The Walt Disney Company (DIS) announced its financial results for fiscal Q3 2022 last Wednesday, reporting that both sales and (pro forma) profits topped analyst expectations, coming in at $1.09 per share and $21.5 billion respectively. Disney+ subscribers grew 31% year over year to 152.1 million, and ESPN+ subscribers grew even faster — up 53% to 22.8 million.

Even Hulu grew its subscriber count for Disney, albeit at a more leisurely 8% rate — 46.2 million subscribers. And going forward, Disney projected that its subscriber growth will actually accelerate in the year’s final fiscal quarter.

In a note responding to earnings, Morgan Stanley analyst Benjamin Swinburne reiterated his Overweight (i.e. Buy) rating and $125 price target on the House of Mouse. And it wasn’t hard to figure out what Swinburne liked about Disney, either. He titled his report: “Streaming Phase II, the Drive to Profitability.”

Although Swinburne noted that it was Disney’s Parks & Experiences division that “led” the company’s results higher, and admitted that these are “uniquely attractive businesses which now and in the future drive over half of Disney’s earnings,” the analyst’s focus is clearly on “Disney’s content assets [that are] both under-earning and under-valued.”

It’s hard to earn money in streaming television, admits Swinburne, pointing to the troubles that Disney rival Netflix has been having with subscriber cancellations. But Disney is at least doing well with its preliminary goal of ramping up its subscriber base, which provides the revenues that should lead to profits in time. Disney+ has already passed the high end of the company’s original goal (stated in April 2019) of attracting up to 90 million subscribers. (And that’s not counting Hotstar subscribers in India — where management expects to have 80 million subscribers there alone by 2024). In fact, not even counting Hotstar, Disney appears to be two years ahead of schedule in reaching its subscriber goals with Disney+.

Across its several streaming brands, Disney now boasts a total of 220 million subscriptions, and more than $20 billion in annual revenue from streaming.

That being said, Disney has yet to achieve profitability in the streaming business. Operating losses from streaming topped $1 billion in fiscal Q3, and Disney is likely to lose $800 million or more in fiscal Q4, says the analyst.

But — and this is key — Disney’s streaming business may be on the cusp of profitability as it plans to hike prices for Disney+, and also introduce an ad-supported tier of Disney+ subscriptions in December. While hiking prices carries with it the risk of scaring away subscribers, Disney plans to release new content in Q4 that may cause subscribers to think twice before abandoning the service. In Swinburne’s view, the net result of these moves could be as much as 35% full-year revenue growth for Disney in fiscal 2022, and 50% revenue growth in 2023. And by 2024, the analyst is forecasting that Disney+ will finally be operating in the black.

Swinburn recommends that investors buy the stock before that happens. (To watch Swinburn’s track record, click here)

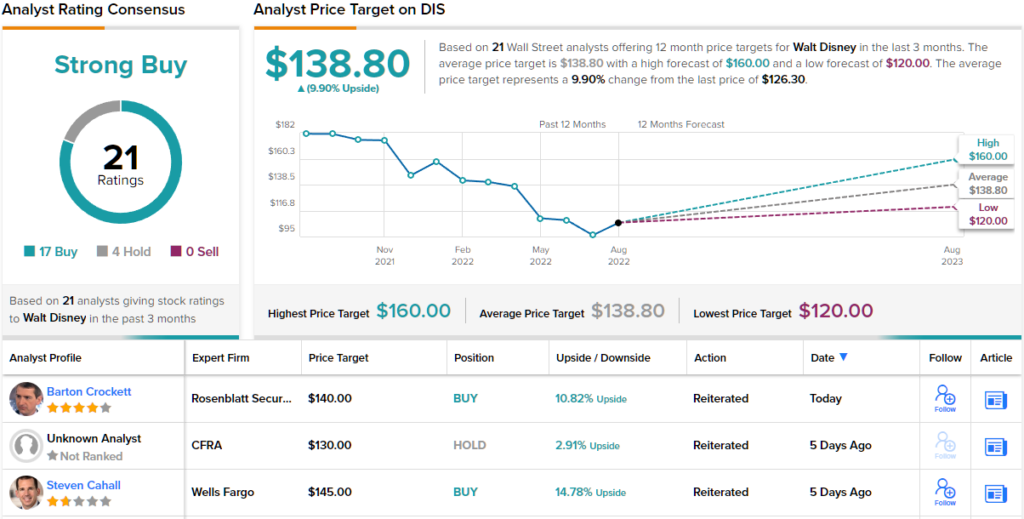

All in all, DIS has 21 recent analyst reviews, breaking down to 17 Buys and 4 Holds – this gives the stock a Strong Buy consensus rating. Shares are selling for $126.45 and have an average price target of $138.8, which amounts to ~10% upside potential. (See DIS stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com