In this piece, I evaluated two electric vehicle stocks, Li Auto (NASDAQ:LI) and Lucid Group (NASDAQ:LCID), using TipRanks’ comparison tool to see which is the better buy. A closer look suggests a bullish view for Li Auto and a bearish view for Lucid Group.

China-based Li Auto designs, develops, manufactures, and sells electric SUVs, while U.S.-based Lucid Group manufactures electric luxury sports cars and grand tourers, a type of luxury car designed for long-distance and high-speed driving.

Shares of Li Auto have already plunged 25% year-to-date, although they’re still in the green for the past one-year period, up 11%. Meanwhile, Lucid Group stock has plummeted 37% year-to-date and is off 70% over the last 12 months.

Those year-to-date declines in both stocks are the result of an industry-wide plunge in EV makers so far in 2024. Even the mighty Tesla (NASDAQ:TSLA) has tumbled 17% year-to-date following a growing number of headlines that suggest weakening demand for EVs in general.

Between the news of Tesla’s price cuts and Ford’s decision to cut production of its all-electric F-150 Lightning, EV stocks just can’t catch a break. However, this recent sell-off could offer some buy-the-dip opportunities in the EV space.

In fact, the sell-off has dragged both Li and Lucid down nearly to oversold territory, with Li’s Relative Strength Index at 30.6 and Lucid’s at 30.8. However, a closer look is needed to determine whether either company is worth picking up on the cheap.

Li Auto (NASDAQ:LI)

Li Auto is a particularly interesting EV play because of how quickly it has scaled and become profitable. Its exposure to China is a key factor in that rapid growth, and the fact that it is one of only a few profitable EV makers there further sets it apart. Thus, a bullish view seems appropriate in light of these factors and the recent sell-off. At current levels, this stock looks far too cheap to ignore.

Goldman Sachs (NYSE:GS) initiated coverage of Li Auto earlier this month with a price target betting on a 50% pop in Li’s stock price. Analyst Tina Hou highlighted the company’s skyrocketing delivery growth and preparations for the launch of a new all-electric model.

Li delivered over 50,000 vehicles in December, up 137% year-over-year and achieving its monthly delivery target. During the fourth quarter, the company delivered 131,805 vehicles, a 184.6% year-over-year increase. In all of 2023, Li Auto delivered 376,030 vehicles, bringing its total number of vehicles delivered to over 600,000, the most among emerging new-energy automakers in China.

Hou also noted that Li is one of the very few Chinese EV makers that is profitable and highlighted its innovative use of range extenders that utilize a fuel tank to charge the battery and extend the range. Li Auto also plans to launch multiple new vehicles this year, bringing its portfolio to a total of eight models by the end of the year. Thus, there are plenty of upcoming catalysts that could drive further upside this year.

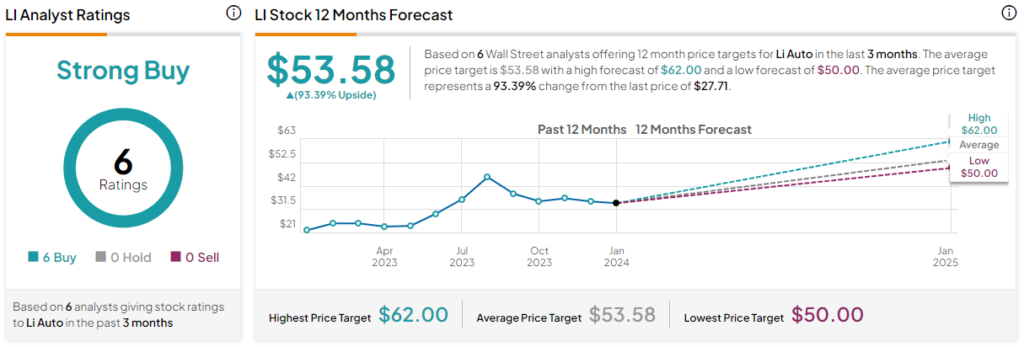

What is the Price Target for LI Stock?

Li Auto has a Strong Buy consensus rating based on six Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $53.58, the average Li Auto stock price target implies upside potential of 93.4%.

Lucid Group (NASDAQ:LCID)

Unlike Li Auto, Lucid Group is not profitable. In fact, at its price-to-sales (P/S) ratio of 10, Lucid is trading at a steep premium to Li with its P/S of 2.1. Thus, a bearish view looks appropriate for Lucid Group, especially considering that it’s trading at that premium to Li Auto, even though it’s a fraction of the size.

Li Auto has generated US$13.7 billion in sales over the last 12 months compared to Lucid’s $695.8 million in revenue. Lucid delivered 1,734 vehicles during the entire fourth quarter and 6,001 vehicles in all of 2023, so it has a long way to go to catch up to its Chinese competitor.

In fact, a deeper dive into Lucid’s production and delivery numbers reveals some potential problems. Although its full-year production number of 8,428 vehicles was toward the top of the automaker’s guidance, its original target was to produce 14,000 vehicles in 2023. Lucid cut that original guidance to 10,000 and then lowered it again late in the year to a range of 8,000 to 8,500.

Additionally, Reuters reported recently that Lucid’s push into Saudi Arabia could be fraught with trouble due to the kingdom’s lack of supply-chain infrastructure for automakers. Saudi Arabia also doesn’t have a workforce skilled in building cars and could face significant problems getting raw materials there. Meanwhile, Li Auto is chugging along in the rapidly growing Chinese market, which is a far better place to be right now.

Further, this might not be the best time to be trying to scale up while exclusively selling luxury cars, given the possibility of a recession. At the same time, Li Auto has a much wider array of vehicle types and classes, and its price war with Tesla has attracted plenty of press (a.k.a. free advertising).

Finally, after the recent sell-off, Lucid shares are trading around their record low, but there are just too many potential issues to warrant picking up some shares, even at current prices.

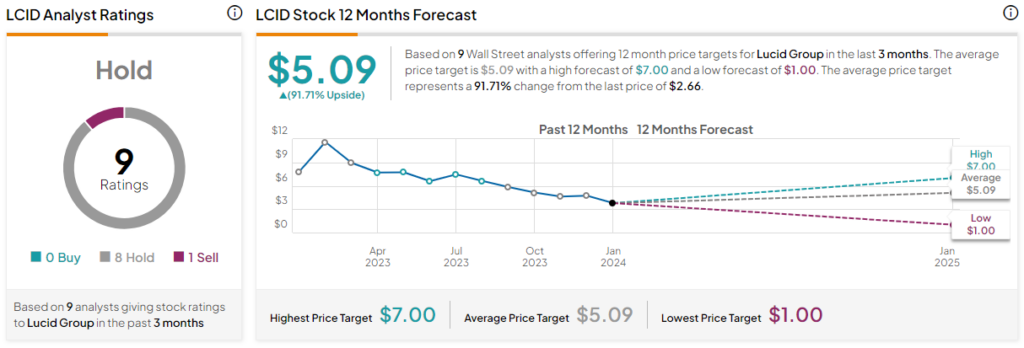

What is the Price Target for LCID Stock?

Lucid Group has a Hold consensus rating based on zero Buys, eight Holds, and one Sell rating assigned over the last three months. At $5.09, the average Lucid Group stock price target implies upside potential of 91.7%.

Conclusion: Bullish on LI, Bearish on LCID

Comparing Li Auto with Lucid Group is like comparing night and day. Where Li Auto’s delivery and growth trends are positive as its sales continue to jump higher, Lucid is failing to meet its targets. Additionally, Lucid is trading at a much higher P/S multiple than Li, a valuation that simply doesn’t make any sense. Thus, if you were to continually monitor only one emerging EV maker, it probably should be Li Auto.