Our digital world runs on computer tech, and that tech is only going to become more autonomous and more ubiquitous. And that, in turn, only underscores the ongoing importance of online security. With digital automation growing, it’s more important than ever, right now, to start firming up the digital protections.

Against this backdrop, Goldman Sachs’ Gabriela Borges has turned her eye on the cybersecurity sector. The analyst sees several industry dynamics that are favorable for long-term investors, including: “(1) Multi-product platforms have gained momentum and are closer to solving the challenge of staying innovative in subsegments historically defined by boom and bust product cycles. (2) The industry is less cyclical as mix shifts away from hardware and toward SaaS, and given consistent prioritization of security spend in enterprise budgets.”

Borges doesn’t leave us with a macro view of the industry. The analyst goes on to give a drill-down to the micro level, and picks out two cybersecurity stocks that she sees as potential winners for the long haul.

In fact, Borges is not the only one singing these stocks’ praises. According to the TipRanks platform, each boasts a “Strong Buy” consensus rating from the broader analyst community, and offers double-digit upside potential for the year ahead. Let’s take a closer look.

CrowdStrike Holdings (CRWD)

The first Goldman-pick we’ll look at is CrowdStrike, the producer of the high-end Falcon Endpoint Protection line, and a leader in the cybersecurity ecosystem. CrowdStrike’s products have set an industry standard for online network protection and for digital security, and include a range of cloud-based modules for a wide variety of applications. The company makes the products available by subscription through the Software-as-a-Service model.

The company reported some sound metrics in its last quarterly report, for Q3 of fiscal 2023. Revenue was up 53% year-over-year, at $581 million, and annual recurring revenue, at $2.34 billion, was up 54%. On the bottom line, CrowdStrike reported a fiscal Q3 earnings of 40 cents per share, by non-GAAP measures, beating consensus estimate of 32 cents per share.

However, the company provided revenue guidance that fell short of estimates. Specifically, Q4 revenue is expected to be in a range of $619.1 million to $628.2 million, below Street estimates of $634.2 million.

While acknowledging that current market conditions act as a headwind on the stock, Goldman Sachs’ Gabriela Borges believes it is well-placed for strong growth.

“We expect to see a moderation in growth rate… driven primarily by slower growth in the endpoint TAM and a slower pace of market share gain – and we believe this is well understood by the market. Over the medium term, 1) we expect to see steady growth in endpoint (80%+ of ARR), based on our bottom-up market share model suggesting next-gen endpoint technologies hold close to 50% share today; 2) we expect to see outsized growth in cloud, where our industry conversations suggest CrowdStrike is competitive given its core competencies in data collection and monitoring,” Borges opined.

“Taken together with strong FCF generation today and a reset to numbers in 3Q23 (2023 Street revenue has been revised down 3% over the last 3 months), we believe risk/reward is attractive,” the analyst summed up.

Overall, Borges believes this is a stock worth holding on to. The analyst rates CRWD shares a Buy, and her $141 price target suggests a 22% upside in the next 12 months. (To watch Borges’ track record, click here)

Altogether, CrowdStrike has 37 recent analyst reviews on file – these include 32 Buys and just 5 Holds, for a Strong Buy consensus rating. The shares are selling for $115.12 and the average price target, now at $160.26, implies a 39% one-year gain. (See CRWD stock forecast)

Palo Alto Networks (PANW)

The next stock on Goldman’s radar is Palo Alto Networks, another major name in digital security. This company’s combination of firewall products and state-of-the-art cybertech offers customers a high level of protection for online systems, including protection against malware attacks, and also allows automation of network and online security operations. Palo Alto also makes its enterprise-grade security software available to home and small business users looking to protect their network and cloud applications.

Over the last few years, Palo Alto has built a steadily increasing revenue stream based on its product line and industry-leading reputation. In the last reported quarter, for fiscal 1Q23, the company reported $1.56 billion at the top line, based on $175 billion in total billings. These figures represented year-over-year increases of 25% and 27% respectively. The company’s backlog, a key indicator of future work and revenues stood at $8.3 billion as of October 31 last year.

At the bottom line, Palo Alto posted an adjusted 83 cents per share, beating estimates of 69 cents per share. The company finished its fiscal first quarter with a $1.2 billion in free cash flow, and nearly $2.1 billion in cash on hand. We’ll see next week, when Palo Alto reports earnings for fiscal Q2, how its performance is holding up.

In the meantime, Goldman’s Borges sees a clear path forward for the company, and lays it out in easy prose: “We view Palo Alto as a portfolio of network, endpoint and cloud products at different stages of product maturity, each leveraging centralized domain expertise in user interface/user experience (UIUX), marketing, security intelligence and machine learning. Together with a successful M&A strategy, we expect to see durable growth of ~20% for the next 5 years with top quartile software KPIs, a path to GAAP profitability this year, and active capital allocation.”

Tracking ahead from here, Borges gives PANW shares a Buy rating, with a $205 one-year price target that suggests a potential gain of 19%.

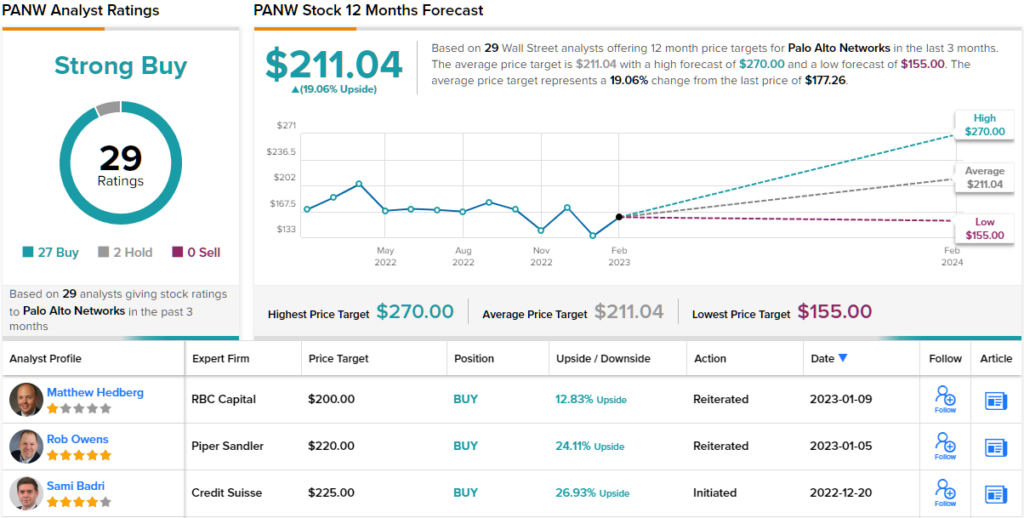

The Strong Buy consensus rating on this stock shows that the Street is clearly in-line with Goldman’s bullish view; of the 29 recent analyst reviews, 27 are to Buy and only 2 to Hold. PANW shares have an average price target of $211.04, implying a 19% upside from the trading price of $172.02. (See PANW stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.