After the summer bulls, markets corrected themselves – but more than that, the selling was highly concentrated in the tech sector. The tech-heavy NASDAQ is now leading the on the fall, having lost 11.5% since September 2.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

JPMorgan strategist Marko Kolanovic points out that much of the market is now well-positioned for a rebound. Kolanovic believes that stocks will head back up in the last quarter of the year.

“Now we think the selloff is probably over. Positioning is low. We got a little bit of a purge, so we think actually market can move higher from here,” Kolanovic noted.

Acting on Kolanovic’s outlook, JPMorgan’s stock analysts are starting to point out their picks for another bull run. These are stocks that JPM believes they may double or better over the coming year. Running the tickers through TipRanks’ database, we wanted to find out what makes them so compelling.

NexTier Oilfield Solutions (NEX)

The first JPM pick is NexTier, a provider of oilfield support services. The oil industry is more than just production companies. There are a slew of companies that provide drilling expertise, fluid technology for fracking, geological expertise, pumping systems – all the ancillary services that allow the drillers to extract the oil and gas. That is the sector where NexTier lives.

Unfortunately, it’s a sector that has proven vulnerable to falling oil prices and the economic disruption brought on by the coronavirus pandemic crisis. Revenues fell from Q1’s $627 million to $196 million in Q2; EPS was negative in both quarters.

But NexTier has a few advantages that put it in a good place to take advantage of a market upturn. These advantages, among others, are on the mind of JPM analyst Sean Meakim.

“Admittedly we’re concerned about the sector disappointing the generalist ‘COVID-19 recovery’ crowd given the asymmetry of earnings beta to oil, but with 1) a solid balance sheet (net debt $17mm), 2) our outlook for positive (if modest) cash generation in 2021 (JPMe +$20mm), 3) a pathway to delivering comparably attractive utilization levels and margins, and 4) the cheapest valuation in the group (~20% of replacement), we think NexTier stands out as one of the best positioned pressure pumpers in our coverage,” Meakim opined.

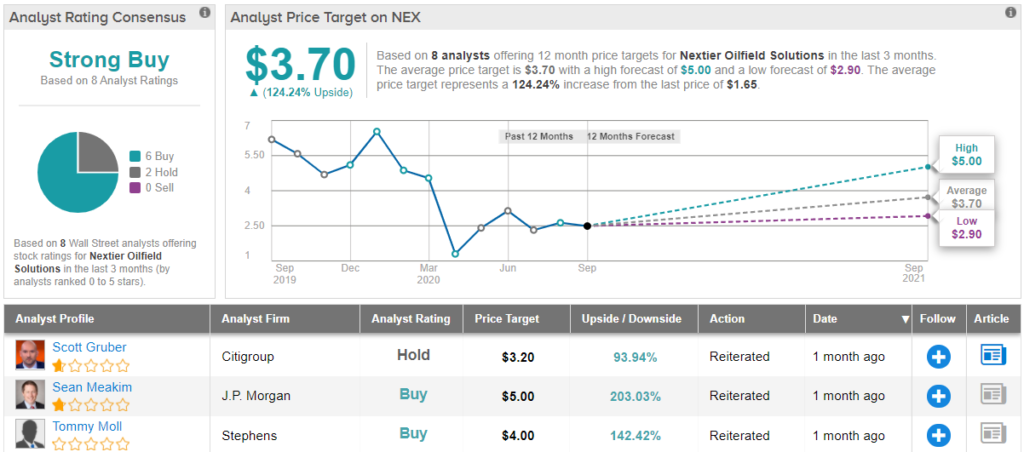

In line with his optimism, Meakim rates NEX an Overweight (i.e. Buy) along with a $5 price target. His target suggests an eye-opening upside potential of 203% for the coming year. (To watch Meakim’s track record, click here)

