We’re getting toward the tail end of the year, and it’s time to start deciding just how to allocate the portfolio for a solid year-end return. In a recent note from JPMorgan, focused on the energy sector, 5-star analyst Arun Jayaram recommended oil and gas producers as likely to beat the overall markets going forward.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Getting quickly to the bottom line, Jayaram states, “We remain fans of the longer-term story for natural gas driven by a growing global demand for low cost U.S. gas exports.”

With this in mind, we took a closer look at two energy stocks that have gotten the thumbs-up from the JPM expert. In fact, Jayaram is not the only one singing these stocks’ praises. According to the TipRanks platform, they are rated as Strong Buys by the rest of the analyst community.

Permian Resources (PR)

First up is Permian Resources, a Texas-based E&P operating in the Delaware Basin. Permian was formed this year through the merger-of-equals transaction between Centennial Resource Development and Colgate Energy. Permian Resources emerged from that merger as the largest pure-play E&P firm operating in the Delaware. Permian’s productive assets include 180,000 net lease acres and 40,000 royalty acres; these holdings generated 137,000 barrels of oil equivalent per day, evenly divided between oil and gas products.

Permian Resources’ assets are highly valuable, and the company’s production translated to high revenues and earnings in the recently reported 2Q22. The top line came in at $472.7 million, more than doubling year-over-year from $232.6 million. Earnings, reported at $193.1 million, generated a diluted EPS of 60 cents. This was a strong turnaround from 2Q21, which saw a 9-cent quarterly EPS loss.

This company is currently operating an 8-rig drilling program, but has detailed a 2023 development plan that specifies starting with 7 active rigs. Permian’s plans include improving its operational efficiencies, and the company is targeting $1.1 billion to $1.3 billion in free cash flow for the full year 2023.

Jayaram, in his JPM report, points out Permian’s free cash flow and production growth as key points for investors, saying of the company: “We expect PR to deliver an attractive combination of significant cash return paired with differentiated volume growth while trading a turn below peers on 2023 DACF and at a premium on FCF metrics. PR established a $0.20 per share annual base dividend and will return at least 50% of post-dividend FCF to shareholders beginning in 2Q22.”

“PR also ranks in the top quartile of our updated JPM Forced Ranker, which places the heaviest weighting on cash return and FCF generation, what we view as the most important metrics for investors. We estimate that PR is set to return 10% of market cap to shareholders in 2023 while also delivering oil volume growth of 10%,” Jayaram added.

Quantifying his position, Jayaram gives PR an Overweight (i.e. Buy) rating, with a $12 price target that implies ~56% upside for the next 12 months. (To watch Jayaram’s track record, click here)

Overall, Permian gets a Strong Buy consensus rating from the Street, based on 8 analyst reviews that include 7 Buys over 1 Hold. The shares are selling for $7.66, and their average price target of $10.86 suggests a 35% one-year upside. (See PR stock forecast on TipRanks)

EOG Resources (EOG)

The second stock we’ll look at, EOG, is one of the largest E&Ps on the North American hydrocarbon scene. The company has a market cap exceeding $71 billion, and operates in some of the continent’s richest oil and gas regions. EOG has production activities in Texas, Louisiana, Oklahoma, and New Mexico, in such big-name areas as Eagle Ford, Permian, Anadarko, and Barnett. The company is also operational in the DJ Basin of Colorado, the Powder River basin of Wyoming, and the Williston Basin on the North Dakota-Montana border. EOG even operates in the Caribbean, with activities in the offshore Columbus Basin near the island of Trinidad.

All of this has pushed EOG’s revenues to record levels. The company reported a total of $7.4 billion at the top line in 2Q22, the most recent reported, after quarterly production of 920.7 MBoed. Adjusted net income for the second quarter came to $1.6 billion, with an adjusted EPS of $2.74. On the balance sheet, EOG reported slightly over $5 billion in total debt, and some $3 billion in cash and liquid assets.

EOG has seen 8 consecutive quarters of sequential revenue increases. Earnings have been more volatile, but the Q2 EPS was up 58% y/y.

Summarizing EOG for investors, Jayaram writes: “We continue to view EOG as a long-term core holding in the space given its premium drilling strategy that is poised to support differentiated returns on capital assuming mid-cycle pricing or better. One of the key themes has been the differentiated performance of E&Ps that are accelerating the return of cash to equity holders. Cash return to equity holders has been rewarded more than debt reduction, which is favoring companies with strong balance sheets such as EOG.”

The JPM analyst gives EOG an Overweight (i.e. Buy) rating, and his price target, which he set at $156, indicates his confidence in a 28% upside in the coming year. (To watch Jayaram’s track record, click here)

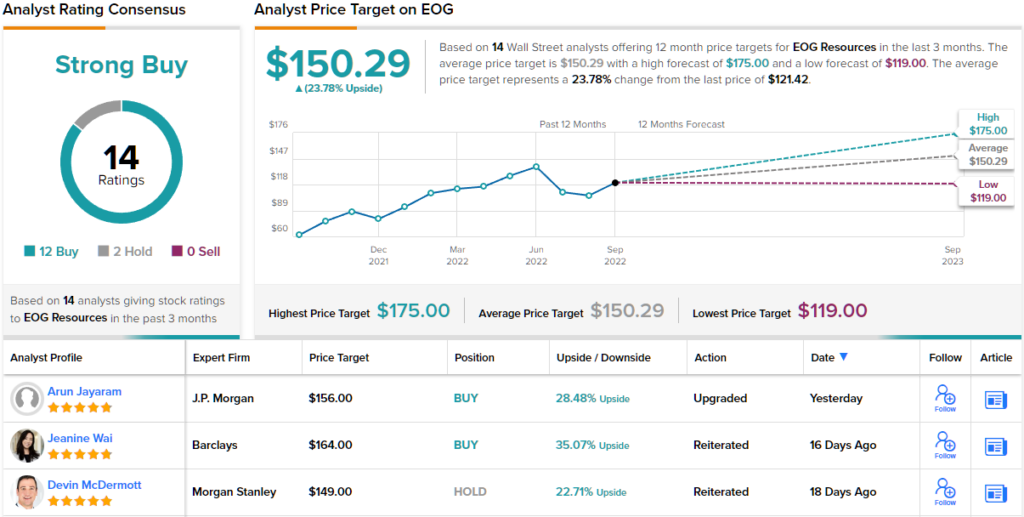

Wall Street clearly agrees with Jayaram that this stock is a Buy proposition – the 14 analyst reviews on file include 12 Buys and 2 Holds. The shares are trading at $121.42, and the $150.29 average price target implies ~24% upside going forward. (See EOG stock forecast on TipRanks)

To find good ideas for energy stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.