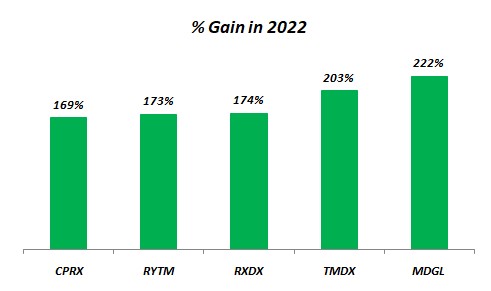

2022 was a challenging year for equity investors, as even shares of mega-cap companies got smashed. On the positive side, healthcare was among a few resilient sectors, like energy, that outperformed the broader market averages. Within the healthcare space, shares of Madrigal Pharmaceuticals (NASDAQ:MDGL), TransMedics Group (NASDAQ:TMDX), Prometheus Biosciences (NASDAQ:RXDX), Rhythm Pharmaceuticals (NASDAQ:RYTM), and Catalyst Pharma (NASDAQ:CPRX), generated enormous profits for their shareholders.

The graph below shows the gain in these five healthcare stocks in 2022.

While these stocks made their investors rich in 2022, let’s check what’s in store for them in 2023.

Is MDGL a Buy?

Madrigal is a clinical-stage biopharmaceutical company focusing on novel therapeutics for NASH (Non-Alcoholic Steatohepatitis), a non-alcoholic fatty liver disease. MDGL stock got a significant boost from the positive phase 3 clinical trial result of Resmetirom, its most advanced clinical candidate for treating the underlying causes of NASH.

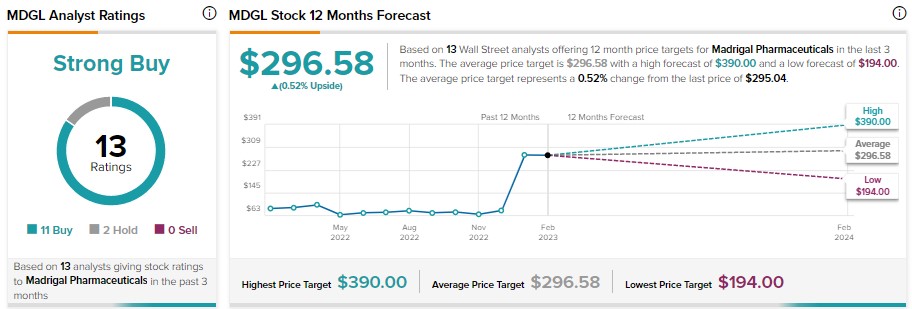

Wall Street analysts are bullish about MDGL stock. It has received 11 Buy and two Hold recommendations for a Strong Buy consensus rating. Due to the recent surge in its price, analysts’ average price target of $296.58 is almost in line with its closing price on February 16. Along with analysts, hedge funds are also optimistic about MDGL. MDGL stock has a maximum Smart Score of “Perfect 10.” Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Is TMDX a Good Stock to Buy?

TransMedics is a commercial-stage medical technology company. It is a leader in assessing donor organs for transplantation and portable extracorporeal warm perfusion. Thanks to the strong clinical demand for its OCS (Organ Care System) technology, TransMedics delivered solid sales in the first nine months of 2022. Further, the TMDX is upbeat and expects its revenue to grow further in the coming years.

TMDX stock has a Moderate Buy consensus rating based on two Buy and one Hold recommendations. However, due to the recent rally in its stock price, analysts’ average price target of $66.67 implies 1.25% upside potential. Our data shows that hedge funds bought TMDX stock in the previous quarter. Meanwhile, insiders sold its shares worth $1.9M. Overall, it has a Neutral Smart Score of six.

What is the Projection for RXDX Stock?

Prometheus Biosciences is a clinical-stage biotech company pioneering novel therapeutics for treating immune-mediated diseases. Its PRA023 (monoclonal antibody) demonstrated strong efficacy and favorable safety results in two clinical studies. This gave a significant boost to its stock price.

Analysts are optimistic about its prospects. RXDX stock has received 10 unanimous Buy recommendations for a Strong Buy consensus rating. Furthermore, analysts’ average price target of $143.30 implies 18.66% upside potential.

Besides for analysts, hedge funds are also bullish about RXDX. Moreover, RXDX sports a maximum Smart Score of “Perfect 10.”

What’s the Prediction for RYTM Stock?

Rhythm Pharmaceuticals is a commercial-stage biopharmaceutical company focusing on the care for rare genetic diseases connected to obesity. The FDA’s approval and U.S. launch of its IMCIVREE, used for chronic weight management, supported RYTM stock.

RYTM stock has two Buy and one Hold recommendations, reflecting a Strong Buy consensus rating. Meanwhile, analysts’ average price target of $39.67 implies 53.88% upside potential. Our data shows that hedge funds bought 6.3M shares of RYTM in the previous quarter. Further, RYTM carries a maximum Smart Score of “Perfect 10.”

Is It Good to Invest in CPRX?

Catalyst Pharmaceuticals is a commercial-stage biopharmaceutical company pioneering novel medicines to treat rare diseases. It has a strong portfolio and solid sales of Fidrapase, a drug used to treat disorders of the neuromuscular junction.

CPRX stock has three unanimous Buy recommendations for a Strong Buy consensus rating. These analysts’ average price target of $22.33 implies 46.81% upside potential. Along with analysts, hedge funds are also bullish about CPRX stock. Moreover, CPRX has a maximum Smart Score of “Perfect 10.”

Bottom Line

These healthcare stocks generated solid returns in 2022. Further, MDGL, RXDX, RYTM, and CPRX stocks sport a “Perfect 10” Smart Score, implying they are more likely to outperform the broader market. Also, analysts’ price targets show a significant upside in RYTM and CPRX stocks. Meanwhile, investors can gain exposure to the healthcare sector through the Health Care Select Sector SPDR Fund ETF (XLV).