Similarly, the rest of the Street is getting onboard. 6 Buy ratings and 2 Hold assigned in the last three months add up to a Strong Buy analyst consensus. In addition, the $3.70 average price target puts the potential twelve-month gain at 124%. (See NEX stock analysis on TipRanks)

Fly Leasing (FLY)

The next stock on our list of JPMorgan picks is Fly Leasing, a company with an interesting niche in the airline industry. It’s not commonly known, but most airlines don’t actually own their aircraft; for a variety of reasons, they lease them. Fly Leasing, which owns a fleet of 86 commercial airliners valued at $2.7 billion, is one of the leasing companies. Its aircraft, mostly Boeing 737 and Airbus A320 models, are leased out to 41 airlines in 25 countries. Fly Leasing derives income from the rentals, the maintenance fees, and the security payments.

As can be imagined, the corona crisis – and specifically, the lockdowns and travel restrictions which are not yet fully lifted – hurt Fly Leasing, along with the airline industry generally. With flights grounded and ticket sales badly depressed, income fell – and airlines were forced to cut back or defer their aircraft lease payments. This is a situation that is only now beginning to improve.

The numbers show it, as far as they can. FLY’s revenue has fallen from $135 million in 4Q19 to $87 million 1Q20 to $79 million the most recent quarter. EPS, similarly, has dropped, with Q2 showing just 37 cents, well below the 43-cent forecast.

But there are some bright spots, and JPM’s Jamie Baker points out the most important.

“[We] conservatively expect no deferral repayments in 2H20 vs. management’s expected $37m. Overall, our deferral and repayment assumptions are in line with the other lessors in our coverage. We are assuming no capex for the remainder of the year, consistent with management’s commentary for no capital commitments in 2020 […] Despite recent volatility seen in the space, we believe lessors’ earnings profiles are more robust relative to airlines,” Baker noted.

In short, Baker believes that Fly Leasing has gotten its income, spending, and cash situation under control – putting the stock in the starting blocks should markets turn for the better. Baker rates FLY an Overweight (i.e. Buy), and his $15 price target implies a powerful upside of 155% for the next 12 months. (To watch Baker’s track record, click here)

Over the past 3 months, two other analysts have thrown the hat in with a view on the aircraft leasing company. The two additional Buy ratings provide FLY with a Strong Buy consensus rating. With an average price target of $11.83, investors stand to take home an 101% gain, should the target be met over the next 12 months. (See FLY stock analysis on TipRanks)

Lincoln National Corporation (LNC)

Last up, Lincoln National, is a Pennsylvania-based insurance holding company. Lincoln’s subsidiaries and operations are split into four segments: annuities, group protection, life insurance, and retirement plans. The company is listed on the S&P 500, boasts a market cap of $5.8 billion, and over $290 billion in total assets.

The generally depressed business climate of 1H20 put a damper on LCN, pushing revenues down to $3.5 billion from $4.3 billion six months ago. Earnings are down, too. Q2 EPS came in at 97 cents, missing forecasts by 36%.

There is a bright spot: through all of this, LNC has kept up its dividend payment, without cuts and without suspensions. The current quarterly dividend is 40 cents per common share, or $1.60 annually, and yields 4.7%. That is a yield almost 2.5x higher than found among peer companies on the S&P 500.

Jimmy Bhullar covers this stock for JPM, and while he acknowledges the weak Q2 results, he also points out that the company should benefit as business conditions slowly return to normal.

“LNC’s 2Q results were weak, marked by a shortfall in EPS and weak business trends. A majority of the shortfall was due to elevated COVID-19 claims and weak alternative investment income, factors that should improve in future periods […] The market recovery should help alternative investment income and reported spreads as well…”

These comments support Bhullar’s Overweight rating. His $73 price target indicates room for a robust 143% upside from current levels

Overall, the Moderate Buy rating on LNC is based on 3 recent Buy reviews, against 5 Holds. The stock is selling for $30 and the average price target is $45.13, suggesting a possible 50% upside for the coming year. (See LNC stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.