‘Tis the week of the tech behemoths. Against a precarious macro backdrop, the market’s heavy hitters will take turns this week to deliver Q3’s financials. Hardly any come much bigger than Alphabet (GOOG) and following the market’s close today, the search giant will announce 3Q22 results.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

According to Wolfe Research analyst Deepak Mathivanan, the Street is expecting a bit too much although that does not necessarily mean the Alphabet growth story has hit a brick wall.

“In terms of the stock,” says the 5-star analyst, “elevated consensus estimates, admittedly, creates an unfavorable setup into 3Q print but we think the long-term bull case on Alphabet (search competitive position, sustainable earnings growth) remains intact.”

Mathivanan thinks current consensus estimates do not take into consideration the “deceleration from 2Q levels across various businesses,” which will likely result in the performance coming below anticipated levels. “However,” adds Mathivanan, “the magnitude of deceleration at search and YT in 3Q are important signals to evaluate Alphabet’s cyclicality/sensitivity to incremental macro slowdown in 1H23.”

The analyst will also be hoping for some commentary suggesting a “moderation in operating expense growth” over the next few quarters, which could go toward “firming up” FY23 EPS ranges.

As for the numbers, Mathivanan is calling for Q3 search revenues of $38.7 billion (indicating 7% year-over-year growth ex-FX, compared to Q2’s 17%), which is 6% off consensus estimates. This is in anticipation of “another soft quarter” for YouTube, for which Mathivanan expects a low-single-digit revenue decline on ex-FX basis. On the other hand, given its healthy backlog, cloud growth should come in “near high-20s.”

At the other end of the scale, with mark-to-market of debt/equity investments affecting proceedings by $0.09 in Q3 vs. Q2’s $0.08, Mathivanan expects GAAP EPS of $1.06. This is also some distance below the Street’s more exuberant $1.28 forecast.

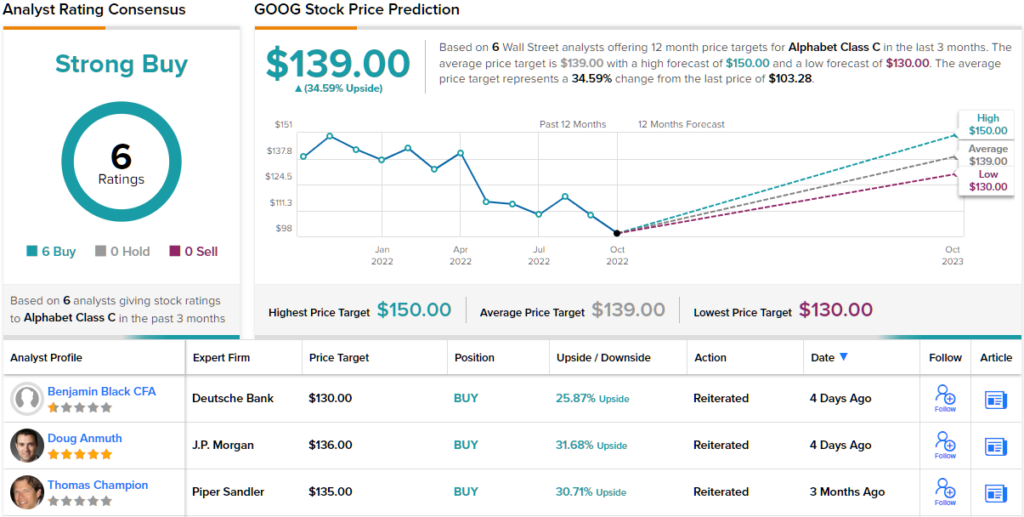

All in all, Mathivanan rates Alphabet shares an Outperform (i.e., Buy), along with a $120 price target. The implication for investors? Upside of 16% from current levels. (To watch Mathivanan’s track record, click here)

In total, 30 analysts have assessed Alphabet’s prospects over the past few months and barring one doubter, all the reviews are positive, making the consensus view here a Strong Buy. The forecast calls for 12-month gains of ~36%, considering the average price target clocks in at $139. (See GOOG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.