Popular department store and retailer Kohl’s (NYSE: KSS) response to a grim outlook during the COVID-19 pandemic not only restored pre-pandemic performance, but greatly exceeded it. Focused on both consumer and shareholder value, Kohl’s enjoys near all-time highs of return on equity and return on assets and has doubled its market capitalization the past year alone. With the holiday season underway, consumers flock to such retailers, who offer extensive variety and value.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

I’m bullish on Kohl’s.

Beating Expectations

Kohl’s reported net sales increased 16% in Q3 year-over-year, along with the company’s gross margin reaching 39.9% compared to last year’s 35.8%. Record third-quarter diluted EPS of $1.65 were reported, compared to a mere $0.01 adjusted diluted EPS in Q3 2020 and drastically beating an expected $0.70 diluted EPS, resulting in the full year 2021 EPS guidance being raised from $5.80-$6.10 to $7.10-$7.30.

Similarly, operating margin growth outlook was improved, increasing to 8.4%-8.5% from 7.4%-7.6% – the highest in nine years. As the company is directly concerned with increasing shareholder value, $506 million of shares were repurchased during Q3, with an estimated $1.3 billion of shares purchased in 2021.

Kohl’s chief executive officer Michelle Gass attributed these successes to new initiatives in their growth strategy, stating, “We drove accelerated growth in Active and successfully launched several new brand partnerships, including the initial rollout of 200 Sephora at Kohl’s stores, which are off to a great start.” She continued, “All of the pieces of our strategy are coming together, and we remain incredibly confident in the future of our business.”

This strategy is made possible by Kohl’s exploitation of several competitive advantages they have secured.

Scope and Customer Retention: The Keys to Success

Kohl’s main strategy is founded on two crucial aspects of the business: economies of scope and customer retention.

Kohl’s has established economies of scope, not only bettering customers’ experiences, but proliferating financial performance. A partnership has been established with personal care and beauty retailer Sephora, opening 200 in-store locations. Plans are in place to introduce an additional 400 locations in 2022, eventually reaching at least 850 locations by 2023.

Even if consumers are not attracted to Kohl’s itself, this relationship now provides a new incentive to visit the store, now carrying approximately 125 additional brands at various price levels. Once there, however, customers are subsequently led to purchase Kohl’s products, evidenced by high attach rates to other parts of the business.

Kohl’s continues to have strong relations with renowned brands such as Nike (NKE), Adidas (ADDYY), and Under Armour (UA), highly desired brands by consumers. Moreover, focusing on their “Active” selection, Lands’ End (LE) offerings have been expanded, along with the launch of Eddie Bauer products. In furthering the scope of Kohl’s existing products, the company is also enhancing home necessities, such as décor, sheets, and small appliances from brands such as Sonoma.

Kohl’s has also focused on making the purchase of such products more convenient for their customers, creating another competitive advantage.

Realizing the importance of an omni-channel approach to sales, Kohl’s has heavily invested in its proliferation. Services such as the Kohl’s app, Buy-Online-Pick-Up-In-Store, and Buy-Online-Ship-to-Store target younger generations, not only allowing them to purchase many popular products in one store through multiple channels, but also providing the option to return items in-store without incurring shipping fees.

Once customers are initially attracted, Kohl’s has also made it difficult for them to make only one purchase.

The Kohl’s Rewards loyalty program has proliferated existing means of customer retention while personalizing new rewards for their customers. The offering of “Kohl’s Cash,” or discounts on future purchases after making prior purchases, prompts customers to return to the store and purchase additional items, thus appealing to the emotional side of consumers. Furthering this emotional appeal, consumers are provided with additional opportunities to save through holding a Kohl’s card.

Lastly, Kohl’s has also been able to partner with and offer third-party services within their stores. For example, Amazon Returns (AMZN) services are located in-store. Not only does this increase foot traffic overall, but coupons included on receipts of Amazon Returns also lead customers back to Kohl’s. While the effects of this cycle for the consumer may be subjective, it is undeniably beneficial for the company, and Kohl’s recognizes this through the implementation and improvement of such services.

Headwinds and Tailwinds: Turbulence Easing

For the retail industry, the pandemic has acted as a double-edged sword. Lockdowns made it impossible for consumers to shop in-store at most retailers, and in the early months of uncertainty, consumers were often wary of spending large sums of money on clothing and household items. Though lockdowns have eased, emerging COVID-19 variants could lead to similar measures, and the supply chain issues from the first lockdown have yet to be resolved.

However, many of these concerns have quickly been settled, as is apparent in Kohl’s Q3 financials.

Rather than shopping in-person, customers took advantage of Kohl’s e-commerce, with digital sales increasing 40% in 2020, computing a digital sales compound annual growth rate of 17%. Additionally, customer savings, compounded by generous stimuli provided by the government, paradoxically proliferated spending, especially with the holiday season underway.

Do analysts believe that these tailwinds will overcome the headwinds, leading to continued success? It seems so.

Wall Street’s Take

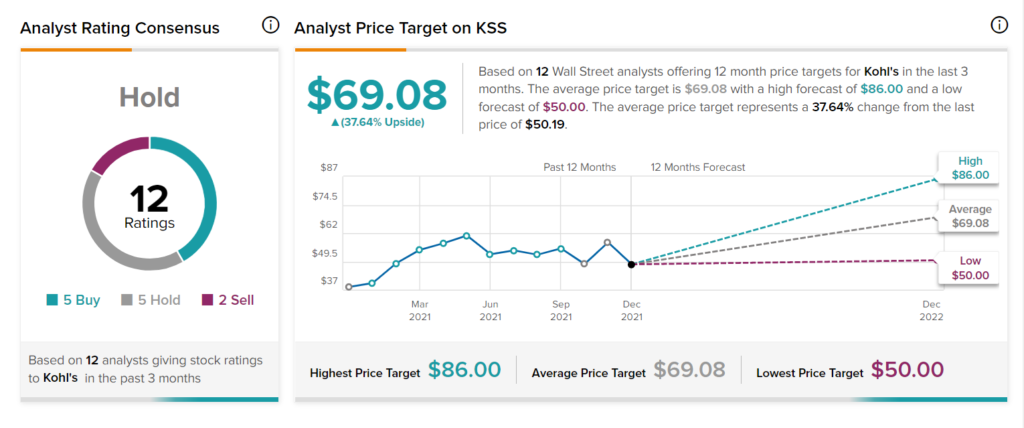

KSS currently has a Hold consensus rating; out of the twelve analysts following KSS, five have placed a Buy rating, five a Hold rating, and two a Sell rating. A Kohl’s price target of $69.08 implies a 37.64% upside, with a high price target of $86 and a low of $50.

The Bottom Line

Kohl’s is not only in the right market at an opportune time, but has a solid strategy focused on both shareholders and consumers; its success is evident in the its Q3 earnings.

Disclosure: At the time of publication, Brandon Humbert did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >