Germany’s flagship carrier, Deutsche Lufthansa AG (DLAKY) (DE: LHAB), seems to be in deep trouble as a strike by its ground staff is causing a major disruption. A “warning strike” by the trade union Verdi, demanding a 9.5% pay hike, forced Lufthansa to cancel almost the entire flight schedule at its hubs in Frankfurt and Munich for Wednesday, July 27. The strike by 20,000 ground staff has massively hurt the airline’s operations in the middle of the peak summer travel season. The strike has impacted an estimated 134,000 passengers at the Frankfurt and Munich hubs.

While Lufthansa is making efforts to restore normal operations, it stated that the effects of the strike may still cause individual flight cancellations or delays on July 28 and July 29.

No End to Lufthansa’s Operational Woes

Lufthansa and other major airlines across the globe are unable to cope with the spike in travel demand following the easing of restrictions. European airlines have been immensely hit by staffing shortages and the COVID-19 pandemic.

As per Reuters, earlier this month, Lufthansa canceled an additional 2,000 flights for this summer from its Frankfurt and Munich hubs. The carrier had earlier canceled 770 flights scheduled for June and July and another 3,000 scheduled for July and August.

Impact on Lufthansa’s Financials

The financial impact of the strike and flight cancellations could be massive for Lufthansa, given the magnitude of business affected. The company has not provided a specific estimate of the financial impact yet.

Earlier this month, Lufthansa reported its preliminary second-quarter results. The carrier returned to profitability in the second quarter, as revenue more than doubled to €8.5 billion, from about €3.2 billion. Adjusted EBIT (Earnings before Interest and Tax) came in between €350 million and €400 million, compared to a loss of €827 million in the prior-year quarter. Lufthansa will report its final second-quarter results on August 4.

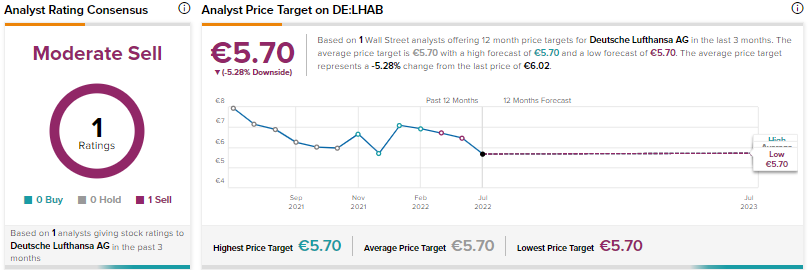

Wall Street has a Bearish Outlook

On TipRanks, Lufthansa scores a Moderate Sell consensus rating based on one recent Sell recommendation. The average Deutsche Lufthansa price target of €5.70 implies a 5.28% downside potential from current levels.

Conclusion

Lufthansa is facing massive operational issues due to staffing shortages, which is impairing its ability to meet strong travel demand. If the ongoing strike is not amicably resolved, then it might be a huge blow to the company financially. It would cause a lot of inconvenience to travelers amid the peak travel season.

As per TipRanks Smart Score System, Lufthansa scores a one out of 10, indicating that the stock could likely underperform the broader market.