With no end in sight to the UAW strike and the prospect of its expansion, one name not directly involved looms over the proceedings.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Detroit Big Three (Stellantis, Ford, and General Motors) are all being impacted to varying degrees. However, Tesla (NASDAQ:TSLA) stands out as the only major American vehicle manufacturer with no UAW members among its workforce. Consequently, the strike does not affect Tesla.

However, as Morgan Stanley analyst Adam Jonas notes, Tesla has a role to play in the event, and he makes the case that there’s a significant difference between the current UAW strike and the one that took place in 2019. “There’s a viable alternative for U.S. domestic auto production outside of the Detroit 3 (D3),” says Jonas. “Tesla’s influence on both sides of the negotiating table looms larger than it appears.”

This is because Tesla has played a significant part in pressuring the three traditional automakers to expedite their transition to EVs, which is a major source of disagreement. While the news mainly focuses on the UAW’s demands for a 40% salary increase, a shortened four-day workweek, enhanced overtime, and retirement benefits, they are also seeking safeguards against factory shutdowns. This is especially relevant as these established automakers are increasingly choosing to construct new EV facilities instead of converting their existing ICE (internal combustion engine) production plants in many instances.

The problem for the legacy automakers is that even before any salary hikes, they are experiencing financial losses with their EV endeavors. “In our view,” says Jonas, “even before a potential 30 to 40pct rise in hourly worker labor costs, we questioned the ability of the D3 to be able to produce high volume EVs at a profit.”

While the legacy auto giants are faced with an “existential stand-off,” Tesla will probably end up the winner, which brings us back to 2019, when the UAW struck at General Motors for 6 weeks and Tesla’s market share barely scratched 1%. That is a rather different situation to the current one.

“Today, Tesla’s US share is testing 5pct and we expect this to double between 2 and 3 years,” the analyst said, before sounding ominous regarding the legacy auto giants’ future. “On our forecasts, Tesla’s US market share should be larger than GM and Ford combined before the end of the decade.”

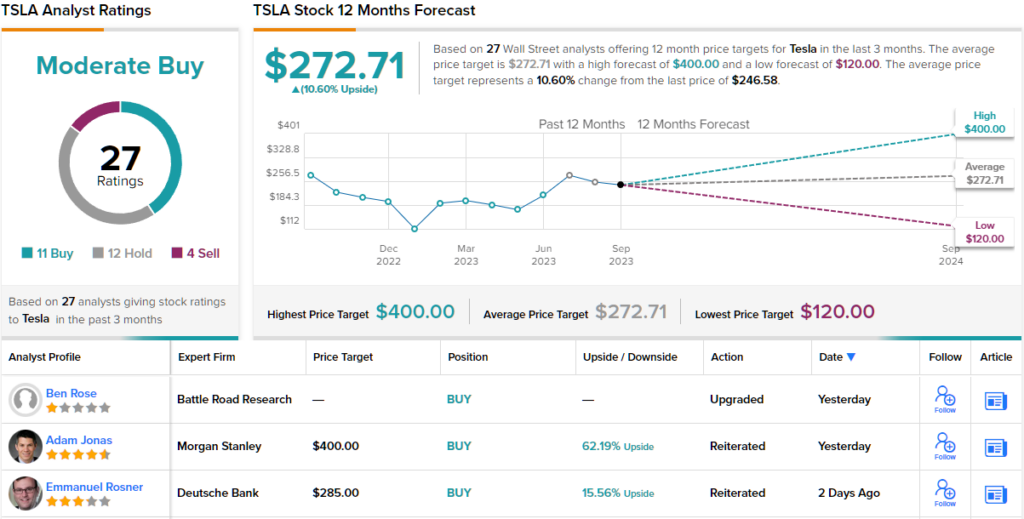

To this end, Jonas kept an Overweight (i.e., Buy) rating on TSLA shares, accompanied by a Street-high $400 price target. There’s potential upside of 62% from current levels. (To watch Jonas’ track record, click here)

On the Street, Tesla’s Moderate Buy consensus rating is based on a mix of 11 Buys, 12 Holds and 4 Sells. The analysts see shares climbing 13% higher over the coming months, considering the average target stands at $272.71. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.