On Wednesday, the Fed bumped up interest rates again, its third 75-basis point hike since June, and signaled that there could be two more such hikes by the end of this year. The conventional wisdom has the Fed acting properly, and aggressively, in an attempt to counter inflation raging at 40-year high levels. But conventional wisdom isn’t always right – and we can learn a lot by consulting the contrarians.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

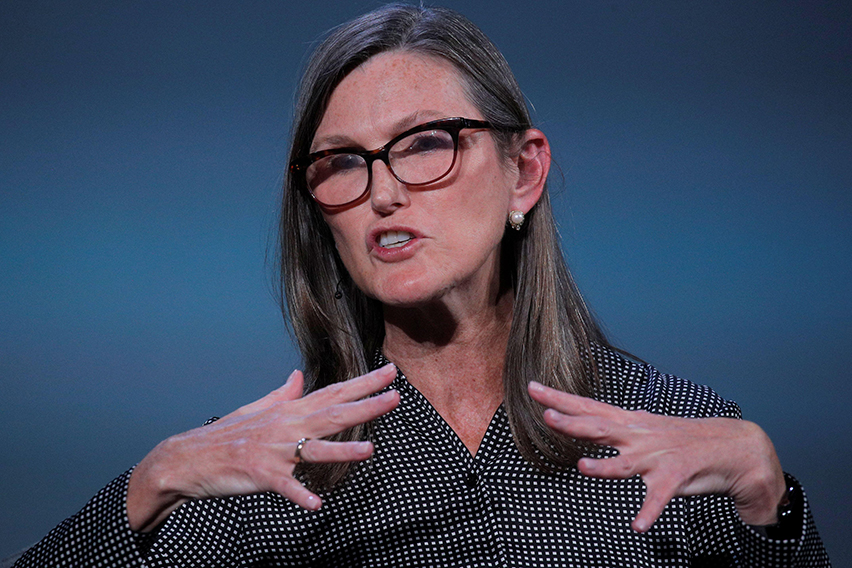

Few top investors are more contrarian than Cathie Wood. The founder and manager of ARK Invest has a reputation for going all-in on high-risk, high-potential sectors, with a focus on disruptive technologies. Her strategy built ARK Invest into a $60 billion giant – but some of her flagship funds have badly underperformed in recent months.

Lately, Wood has made some waves by predicting a deflationary wave on the way, rather than increasing inflation. She points to falling commodity prices, and notes, “Even the oil price has dropped more than 35% from its peak, erasing most of the gain this year.”

Wood also notes some important historic dis-similarities between current conditions and the last run of high inflation in the 70s and early 80s, saying, “The Fed seems to responding {sic] to COVID-related supply shocks spanning 15 months the same way that Volcker battled inflation that had been brewing and building for 15 years. I would not be surprised to see a significant policy pivot in the next three to six months.”

In the meantime, let’s see just where Wood is doubling down on her own investments. She’s been ‘buying the dip’ this month, picking up stocks that have seen sharp declines in share price and are now selling for less than $10 per share.

Using the TipRanks database, we’ve pulled up the details on two of her recent large buys. Here they are, along with commentary from the Street’s analysts.

Ginkgo Bioworks Holdings (DNA)

We’ll start with Ginkgo Bioworks, an interesting company in the biotech sector. This firm is in the business of creating designer microorganisms – that is, living cells which can be used in a variety of applications in science and industry. The company engineers its cell lines through a proprietary platform and process, that includes machine learnings, biodiversity, DNA synthesis, organic fermentation, and software and automation. Ginkgo has built a reputation as the ‘go-to’ company for researchers seeking quality cell technology.

Ginkgo went public through a SPAC transaction last September – it entered the public markets on the 17th of the month – and since then, the stock has fallen by 76%. Over the past year, the company has posted net losses in every quarter, although revenues have consistently beaten the forecasts. The most recent financial release, for 2Q22, showed a loss from operations of $647 million, a far deeper loss then the year-ago quarter’s $60 million. At the same time, revenues were up strongly year-over-year, 231% from $44 million to $145 million.

For investors, the important part of the company’s release was the forward guidance. Ginkgo is expecting to reach 60 new cell program in its foundry platform this year, an important draw for its customer base. The company is guiding toward full-year revenue of $425 million to $440 million, an increase from previous guidance of 13% at the midpoint.

All of this caught the eye of Cathie Wood. She has bought into Ginkgo through two of her investment funds, ARK Innovation and ARK Genomic. In the former, she holds a total of 78.882 million shares of DNA, an increase of 5.26 million shares this month. In the latter, Wood added 3.57 million shares this month, to bring her holding to 27.439 million shares. In all, Wood’s stake in Ginkgo totals over 106 million shares, worth over $305 million at current valuations.

Wood is hardly the only bull on this stocks. BTIG analyst Mark Massaro also takes a bullish stance, based on his view of the company’s forward prospects.

“Looking to 2H/22, management noted that Foundry services revenue are likely to remain flattish, though expected milestone payments are expected to hit in 2H’22 in order for Ginkgo to hit or beat its 2022 Foundry guidance. Ginkgo helps its customers harness biology and grow products that may be superior in quality, less expensive, and more sustainable than those in use today, which we think will include new nucleic acid vaccines, cell and gene therapies, and novel antibiotics over time,” Massaro wrote.

“We believe Ginkgo’s business model, consisting of its Foundry and downstream value share, is sound and positioned to capture a wide range of business,” Massaro summed up.

Putting these comments into numbers, Massaro gives DNA shares a $6 price target, suggesting a one-year upside of 113% for the stock. He rates the shares as a Buy. (To watch Massaro’s track record, click here)

Other analysts don’t beg to differ. With 4 Buy ratings and no Holds or Sells, the word on the Street is that DNA is a Strong Buy. The $10.83 average price target is more aggressive than Massaro’s and implies 285% upside potential from the current share price of $2.81. (See DNA stock forecast on TipRanks)

TuSimple Holdings (TSP)

The second stock we’ll look at is TuSimple Holdings, a company working on autonomous vehicles in the long-haul transportation industry. TuSimple’s goal is marry AI-powered self-driving systems with long-haul freight carriage, to create true autonomous trucking – and to resolve issues of efficiency, range, and safety in the industry.

While TuSimple’s technology is not yet in commercial use, the company has established an autonomous freight network (AFN) in the southern US, from Arizona to Florida. The company bases its network on strategically placed hubs and an expanding digital map, and is currently working on its Driver Out test operations. In an important milestone, last December TuSimple was able to drive a semi-truck in fully autonomous mode, without a human crew on board, on open public roads.

In its 2Q22 financial report, TuSimple reported a net loss of 49 cents per share – the sixth such loss in a row since going public. On a positive note, TuSimple’s losses have been moderating over time; the year-ago loss was 64 cents per share.

In one item of vital importance for investors to consider, TuSimple has been involved in a major safety investigation – including a lawsuit and governmental oversight – stemming from a crash in April. A truck, testing the autonomous driving system on the road but with a human backup crew, unexpectedly lurched left and crashed a concrete lane divider on I-10 in Tucson. The human crew was able to take control and avoid damage to any other people or vehicles. TuSimple has put the accident down to human error, but questions do remain – and are under investigation.

The accident has not discouraged Wood, however, from increasing her holding. In the last few weeks, Wood has bought up some 765,000 shares of TSP through her ARK Innovation fund, which now holds over 10.8 million shares of the company. Overall, her fund is into the stock for $73 million.

Ravi Shanker, a tech-sector analyst from Morgan Stanley, has also been following this stock since its IPO last year – and in his latest note, he was encouraged by how management is coping with the recent accident.

“We remain confident that the LT story and TSP’s leadership position remain on track. We are encouraged by mgmt’s handling of the safety incident and based on our understanding of what occurred, we are confident that this will not escalate into a significant obstacle on their path to commercial adoption. We are also very encouraged by the improved cost and cash burn and ending FY22 with $950 mm of cash which at the current ~$75-80 mm/qtr cash burn run rate will give TSP several quarters/years of liquidity beyond 2022 and can bridge to the start of commercial production,” Shanker wrote.

To this end, Shanker puts an Overweight (i.e. Buy) rating on TuSimple shares, and his price target, set at $35, implies an impressive one-year gain of 392%. (To watch Shanker’s track record, click here)

While Shanker – and Wood – are highly bullish on this stock, Wall Street generally is more split. The bulls come in slightly ahead, with 3 Buys compared to 2 Holds received over the previous three months. Yet, the $15.19 average price target suggests ~125% one-year upside from the current trading price of $6.76. (See TSP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.