Bitfarms (BITF) stock investors had a highly rewarding November. The cryptocurrency miner’s common shares hit an all-time high of $9.36 during the past month, and have made impressive gains of $286.6% year-to-date.

Insiders determined it was time to take some profits on their personal BITF stock positions. Could this be the signal for investors to cash out of their positions in the blockchain giant?

Bitfarms owns and operates blockchain farms that provide computing power to cryptocurrency networks such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Dash, earning fees and commissions from each network for securing and processing transactions.

I am neutral on BITF stock, though skeptical of recent insider activity. (See Analysts’ Top Stocks on TipRanks)

BITF Executives Sell Actions

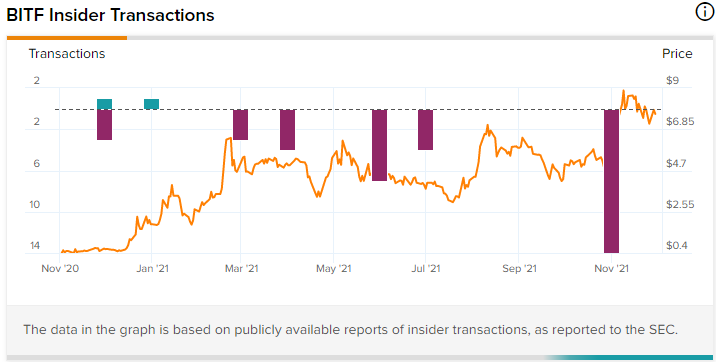

Six senior managers and executives sold their employer’s stock in 14 separate transactions during the last month. Insiders have sold shares worth about $14.4 million during the past three months.

The most prominent insiders who sold Bitfarms stock in November were the company’s two co-founders, namely board chairman Nicholas Bonta and CEO Emiliano Joel Grodzki.

Bonta sold 355,000 shares between the 20th and the 27th of November for total gross proceeds above $2.8 million. However, his activity pales in comparison with Grodzki’s disposal of 580,000 shares for gross proceeds of $4.64 million.

What to Make of It

Whichever way one looks at it, the massive insider sales of Bitfarms stock in November look a bit ugly in investors’ eyes, more so when read together with the company’s monthly “production” report released on December 1.

Company founders, chief executives, and chief financial officers are key insiders who usually possess material information about the company’s current and future business prospects. Whenever they buy or sell their company’s stock, investors should take a closer look. Especially if their transactions seem coordinated in some way.

In Bitfarms’ case, both founders and the CEO offloaded significant portions of their holding of BITF stock in November. The biggest transactions happened towards the end of the month.

Now, the big news in the company’s monthly report for November is that the company mined just 339 Bitcoins during the month, down from 343 Bitcoins for October. The sequential decline in monthly production still happened even after the company increased its computing power by 16% during the month to 2.1 Exahashes per second (EH/s).

The company revealed an increase in mining difficulty during the month.

“Even with an increase in network difficulty, our BTC production level held steady in November, and we ended the month with nearly 3,000 Bitcoin,” Grodzki was quoted in the company’s statement released on Wednesday.

Investor Takeaway

Company insiders may sell stock for several personal and investment-related reasons at times. The fact that they are restricted to specific trading windows sometimes makes the timing of their transactions a bit complicated.

Perhaps the timing for Bitfarms founders’ sales only coincided with news about depreciating productivity in the company’s operations. The two data points could still be unrelated.

However, the insider sales were still significant, and their coincidence with a lukewarm production report for the past month could put a dent on investor confidence. A 16% sequential increase in “productive capacity” resulted in a sequential 1.5% decline in total Bitcoin production, as mining difficulty increased in November.

That said investor sentiment is still positive on the company. The consensus analyst rating on Bitfarms stock is a Moderate Buy, and key technical indicators are still positive too.

Disclosure: At the time of publication, Brian Paradza did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >