Shares of Lightspeed (LSPD) fell 12% after reporting earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at -$0.12, which was in line with analysts’ consensus estimate of -$0.12. In the past nine quarters, Lightspeed has beat estimates six times.

In addition, sales increased 50% year-over-year, with Lightspeed’s revenue hitting $173.9 million compared to $115.9 million. The revenue increase was primarily driven by organic growth, with acquisitions contributing $16.8 million.

However, gross profits only increased by 34%, which means that the company did not demonstrate any operating leverage since it increased less than revenue. Indeed, the gross margin contracted from 49.7% to 44.6%. This, along with an increase in operating expenses, caused the company’s operating loss to increase dramatically from $51.2 million in the comparable period to $104.9 million now.

TipRanks Investors are Not Too Optimistic About LSPD

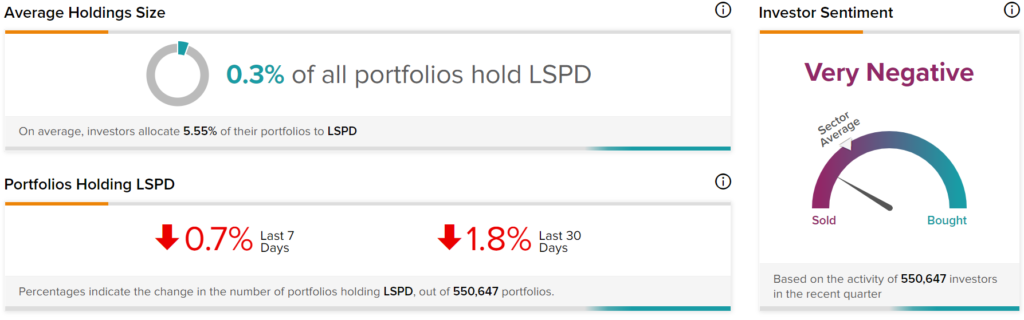

The sentiment among TipRanks investors is currently very negative. Out of the 550,647 portfolios tracked by TipRanks, 0.3% hold LSPD. However, the average portfolio weighting allocated towards LSPD among those who do have a position is 5.55%. This suggests that investors of the company are quite confident about its future.

Nonetheless, in the last 30 days, 1.8% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Wall Street’s Take on LSPD

Lightspeed has a Strong Buy consensus rating based on 12 Buys, one Hold, and one Sell assigned in the past three months. The average LSPD price target of $37.28 implies 71.7% upside potential.

Final Thoughts – Is Lightspeed a Strong Buy?

Analysts seem to believe that Lightspeed is a Strong Buy. The company saw very strong growth in the quarter, as revenue increased substantially while earnings came in as expected. However, the contracting margins and widening losses are not what investors want to see, especially in the current market environment. As a result, we don’t agree with the analysts’ recommendation and believe that there are better opportunities elsewhere.