street’s view on the stock goes, MasterCard boasts a Strong Buy consensus rating based on 22 Buy and one Hold recommendation assigned in the past three months. At its current stock price of $471.36, the average Mastercard stock forecast suggests 7.4% upside potential.

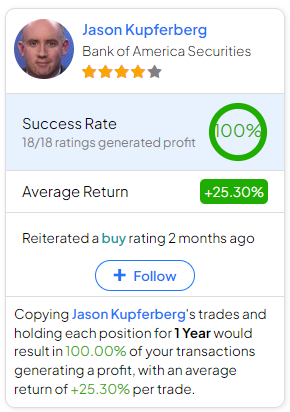

If you’re wondering which analyst you should follow if you want to buy and sell MA stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jason Kupferberg from Bank of America Securities, with an average return of 24.39% per rating and a 100% success rate.

The Takeaway

Mastercard appears well-positioned to sustain its robust growth trajectory in the face of an evolving economic landscape. The prospect of a soft landing scenario gains credence, thanks to the Fed’s adept management, fostering stability and confidence.

The resilience exhibited by Mastercard during recent economic uncertainties, coupled with favorable indicators such as consumer confidence and controlled inflation, bodes well for the company’s future.

Given that the market anticipates potential interest rate cuts this year, Mastercard’s momentum seems poised to last. I believe this momentum will extend to the stock price, likely propelling it to keep reaching new all-time highs.