One of the most common reasons markets go down is worries about a pandemic. There were also concerns in early 2022, with inflation and interest rates rising on top of this. As a result, the markets are unforgiving. 3M (MMM) doesn’t look like an interesting prospect in this environment.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The 3M Company is the leading manufacturer of post-it notes and other office supplies. It also manufactures adhesives, abrasives, films and tapes, specialty materials, and various other utility products, and has evolved into one of the largest manufacturers in the world.

However, shares have been under the hammer since the start of the year due to ongoing legal battles. These legal cases are becoming topics of public attention, and investors are worried about their positions.

3M has struggled to keep up with the pressure from many sources, including the growing settlement of PFAS (per- and polyfluoroalkyl substances) contamination and alleged defects in military earplugs.

Plus, it is always a good idea to make sure that you’re analyzing things from all angles, such as your company’s revenue and margin leverage performances. 3M’s growth has been pretty lackluster over the last decade. Therefore, it doesn’t secure a high grade on this matter.

To be fair, 3M does has some great qualities. It is a highly profitable company, commands great brand value, and is internally integrated. However, just because it’s worked in the past doesn’t mean it will continue to drive gains in the future. While other companies have been aggressive when it comes to M&A activity, 3M has moved slowly on this matter.

3M Earnings Left Much to Be Desired

In 3M recently reported earnings, the company noted COVID-19-related demand for masks has fallen, and litigation related to a settlement in Belgium has impacted the company.

3M announced its earnings for the first quarter of the year, with an adjusted profit per share of $2.31 for the three months ending in March. This was 16% lower than last year compared to what analysts expected to see.

3M announced that its GAAP earnings will now fall from $9.89 to $10.39 per share, down from prior estimates of $10.15 to $10.65 per share. It expects organic sales growth of anywhere between 2% and 5%, with research and development spending on cutting-edge products at around 4 billion.

3M’s new accounting guidance is between 10.75 and 11.25 per share.

3M is in Danger of Becoming a Retirement Stock

There are many uncertainties in today’s market, like runaway inflation and interest rate hikes. People planning to retire soon are looking into safer options such as retirement stocks. For them, 3M will continue to remain attractive.

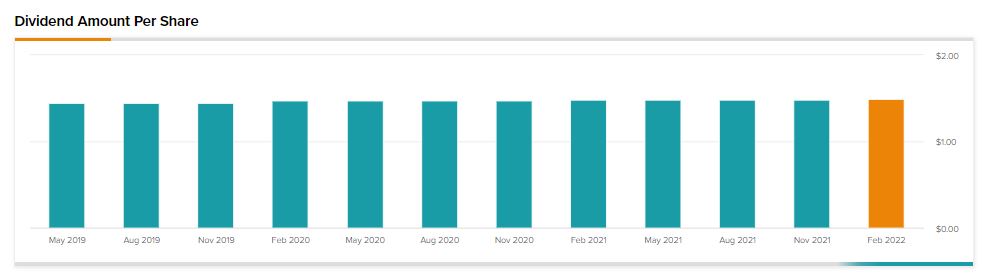

The company’s dividend yield of 4.05% is one of the best in the industry. That will keep investors interested in the stock. 3M’s payout ratio is 59.30%, which means it has room to grow its dividend even further.

However, the risk is that the company could exclusively become known as a retirement stock. Price momentum for shares has been lackluster for the last several years.

Additional Risks for 3M

The cost of production has been increasing on the supply-side, limiting future earnings growth.

3M has a global presence in over 70 countries, and 60% of the company’s revenues are from outside the US. As a result, competition is intense and environmental conditions can change relatively rapidly. The recent turmoil in these different countries could seriously affect its operations.

It is hard to predict how the company’s current lawsuits will end, as many are pending settlement. 3M is being sued by many individuals for several large payouts, which is something investors will need to keep in mind when allocating their capital to this company.

Wall Street’s Take

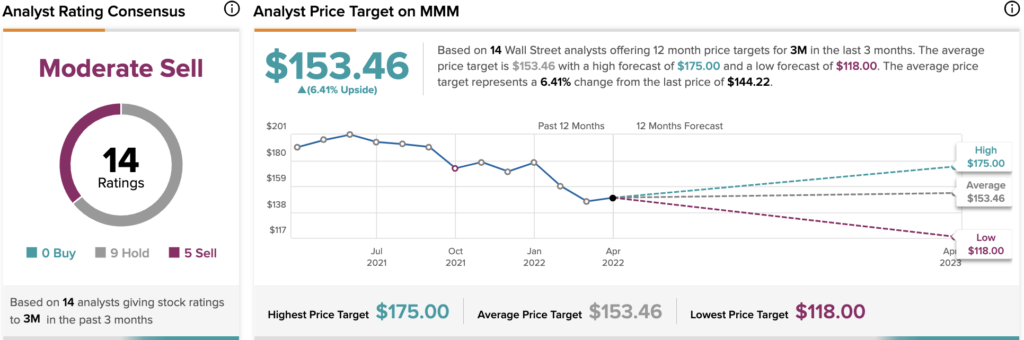

Wall Street has a negative view of 3M, with a Moderate Sell consensus rating based on nine Holds and five Sells. The average price target of 3M is $153.46, which implies a 6.41% upside.

Bottom Line

3M continues to generate healthy cash flows. They return a significant portion to shareholders. The company has an excellent balance sheet and outperforms its competitors when it comes to profitability. One of the risks is that they’re involved in multiple court battles, but there are also risks with input costs rising as well. 3M is a longstanding business with decades of experience.

As a result, the company might be a good retirement stock. However, investors who focus on growth stocks and value stocks will likely avoid this name until it gives more reasons to invest in it.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure