The shipping and trucking industry forms the lifeblood of the American economy. In 2022, the last year with full data available, the trucking industry generated $940.8 billion in sales, representing more than 80% of the nation’s aggregate freight billing, and the 11.46 billion tons of cargo moved was up nearly 5% year-over-year. We just can’t do without trucking.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

That doesn’t mean that we always need a full load on the truck. The trucking industry’s ‘less than truckload,’ or LTL sector, holds an $82 billion niche within the larger transport segment. LTL is logistically and organizationally demanding – but makes it possible for smaller shippers to get their goods into the system without having to fill a whole trailer. The recent bankruptcy of the major trucking company Yellow has opened up new opportunities for LTL, as the defunct firm’s assets were auctioned off.

JPMorgan’s Brian Ossenbeck has run with that theme, noting advantages for LTL and saying that he “believe[s] the industry is still on a positive multi-year trajectory as not all of Yellow’s capacity will come back online, which will re-enforce the industry’s focus on yields and disciplined growth… better service and network density can drive further market share gains over time while a recovering manufacturing PMI is a positive sign for volumes in 2024-2025.”

Following from this, the analyst has picked 3 LTL stocks to buy as the market shifts underfoot. We ran these tickers through the TipRanks database to see what other Street experts make of their prospects. Let’s check the details.

ArcBest Corporation (ARCB)

First on our list is ArcBest, the Arkansas-based trucking firm that has a century of experience in the shipping business. ArcBest is a holding company, and works through a group of subsidiary companies that include trucking firms, LTL shippers, and logistic brokers and transport managers. ArcBest provides the logistic solutions its customers need to maintain their own supply chains and deliveries. Among ArcBest’s subsidiaries, ABF Freight is the best-known LTL carrier.

Altogether, ArcBest is a powerhouse in the shipping industry. The company boasts some 15,000 employees, working across 250 locations throughout the US. ArcBest has over 105,000 active carriers, and generated $4.4 billion in revenue last year. The company prioritizes technology and innovation, and invests nearly $175 million annually in tech initiatives to maintain top-flight service.

Turning to the company’s results, we find that ArcBest last reported quarterly results for 4Q23. In that quarter, the company brought in $1.09 billion in consolidated revenue, a total that included a double-digit percentage increase in the LTL-rated business. The total quarterly revenue was down more than 6% year-over-year, but beat the forecast by $10 million. At the bottom line, ArcBest realized a non-GAAP diluted EPS of $2.47. This was 24 cents, or nearly 10%, better than had been expected.

For JPM’s Ossenbeck, the picture here shows a shipping company that is expanding on its position. The analyst sees ABF as a solid contributor to ArcBest’s overall success, and writes, “We believe the strong 2H23 performance, which beat normal operating ratio seasonality, shows ABF is on the right path that also gets a bit easier in 2H24 when labor inflation drops 630bps under the union labor contract. Continuing to shrink ABF’s reliance on transactional activity likely provides a mix tailwind and improves sentiment on ARCB given the market is still skeptical that dynamic pricing is margin accretive. In addition, we believe ArcBest can demonstrate greater leverage in the early stages of a cyclical freight market recovery given the company has high cost LTL operations and an asset-light operation that was barely profitable last year.”

“We believe the combination of these factors merit an Overweight rating on ARCB especially given valuation does not appear demanding even on a discounted SoTP basis,” Ossenbeck summed up.

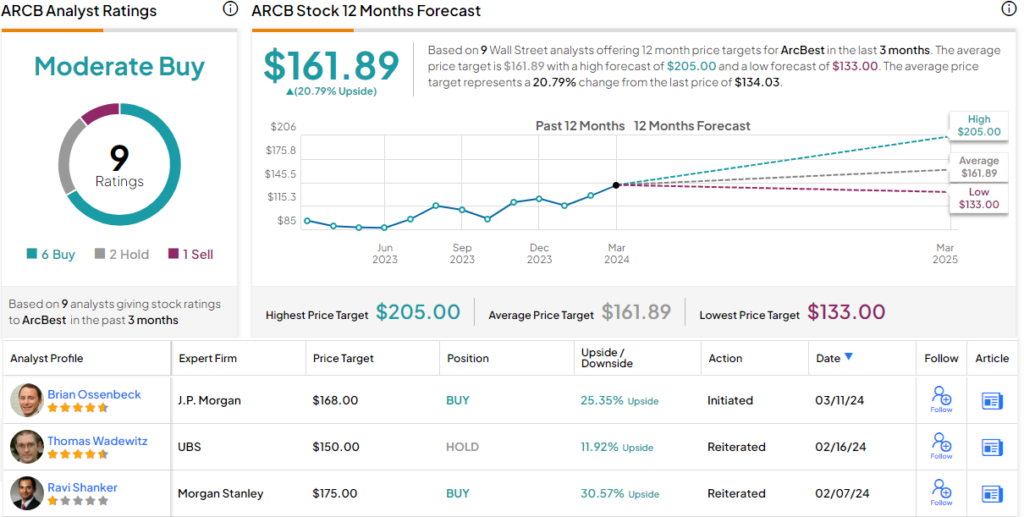

That Overweight (Buy) rating is complemented by a $168 price target that implies a one-year upside potential of 25% for the stock. (To watch Ossenbeck’s track record, click here)

Overall, ARCB shares get a Moderate Buy rating from the Street’s consensus, based on 9 recent reviews that include 6 Buys, 2 Holds, and 1 Sell. The stock is trading for $134.03 and carries an average price target of $161.89, suggesting a gain of 21% for the next 12 months. (See ArcBest’s stock forecast)

Saia, Inc. (SAIA)

Next up is Saia, a trucking company that got its start in Louisiana and Texas in 1924, and began expanding across the South in the 1980s. Today, the company operates in 36 states, and can even manage ‘offshore’ deliveries to Alaska, Hawaii, and Puerto Rico. The firm specializes in LTL shipping, and offers delivery guarantees along with shipment tracking resources. The company is also able to handle cross-border traffic with Canada and Mexico.

In the full-year 2023, Saia generated a total of $2.9 billion in revenue. This was up 3.2% year-over-year, and reflected an acceleration in business during the second half of the year. Zooming into the quarterly performance for Q4, we can see those 2H gains close-up.

For the quarter, Saia brought in $751.1 million in revenue, a total that was up 14.5% from the prior year – and was $5.65 million above the forecast. The LTL business showed solid gains in the quarter, including an 18.1% increase in the LTL shipments per workday, and 8.2% increase in the LTL tonnage per workday, and a gain of 11.7% in LTL revenue per hundredweight. At the bottom line, the company saw earnings per share of $3.33, beating the estimates by 13 cents, and growing significantly from the $2.65 EPS reported in 4Q22. Along with this increased business, the company’s stock is by 114% for the last 12 months, and 35% for 2024 so far.

Turning to analyst Ossenbeck, we find that he is upbeat on this company, particularly in light of its growth in recent years. Ossenbeck says of Saia, “Saia became a national LTL carrier after significant expansion in recent years and management has re-doubled on this growth strategy with the purchase of 28 new service centers for $244mm in the Yellow real estate auction. Saia’s expanded footprint and continued growth will allow for improved coverage and service that in turn drives both volume and market share in addition to network density and a reduced utilization of interline P&D and local agents.”

“Management has a proven track record and is capable of executing a growth strategy without jeopardizing margins or service levels as the company improved OR by a total of 1,000bps and operating income by +38% annually from 2017 to 2022, a period when 41 new terminals were opened and total shipment count grew by +15%,” Ossenbeck adds, and goes to note: “…Saia’s improving service levels will drive yields higher as shippers in Mastio’s annual survey recognize that Saia’s performance and service levels represent better value compared to peers.”

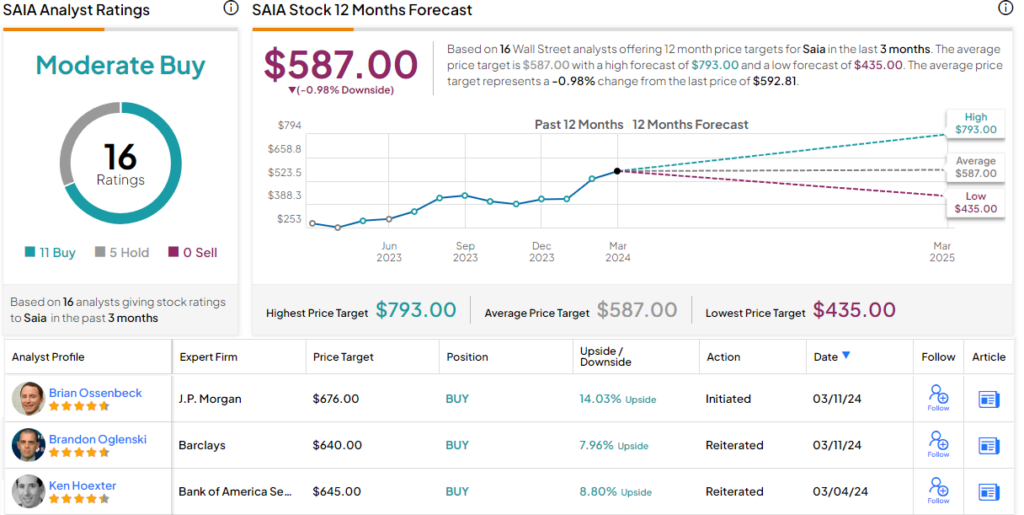

This all adds up to an Overweight (Buy) rating, with a $676 price target to indicate room for 14% share growth over the course of the year.

The consensus view on SAIA is a Moderate Buy, derived from 16 recent reviews that include an 11 to 5 breakdown of Buy over Hold. That said, the shares’ average target price of $587 suggests the stock will remain rangebound for the time being. (See Saia’s stock forecast)

XPO Logistics (XPO)

We’ll wrap up this list with XPO Logistics, a freight hauler based out of Connecticut – and another specialist in LTL shipping. XPO currently operates as a pure-play LTL company; between the summer of 2021 and the fall of 2022, the firm spun off its logistics and transport brokerage businesses, keeping just the LTL activities to itself. XPO can move shipments into 99% of the postal zip codes in the US, and can also reach large areas in both Canada and Mexico.

XPO is a big believer in the use of technology to smooth out logistic operations, and uses a proprietary platform to track the movement of goods and shipments efficiently through its LTL transport system. The company boasts that it de-risks its customers’ supply chains through its use of technology.

On the more mundane side, XPO claims some 38,000 employees, working through 596 locations to serve over 52,000 shipper/customers. The company’s business has been strong, as evidenced in the most recent print, for 4Q23. Revenue rose by 6% YoY to $1.94 billion, in turn beating the Street’s forecast by $20 million. At the other end of the scale, adj. EPS of $0.77 outpaced expectations by $0.15. Such results have certainly helped the shares, which are up an impressive 275% in the last 12 months, with 40% of those gains generated in 2024.

Checking in one last time with JPM’s Ossenbeck, we see that the JPM shipping expert sees multiple supports for XPO shares going forward. He says of the company, its business, and its prospects, “We continue to like the opportunity ahead of XPO to improve service and network density based on self-help initiatives while taking a measured approach to restarting capacity purchased from Yellow. We expect the market will remain somewhat skeptical that XPO can bring on a dozen facilities in 3-6 months without any OR drag but it is worth noting that service center incentives are now more aligned with operating ratio improvement than in prior years… XPO still trades at a discount to pure-play competitors, but we believe the company could close the valuation gap over time by continuing to improve damage claims and service levels while also leveraging the recently acquired terminals from Yellow.”

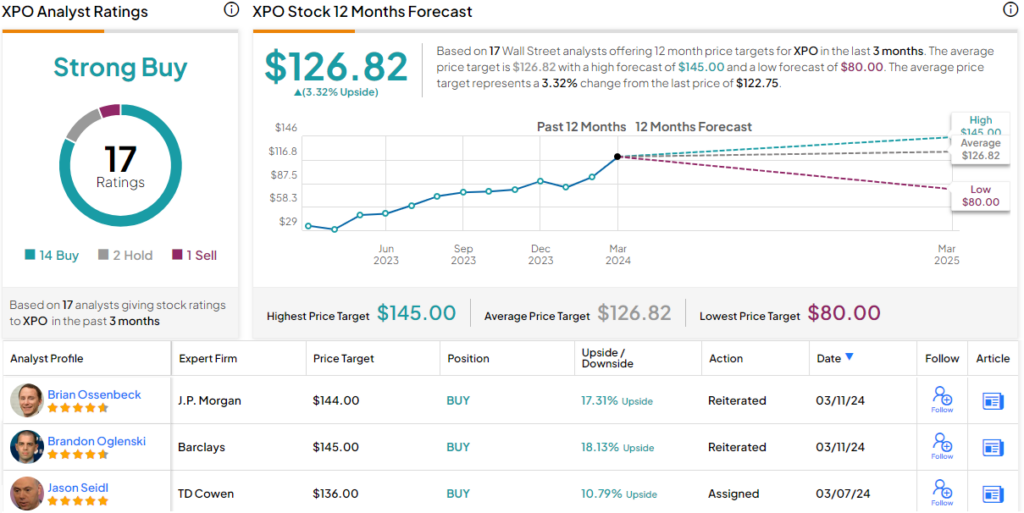

Ossenbeck uses these comments to back up another Overweight (Buy) rating on an LTL shipper, and he gives XPO shares a price target of $144, suggesting a gain of 17% by this time next year.

Overall, XPO gets a Strong Buy consensus rating, a view that is based on 17 recommendations. The break down here includes 14 Buys, 2 Holds, and 1 Sell; the stock is trading for $122.75, and its $126.82 average target price indicates potential for a modest upside of 3% over the next 12 months. (See XPO’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.