Next week, several of Wall Street’s heavyweights will step up to the earnings plate, amongst them Microsoft (NASDAQ:MSFT). The tech giant will deliver its fiscal fourth quarter of 2023 statement (June quarter) on Tuesday (July 25) amidst strong optimism the company is only starting to benefit from the ongoing adoption of generative AI.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As such, ahead of the print, Piper Sandler analyst Brent Bracelin sees a ‘solid’ set-up, given “1) robust Gen AI momentum, which could drive above-consensus capex guidance and help offset Azure optimization headwinds; 2) Azure growth that appears to be stabilizing (even before considering Azure AI services benefit); and 3) non-cloud segments that could show improvements.”

Bracelin thinks the capex (capital expenditures) Microsoft is deploying to support the huge AI opportunity is much bigger than what the Street is factoring in. Gen AI “optimism and interest” underpin his FY24 $48 billion capex estimate, a Street high figure some distance above consensus at $32 billion and based on “aggressive capacity expansion plans to support an untapped AI opportunity.”

A recent Piper Sandler CIO survey which showed growing enterprise interest in Gen AI + “robust spending intentions” on Azure and M365 only confirms his thesis, says Bracelin and offers “further confidence” that it is only the beginning of a Gen AI investment cycle the company is “well positioned to capitalize on.”

Bracelin’s Gen AI bullishness is also based on 3P data. Data on web traffic for ChatGPT, GitHub, and Bing indicates widespread acceptance of Gen AI in both business and consumer domains. Both GitHub and Bing have experienced a significant surge in the number of average monthly users. In the June quarter, GitHub had over 300 million average monthly users, marking an 81% year-over-year increase, while Bing had over 460 million average monthly users, reflecting 35% growth. Although ChatGPT’s month-over-month growth rate has decreased after the initial hype, the web app still showed an impressive 580 million unique users in June.

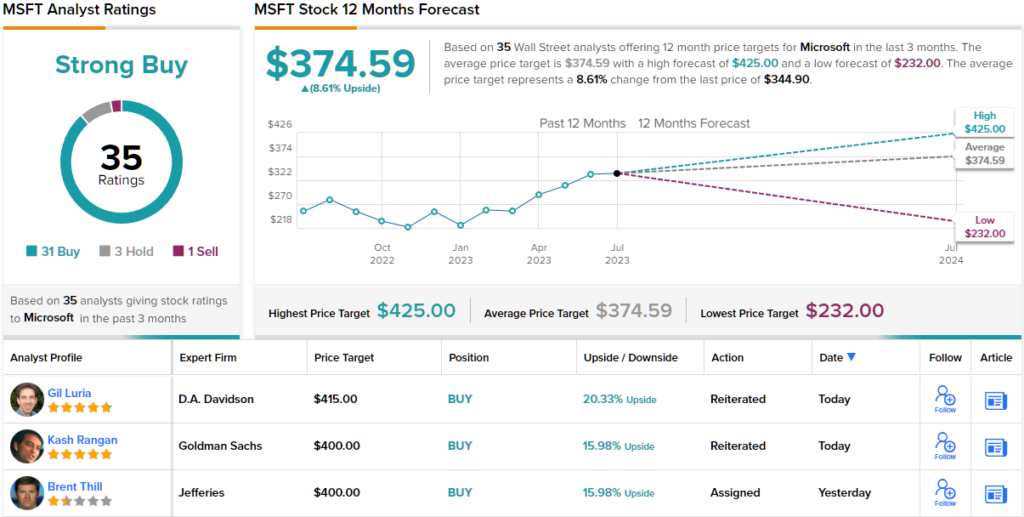

Despite the shares’ excellent AI-driven year-to-date performance (up by 44%), Bracelin “continues to like this AI All-Star” and reiterates an Overweight (i.e., Buy) rating and $400 price target. There’s potential upside of 16% from current levels. (To watch Bracelin’s track record, click here)

Overall, 35 analysts have chimed in with MSFT reviews over the past 3 months, and these breakdown into 31 Buys, 3 Holds and 1 Sell, providing the stock with a Strong Buy consensus rating. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.