In this piece, I evaluated two bitcoin mining stocks, Marathon Digital Holdings (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT), using TipRanks’ comparison tool to determine which is better. Marathon Digital is a digital asset technology company engaged in cryptocurrency mining, focusing on the blockchain ecosystem and generating digital assets. Riot Platforms is a bitcoin (BTC-USD) mining company that supports the bitcoin blockchain by rapidly expanding large-scale mining in the U.S.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Marathon Digital is up 152% year-to-date but is down 20.4% over the last year, while Riot Platforms is up 179% year-to-date, flipping it into the green on a 12-month basis, up 33%.

Both companies have similar stock-price performances on a year-to-date basis, and both plummeted in 2022 amid the robust “crypto winter.” However, a closer look at their valuations is needed to determine whether Riot deserves to be in the green over the last 12 months while Marathon remains meaningfully in the red.

Because of the nature of mining bitcoin, different metrics are more useful for gauging a miner’s valuation than those commonly used for most other sectors. Two of the more important metrics are the realized hash rate and price-to-hash ratio (P/H).

The hash rate is important because it shows how long it takes a company to finish mining one block, and the realized hash rate is the implied hash rate based on a company’s monthly production, the total block rewards from the bitcoin network at a particular time, and the network’s average monthly hash rate.

The average realized hash rate of the top nine miners by realized hash rate was 8.86 in August. Importantly, the higher a company’s hash rate, the more likely it will be able to solve a block and receive a bitcoin.

Meanwhile, the P/H ratio is somewhat comparable to the price-to-earnings (P/E) ratio used to value other companies. It helps estimate the amount each company is paying for every terahash per second (TH/s) of realized hash rate. A terahash is 1 trillion hashes per second.

Essentially, the P/H indicates how much per share an investor is paying for a bitcoin miner to mine bitcoin for them. Of the nine leaders based on P/H in August, the average P/H was 145.7.

One other metric that can be useful in gauging a bitcoin miner’s valuation is the implied cost of bitcoin production, which is the amount each company pays to mine each bitcoin. The average implied cost of bitcoin production for the top nine miners by implied production cost was $10,911 in August.

Marathon Digital Holdings (NASDAQ:MARA)

Marathon Digital enjoyed a much higher realized hash rate than any of the other top miners in August. However, its massive stock-price rally and high P/H ratio compared to the amount it spends to mine one bitcoin call for a bearish view.

For August, Marathon Digital’s realized hash rate came in at 14.34, although it just edged out Riot’s rate. The company also led the way in July and came in second in June and May.

Meanwhile, Marathon’s P/H stood at 233.3 in August, also leading the way. In other words, investors were paying the company more to mine one bitcoin than they paid any other miner to mine a single bitcoin, potentially suggesting that Marathon is overvalued. The company came in third place in July at 216.9 and in second place at 216.6 in June and 153.9 in May.

Additionally, Marathon spends significantly more than most other leading miners to mine a single bitcoin, coming in at $18,900. While the company is recovering from two major storms that shut down operations in 2022, it’s simply overvalued on a P/H basis when considering the large amount spent to mine one bitcoin.

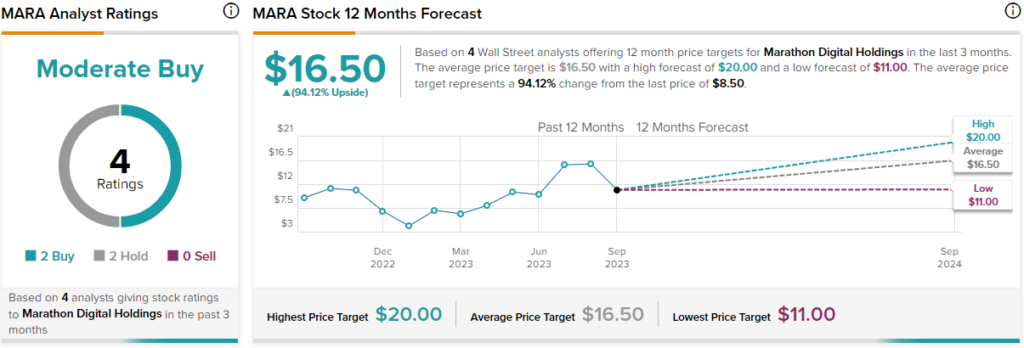

What is the Price Target for MARA Stock?

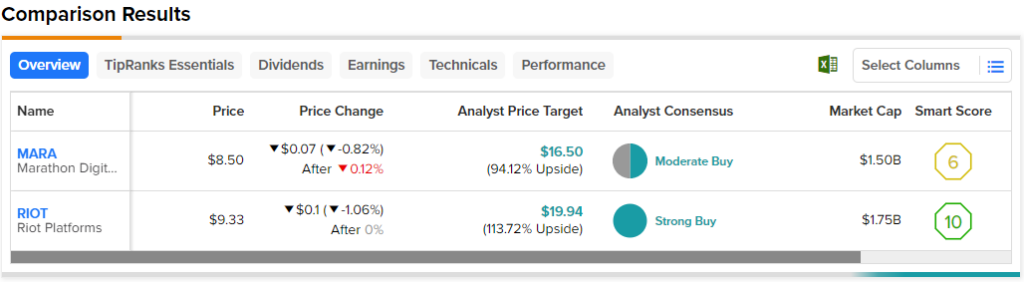

Marathon Digital Holdings has a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sell ratings assigned over the last three months. At $16.50, the average Marathon Digital Holdings stock price target implies upside potential of 94.1%.

Riot Platforms (NASDAQ:RIOT)

On the other hand, Riot Platforms’ numbers look much better than Marathon’s. However, the recent stock-price action suggests the company’s stock might not rise further from current levels, making a neutral view seem appropriate.

Riot Platforms recorded a realized hash rate of 14.13 in August, coming up just shy of Marathon’s rate and much higher than the average of the top nine miners. The company’s P/H was in the middle of the pack at 136.8, putting it slightly below the average.

Meanwhile, Riot Platforms’ implied cost of bitcoin production was the second-best of the nine best miners, coming in at $8,400 — much better than the average. Over the long term, a more constructive view may become appropriate for Riot Platforms. However, Riot shares are off 24% for the last month, pointing to downward momentum.

What is the Price Target for RIOT Stock?

Riot Platforms has a Strong Buy consensus rating based on eight Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $19.94, the average Riot Platforms stock price target implies upside potential of 113.7%.

Conclusion: Bearish on MARA, Neutral on RIOT

When gauging a bitcoin miner’s stock-price performance, it’s also important to look at the price action of bitcoin. Thus far, in 2023, bitcoin miners have significantly outperformed bitcoin. As of July, the average year-to-date stock price gain among the nine leading publicly-traded bitcoin miners was over 250%, nearly three times bitcoin’s gain.

However, more recent price action reveals sizable sell-offs in both stocks. Marathon’s downward momentum is much worse than that of Riot’s, with the stock down 37.9% over the last month.

High short interest in both names suggests a short squeeze can’t be ruled out at some point, with Marathon at 23% and Riot at 17%. However, betting on a short squeeze can be a bit like trying to catch a falling knife. Nevertheless, Riot is the clear winner.