There appears to be a shift in the electric vehicle (EV) industry. Whereas during the last few years, demand was outstripping supply, the inverse now appears to be the case with there being a glut of supply amidst dwindling demand.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The most obvious manifestation of this change was evident in the recent price cuts taken by Tesla. After showing disappointing delivery numbers for Q4, the EV leader has aggressively slashed some vehicle prices by as much as 20% in the U.S. and Europe. Tesla can probably afford to take the hit on margins, given its scale, but what are the implications for other, smaller EV players?

Morgan Stanley’s Adam Jonas thinks the recent price cuts are “just the latest sign the EV market may be entering the ‘shake-out’ phase.”

Tesla’s move also applies “significant fundamental pressure on its peers.” Zooming in one case, what are the ramifications for Lucid Motors (NASDAQ:LCID), a company that has pivoted toward the luxury end of the market?

In a year during which Jonas anticipates there will be “severe EV deflation,” as with many other EV startups, Lucid will have to overcome “execution headwinds.”

Assessing the EV landscape, Jonas is much more inclined to support self- funding projects.

Lucid, on the other hand, “builds cars for more than they sell them for.” That, then, is a big problem.

“As other EV manufacturers grind car prices lower,” the analyst goes on to explain, “we think Lucid would need to react by lowering ATPs alongside them (making their loss-making vehicles even more loss-making), and/or brace for lower unit sale volumes.”

The latter outcome seems more likely to Jonas, given the he does not think Lucid can “necessarily afford selling cars for much less than they already are.”

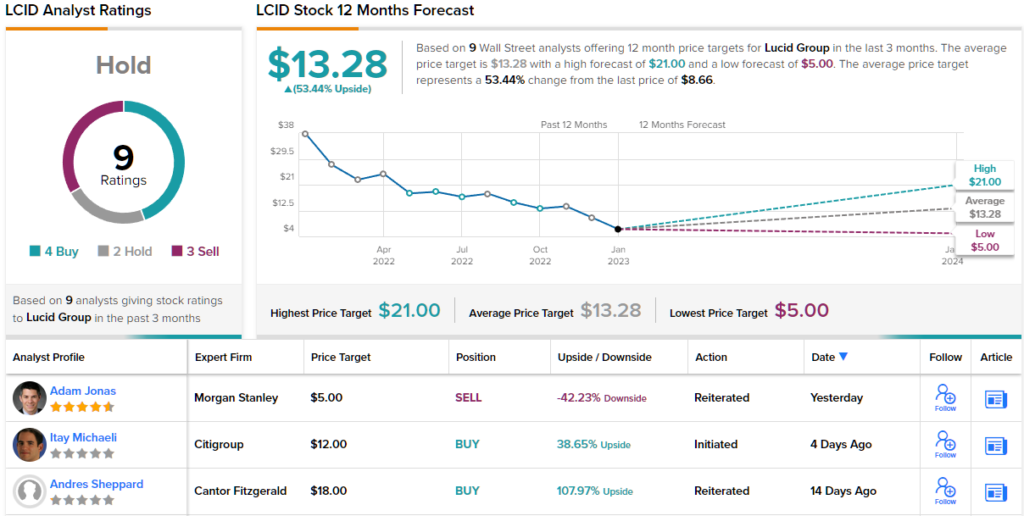

So, headscratchers for Lucid to solve but what does it all mean for investors? Jonas rates the stock an Underweight (i.e., Sell) and lowers his price target from $10 to $5, suggesting the shares are currently overvalued by approx. 40%. (To watch Jonas’ track record, click here)

That outlook contrasts sharply with the Street’s average target which currently stands at $13.28 and implies one-year share appreciation of ~53%. Overall, the stock claims a Hold consensus rating, based on 4 Buys, 2 Holds and 3 Sells. (See Lucid stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.