The green economy isn’t just an idea or a goal for the future; it’s already here, shaping choices of producers and consumers in industries as diverse as food distribution and energy generation. Specifically, green incentives are fueling a boom in residential solar power installations. As this trend matures, it will provide increasing benefits to users, consumers, professionals, and investors.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But we’ll be talking here about residential solar installations. These home power units are seeing solid interest from consumers, based in part on a variety of ‘green’ pressures and in part on increases in electric utility bills. From an investor’s perspective, the key here is module-level power electronics, MLPE, a new take on the microinverter technology that is essential to making small-scale solar installations function.

Writing from banking firm HSBC, analyst Daniel Yang sets out the case for residential solar stocks – and how they’ll gain from MLPE tech.

“The new trend in the global solar inverter market is the rise of premium inverters – known as module-level power electronics (MLPE). They cost more but are safer and create more output. They already dominate the US market and we expect them to increasingly be used in the rest of the world… We think this is an overlooked opportunity by investors in MLPE providers,” Yang opined.

Yang doesn’t leave us with a macro view of the industry. The analyst goes on to give a drill-down to the micro level, and picks out two solar stocks that stand to benefit from the rise of MLPE.

Are other Wall Street analysts in agreement here? We dived into TipRanks, the world’s biggest database of analysts and research, to pull up the details and find out.

SolarEdge Technologies (SEDG)

We’ll start with SolarEdge Technologies, a player in the design and manufacture of microinverters. As mentioned previously, microinverters are an essential piece of solar installation technology. Specifically, microinverters change the DC (direct current) power produced by photovoltaic panels into AC (alternating current) energy that can be used in modern electric power systems.

In addition to microinverters, SolarEdge also produces photovoltaic monitoring systems, power optimizers, and even solar-powered EV chargers. The company markets its products directly to consumers in the residential market, to building owners and businesses in the commercial installation market, and to construction and other installation professionals.

While SolarEdge is well known for its high-end microinverters, it’s power optimizer products actually have a larger market share. The company is moving toward a more MLPE-based technology on all of its product lines, to gain leverage from the rapid growth of this tech in the solar installation niche.

For SolarEdge, this adds up to plenty of opportunity to grow revenue and earnings. The company’s top line has shown consistent quarter-over-quarter sequential increases in the last several years, and in its last report, for 4Q22, SolarEdge beat expectations on both revenues and earnings. At the top line, the $890.7 million reported was $11.6 million above the forecast, and up 61% year-over-year. The bottom line non-GAAP EPS figure of $2.86 came in an impressive $1.27 better than forecast, and represented a massive increase from the mere 74 cent EPS recorded in the prior-year quarter.

So this is a company on the rise, with a solid position in the US solar installation market. That market was estimated at more than $14 billion in 2022, and is expected to see a CAGR of 15% going out to 2030.

With all of this in the background behind, we can see the optimism in Daniel Yang’s comments on the company: “SolarEdge has an 87% global market share in optimisers, devices used to maximise the solar energy output of a solar system. In our view, this is due to its proprietary technology in chip design and algorithms. MLPE’s market share in the US distributed generation (DG) solar market has grown from zero to nearly 100% in the past decade. SolarEdge is one of the leaders in the US market and we expect Europe to be the next growth driver, where we forecast that MLPE adoption will increase from 24% in 2021 to 50% by 2025e.”

Looking forward, it’s no wonder that Yang rates this stock a Buy, and his price target, at $418, implies a one-year upside potential of 31%. (To watch Yang’s track record, click here)

What other analysts have to say about SolarEdge? The stock gets a Moderate Buy consensus rating, based on 23 recent analyst reviews that include 17 Buys against 6 Holds. The stock is trading for $319.20 and its $375.18 average price target suggests it will grow 17.5% from current levels. (See SolarEdge stock forecast)

Enphase Energy (ENPH)

The second stock we’ll turn to is Enphase Energy, the current market leader in overall solar MLPE installations. The company’s chief product line consists of solar power inverters, and Enphase’s leading position is based on its ability to bring commercial-scale inverters directly to the market. Enphase is the dominant player in the US residential solar market, boasting an impressive market share of 86%.

Enphase has rested on its power inverters, however. The company also produces energy storage systems, another technology essential in making residential and small commercial solar installations viable for customers. The company incorporates smart tech into its line of IQ power storage batteries, allowing users finer control of power loads and the ability to set power distribution priorities among notoriously power-hungry appliances.

Like SolarEdge above, one of its chief competitors, Enphase has seen solid and consistent gains at both the top and bottom lines in recent quarters. The company’s 4Q22 results featured solid revenue gains, with the company reported $724.65 million in total sales, up 75% year-over-year and $21.5 million better than had been expected. The non-GAAP quarterly EPS was set at $1.51, or 25 cents better than the forecast. Enphase brought in $237.3 million in free cash flow for the quarter, and finished 2022 with $1.61 billion in cash and other liquid assets on hand.

With a background like that, it’s no wonder that ENPH has attracted rave reviews from HSBC’s Daniel Yang. The analyst rates the stock a Buy, along with a $271 price target, which implies a 21% upside from current levels. (To watch Yang’s track record, click here)

Backing his stance, Yang writes: “Enphase grew its share of the US residential solar inverter market from less than 20% in 2019 to around 45% in 2020…. we believe another reason for the company’s success is a differentiated value proposition for customers, led by compressive and one-stop product offerings; enhanced software solutions that improve the user experience; a strong focus on smaller installers in a fragmented market. These strengths have not only helped the company to gain share in the US market but also convinced customers to pay premium prices for products and services.”

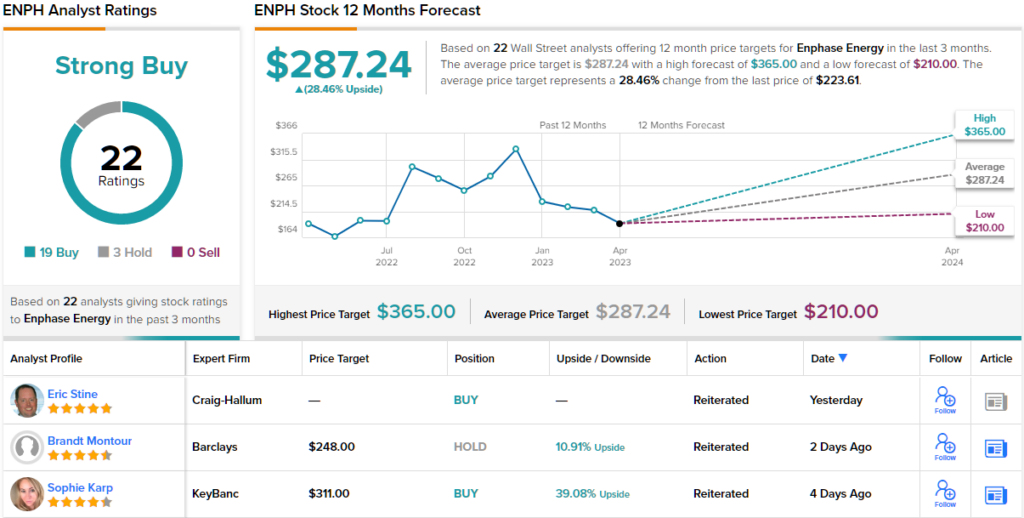

Zooming out, we find that Enphase get a Strong Buy consensus rating from the Street’s analysts, based on 22 reviews that break down to 19 Buys and 3 Holds. The shares have an average price target of $287.24, suggesting a 28% one-year increase from the current trading price of $223.61. (See ENPH stock forecast)

To find good ideas for solar stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.