The Federal Reserve has officially started its rate-cutting cycle. On September 18, the central bank made a more aggressive move than anticipated, slashing the key funds rate by half a percent. This hawkish decision is projected to relieve some pressure on consumers, potentially leading to lower credit card and mortgage rates. While most experts had predicted a rate cut, the consensus expected a more modest quarter-percent reduction.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The larger cut shows that the Fed is upbeat on inflation. The rate of price increases fell to 2.5% in August, and the Fed clearly believes that it will soon hit the 2% target. The rate cut was the first since March of 2020, and puts the funds rate in the range of 4.75% to 5.0%.

With this shift in Fed policy, investors are naturally asking, what’s next? Wells Fargo analyst Donald Fandetti offers a clear recommendation: consider moving into REITs and specialty finance sectors, which historically perform well in rate-cutting cycles, while also providing the added incentive of high dividend yields.

“After underperforming through the rate hike cycle, we now see a favorable risk/reward for the shares, including double-digit div yields. Historically, the stocks do well when the Fed is cutting rates. Agency MBS spreads are still wide and banks could start buying after big hits from mark-to-mkt,” Fandetti opined.

Getting into specifics, Fandetti recommends two such stocks that are paying out dividend yields north of 12%. And he’s not alone in his optimism – according to the TipRanks database, both names are rated as Strong Buys by the analyst consensus. Let’s take a closer look.

Annaly Capital Management (NLY)

The first Wells Fargo pick is Annaly Capital Management, a REIT with a primary focus on residential real estate and mortgage-backed securities. The company has been notably successful in acquiring these assets, and has built up a total portfolio worth $75 billion. The firm has nearly $11 billion in permanent capital, and $6.3 billion in total assets available for financing. In its last financial release, Annaly stated that $66 billion of its total portfolio was held in the ‘highly liquid’ Agency segment.

The Agency business makes up 58% of Annaly’s capital allocation, with the remainder divided between mortgage servicing rights (22%) and residential credit (20%). The company follows a diversified capital management strategy, designed to create durable, long-term risk-adjusted returns across varying economic and interest rate cycles. At its heart, the strategy pairs short-term, floating-rate credit securities with the assets that populate the long-term, fixed-rate agency portfolio.

Annaly also focuses on attracting investors, by prioritizing capital return. The company has a long-standing dividend payment policy, with a payment record going back to the 1990s and a history of adjusting the payment when necessary. Of note, Annaly did not halt the dividend during the pandemic crisis. The company’s most recent declaration, made on September 10, was for a 65-cent payment per common share, to be sent out on October 31. This marks the seventh quarter in a row with the dividend at this rate. The annualized payment of $2.60 per common share gives a forward yield of 12.8%.

The company’s dividend is supported by the earnings available for distribution, or EAD. In the last reported quarter, 2Q24, this metric came to 68 cents per share, 4 cents better than had been expected – and more than enough to cover the 65-cent common share dividend payment.

Checking in with Fandetti, we find the Wells Fargo analyst upbeat on Annaly based on the company’s history and its prospects for improved value going forward. He writes, “We use NLY as a case study how its stock price and dividend reacted during prior Fed rate cycles, given the long history as a public company. Although it did not happen immediately as the Fed lowered interest rates from 2000-2002 the stock price and dividend increased… NLY did lower their dividend earlier in 2024 given the rate environment, but mgt seems to be signaling that the current dividend is sustainable… In terms of NLY’s interest rate sensitivity, for every -15bps MBS spread change, this would improve book value by +6.2%.”

Along with this, the analyst bumps up Annaly’s rating from Equal Weight (i.e. Neutral) to Overweight (i.e. Buy), and sets a $23 price target that implies an 11.5% upside for the coming year. With the annualized dividend, this stock’s one-year return can approach 24%. (To watch Fandetti’s track record, click here)

Overall, NLY shares get a Strong Buy consensus rating from the Street, based on 8 reviews that include 6 Buys and 2 Holds. (See NLY stock forecast)

AGNC Investment (AGNC)

Now we’ll turn our eyes to AGNC Investment, another REIT with a focus on mortgage-backed securities. AGNC is an internally managed firm, and its portfolio is valued at $66 billion. More than $59 billion of that – over 90% – is invested in Agency MBSs, and 96% of the portfolio is invested in 30-year fixed-rate instruments. AGNC also has significant investments in net TBA mortgage positions, CRTs, and non-agency instruments.

A look at the current dividend shows that the stock remains a sound choice for investors seeking a steady return. AGNC pays out its dividend monthly, at a rate of 12 cents per common share. This gives one important advantage, as many investors seek to use dividend stocks for an income stream – and this dividend, with its monthly payment, will fit better with most billing schedules. In addition, the dividend annualizes to $1.44 per common share, a figure that gives a forward yield of 13.9%.

On the financial side, AGNC last reported for 2Q24, and in that quarter the company had non-GAAP EPS of $0.53. While this missed the forecast by a penny, it provides full coverage of the dividend’s quarterly rate.

When we turn again to analyst Fandetti, we find that he likes this company’s prospects going forward, saying of AGNC, “We believe the rate environment could be a nice tailwind to AGNC’s book value… On AGNC’s sensitivity, for every -10bps MBS spread change, this would improve book value by +5%…”

The top-rated analyst is also bullish on the dividend, and adds to his comments, “And the dividend yield is attractive in our view… We believe the dividend is relatively secure at these levels as returns are in the mid-teens for new agency MBS investments. AGNC’s earnings report showed its core earnings of 53c, which is well above the quarterly 36c dividend.”

Taken together, these comments support Fandetti’s upgrade of AGNC from Equal Weight (i.e. Neutral) to Overweight (i.e. Buy), while his price target of $12 indicates potential for a one-year upside of ~14%. The combined upside/dividend return potential on this stock for the year ahead comes to ~28%.

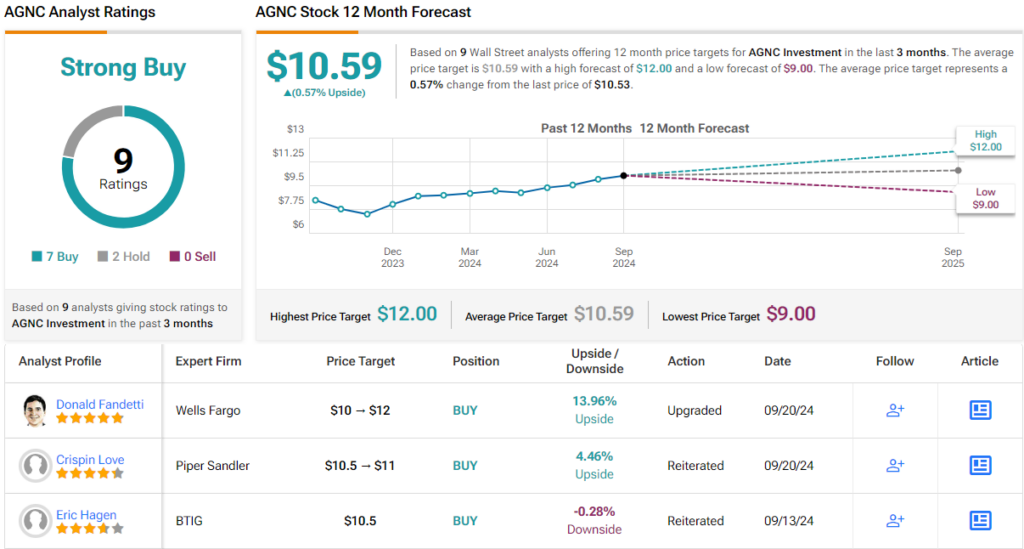

From the Street as a whole, AGNC gets a Strong Buy consensus rating, a stance based on 9 reviews that break down to 7 Buys and 2 Holds. (See AGNC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.