When interest rates are rising, it’s natural to look to bank stocks. In this piece, we used TipRanks’ Comparison Tool to analyze two of America’s biggest banks — JPMorgan Chase (JPM) and Goldman Sachs (GS). Both banks look attractive based on two different valuation metrics, but their earnings numbers show why GS outranks JPM.

However, widespread concerns that a recession is right around the corner have weighed on investor interest in the financial industry despite the rapidly rising rates. After all, when recessions occur, demand for mortgages and auto loans drops while debt defaults rise.

Thus far, Wall Street is struggling, but Main Street and the American consumer appear to be in good shape. Generally, consumers’ financial health shows signs of flagging when a recession is imminent, so it might be a good time to look at bank stocks.

Competing Forces for Bank Stocks

In 2021, JPMorgan and Goldman Sachs both rose steadily as investors generally rotated into value stocks. In the case of bank stocks, many investors were expecting the Federal Reserve to hike interest rates, which it started to do in early 2022. However, when the Fed finally started raising rates, some troubling signs started to appear, including inflation rates that were at 40-year highs.

Talk about the possibility of a recession grew as the year went on. By July, the S&P 500 bank index was down 25% for the year, compared to the S&P 500’s (SPX) 19% decline.

Investors unloaded bank stocks rapidly due to concerns that the Fed’s aggressive rate hikes would lead to a recession. While the U.S. did record its second consecutive quarter of declining GDP, it might not be a bad time to start thinking about bank stocks, which generally look cheap right now.

JPMorgan Chase

With a price-to-book ratio of 1.4x and a P/E of 9.6x, JPMorgan Chase sits at an attractive valuation. The bank’s most recent peak occurred at the end of 2020, when it was around 16x. Even during the brief pandemic-era recession, JPMorgan notched a P/E of 9.4x, and the bank’s P/E was 7.8x when the federal funds rate averaged a yield of 0.1 in 2011 after the Great Recession.

A look at JPMorgan’s second-quarter earnings results demonstrates that the consumer looks healthy while Wall Street is struggling. Average loans from JPMorgan’s Asset & Wealth Management division rose 11% year-over-year and 1% sequentially, while average deposits increased 22%.

On the other hand, gross investment banking revenue from its Consumer Banking division tumbled 32% to $788 million. The segment also recorded a 7% increase in average loans year-over-year and 4% sequentially. Average deposits in the division rose by 4%.

It’s important to note that JPMorgan’s Consumer and Community Banking division is its largest source of revenue, generating $12.6 billion in revenue during the second quarter. Despite the recession concerns, that was only a slight decline from last year’s second quarter at $12.76 billion. However, JPMorgan’s Asset and Wealth Management division still managed to grow its revenue year-over-year, coming in at $4.3 billion versus $4.1 billion a year ago.

Unfortunately, the bank missed the consensus estimates for its earnings per share and revenue for the first and second quarters. This could be why it’s down significantly more than Goldman Sachs year-to-date.

For the second quarter, JPMorgan reported earnings of $2.76 per share on $30.72 billion in revenue, compared to the consensus of $2.89 per share on $31.82 billion in revenue. Shares of JPMorgan are off about 23% this year, although they’ve gained about 8% in the last month.

Is JPM Stock a Buy, Sell, or Hold?

JPMorgan Chase has a Moderate Buy consensus rating based on 10 Buys, seven Holds, and one Sell assigned over the past three months. At $138.33, the average JPMorgan Chase price target implies upside potential of 13.7%.

Goldman Sachs

Goldman Sachs looks cheaper than JPMorgan by some measures, which makes it slightly more attractive. The firm’s P/E currently stands at around 7.4x, and its most recent peak was in December 2020 at about 15x. Goldman Sachs’ P/E is currently rather low compared to its history. In the three years leading up to its peak at 26x in early 2018, the firm’s P/E generally hovered between 10x and 13x.

The firm’s price-to-book value is now at around 1.1x, making it even more attractive than JPMorgan. Goldman Sachs’ price-to-book value bottomed out at around 0.9 in July after declining steadily since August 2021. Meanwhile, Goldman Sachs shares are off about 7% year-to-date but up about 20% in the last month, demonstrating significantly greater confidence among investors.

As far as earnings, the firm beat the consensus estimates for earnings per share and revenue in the first and second quarters. For the second quarter, Goldman Sachs reported $7.73 per share in earnings on $11.86 billion in revenue, compared to the consensus numbers of $6.61 per share on $10.69 billion in revenue.

Goldman gets a larger chunk of its revenue from Wall Street activity, but, like JPMorgan, it also displayed strength in its Consumer division. The firm’s Consumer & Wealth Management reported record quarterly net revenues of $2.18 billion for the second quarter, a 25% year-over-year increase.

Goldman reported a 32% increase in Global Markets revenue, which rose to $6.5 billion. Even revenue in Equities rose, climbing 11% year-over-year to $2.86 billion. All in all, there was little to dislike about the second-quarter print.

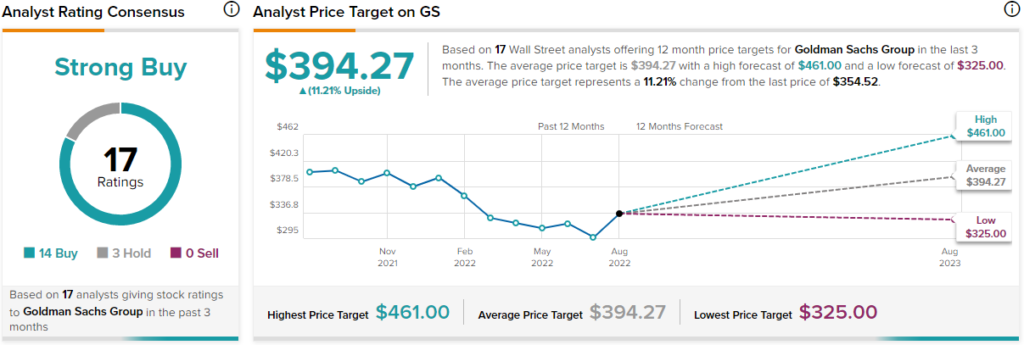

What is GS Stock’s Price Target?

Goldman Sachs has a Strong Buy consensus rating based on 14 Buys, three Holds, and zero Sells over the last three months. At $394.27, the average Goldman Sachs price forecast implies upside potential of 11.2%.

Conclusion: Goldman Sachs Looks Cheaper Than JPMorgan

While the possibility of a recession occurring can’t be entirely discounted, bank stocks do look discounted compared to historical valuations. Digging deeper into the numbers reveals that consumers remain in good shape, although Wall Street is struggling due to negative investor sentiment, something that can easily be fixed. Overall, Goldman Sachs had a stronger second-quarter earnings print than JPMorgan Chase. Also, Goldman’s P/E and price-to-earnings ratios show that the stock is cheaper than JPMorgan’s.

As a result, while both banks might make good investments as interest rates rise and investors await an economic recovery, Goldman Sachs looks a bit better than JPMorgan Chase.