Which technology is set to take the world by storm? 5G, or fifth generation wireless. The technology everyone’s talking about is expected to be so transformational, it has been dubbed the future of communications.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Bursting onto the scene in 2017, the wireless standard enables an enhanced network that promises to connect almost everyone and everything. What exactly is so special about this technology? 5G is meant to deliver faster data speeds, ultra-low latency, more reliability, massive network capacity and increased availability, improving overall performance and efficiency.

While 5G networks already started coming online in 2019, it will take some time before the standard is fully rolled-out. It doesn’t help that the pandemic has slowed the infrastructure work needed to deploy it as well as delayed the release of some 5G smartphones. However, Wall Street pros know that the 5G revolution is approaching, and with this new technology comes a host of exciting stock opportunities.

Research firm J.P. Morgan is among those honing in on the space, pointing out that the names tasked with manufacturing the components needed to make 5G a reality stand to gain as the trend takes over. To this end, four-star analyst representing the firm, Samik Chatterjee, cites two stocks that are particularly well-positioned as possible beneficiaries of the 5G movement.

Using TipRanks’ database, we wanted to take a closer look at these Buy-rated picks to get the rest of the Street’s take. Here’s what we found out.

NeoPhotonics Corporation (NPTN)

The first of J.P. Morgan’s picks is NeoPhonics, which designs and manufactures advanced hybrid photonic integrated optoelectronic devices for ultra-fast communications networks as well as ultra-pure light lasers. With its strong manufacturing capabilities and core integration technologies, the firm sees a clear path to long-term growth.

The company already has a solid track record, as demonstrated by its most recent quarterly results. Management reported that Q1 EPS came in well above expectations and above the high-end of its guidance range at $0.17, driven by better than anticipated revenue, gross margins and opex. Chatterjee had called for EPS of $0.04, with the figure also surpassing the consensus estimate of $0.05 and guidance of $0.00-$0.10.

Chatterjee does acknowledge that opex was helped by one-time benefits, but he points out “revenue strength in the quarter was led by strong underlying demand, particularly from customers in China, which accelerated the pace of 5G deployments following the extended shutdowns immediately after Chinese New Year to try and offset the deployment delays relative to their aggressive 5G infrastructure plans.” He added, “At the same time, gross margins benefited from favorable product mix as well as the roll-off of tariffs.”

Even though the impressive revenue growth seen during Q1 could moderate in the second half of 2020, Chatterjee believes there will be a reacceleration in the first half of 2021 as its 400G DCO product is adopted. It should also be noted that customer inventories in China were higher in Q1, but this will most likely be more balanced by the end of the second quarter once the pace of deployments ramps up.

Looking specifically at gross margins, there was a significant improvement during Q1. Overall, gross margins reached 31.2%, and product gross margins hit 35.8%, benefitting from product mix and price declines as NPTN highlighted a better pricing environment for the latest technologies, according to Chatterjee. Adding to the good news, these tailwinds are slated to persist in Q2 as the product mix continues to expand and utilization improves. The elimination of tariffs should also provide a full quarter benefit.

Based on all of the above, Chatterjee stayed with the bulls. Along with his Overweight rating, he bumped up the price target from $11 to $13, indicating 48% upside potential. (To watch Chatterjee’s track record, click here)

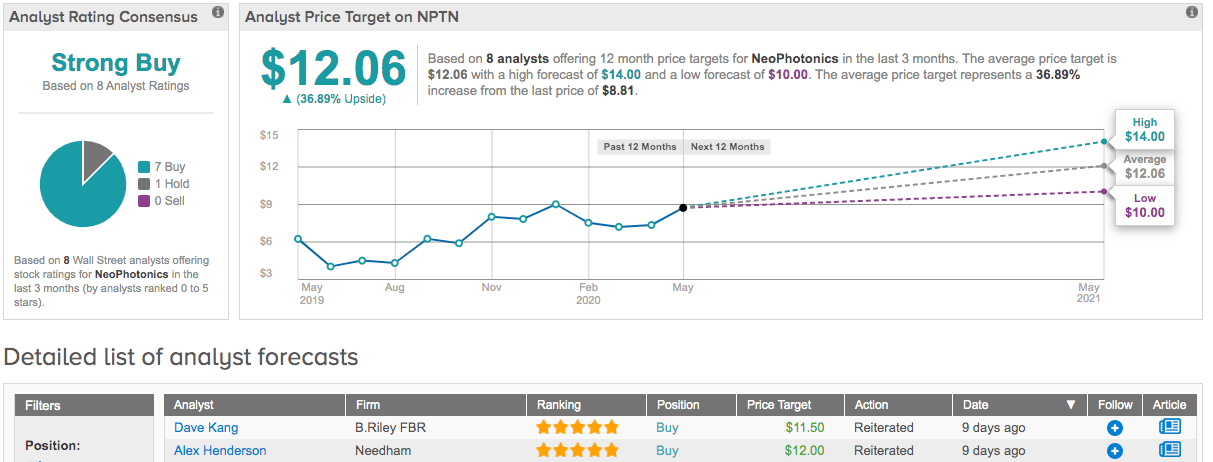

Judging by the consensus breakdown, the rest of the Street is in agreement. 7 Buys and a single Hold add up to a Strong Buy analyst consensus. In addition, the $12.06 average price target brings the upside potential to 37%. (See NeoPhotonics stock analysis on TipRanks)

Qualcomm Inc. (QCOM)

Chip maker Qualcomm has undoubtedly faced headwinds as a result of the disruption to the smartphone market. That being said, J.P. Morgan argues that it has been able to fly past its peers in the industry, which speaks to the strength of 5G smartphone volumes as a whole.

Chatterjee highlights the fact that the company has outperformed with respect to not only its fiscal Q2 results, but also its fiscal Q3 guidance. “Relative to F2Q, Qualcomm delivered largely in line with prior guidance, despite the massive dislocation in the end-market since the time that the guidance was issued in early February helped by resilience of estimated demand for 5G Quanta Cloud Technology (QCT) volumes, which also enabled the company to deliver to the ramp in ASP embedded in the guide…Qualcomm pleasantly surprised investors with an estimated QCT shipment outlook of flat to up modestly on a sequential basis — again led by resilience in 5G volume outlook and better customer mix. Overall, as we look through the upside on results/guidance, we see the resilience of 5G volumes driven by the consumer upgrade cycle as well as aggressive 5G launch plans from smartphone OEMs, to be the primary driver of the upside to investor expectations,” he commented.

Turning now to the Qualcomm Technology Licensing (QTL) segment, part of what makes the outlook so resilient, in Chatterjee’s opinion, is QCOM’s new long-term global patent license agreements with OPPO and Vivo. These deals bring its total number of 5G licensing agreements to 85, with the long-term licenses from customers on the verge of wide-scale 5G smartphone adoption also underscoring the strength of the patent portfolio. Not to mention its multi-year agreement with Apple shows its strong standing in the industry from a technological standpoint.

Expounding on the 5G opportunity, Chatterjee stated, “We expect Qualcomm’s QCT group to benefit substantially from 5G modem and RFFE sales to smartphone manufacturers and non-handset OEMs as well. In addition to the strong growth expectations for the QCT group, Qualcomm will stabilize its QTL licensing revenue as a consequence of a landmark agreement reached with Apple, which will also mitigate potential risk from litigations from other OEMs.”

While some investors have expressed concern regarding the hefty competition facing QCOM, Chatterjee noted, “Qualcomm continues to consistently deliver to implied QCT gross margin of ~48%, representing disciplined pricing actions in line with changes in cost of 5G solutions.”

To this end, Chatterjee kept a bullish call on the stock. Additionally, he gave the price target a lift, from $94 to $100. This new target conveys his confidence in QCOM’s ability to surge 24% in the next year.

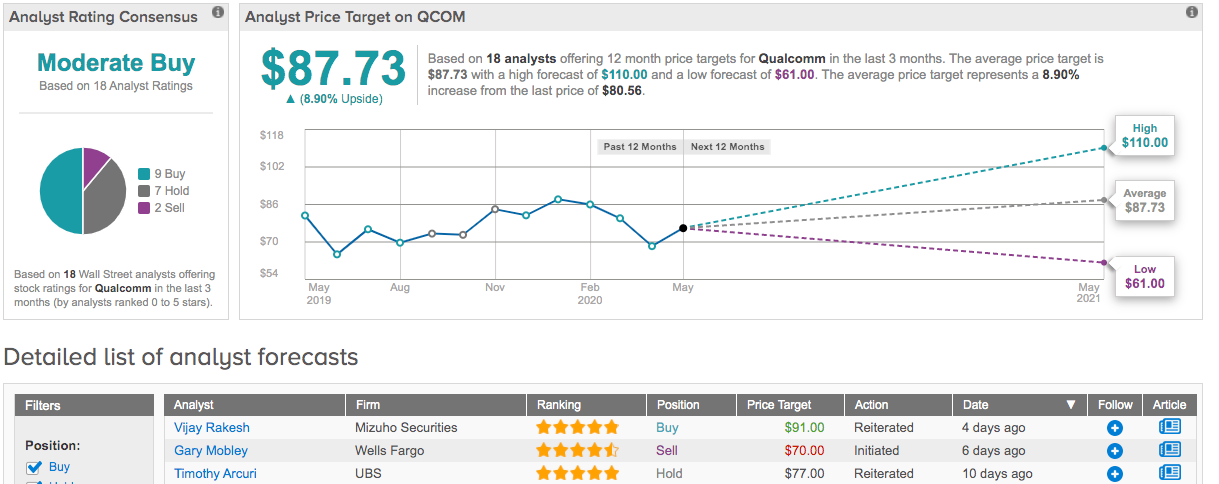

Shifting focus to the rest of the Street, QCOM’s Moderate Buy consensus rating breaks down into 9 Buys, 7 Holds and 2 Sells. At $87.73, the average price target puts the upside potential at a modest 9%. (See Qualcomm stock analysis on TipRanks)