Investing well doesn’t have to be a complicated endeavor, and the iShares Core S&P Total U.S. Stock Market ETF (NYSEARCA:ITOT) is a good example of this. I’m bullish on this $50 billion ETF from BlackRock’s (NYSE:BLK) iShares as a long-term portfolio building block based on its multi-year track record of strong returns, wide-reaching diversification, and ultra-low expense ratio.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

What Is the ITOT ETF’s Strategy?

ITOT’s strategy is a simple one. According to fund sponsor BlackRock, ITOT seeks to give investors “exposure to a broad range of U.S. companies” and “low-cost, convenient access to 90% of the total domestic stock market.”

And that’s exactly what the fund does. Essentially ITOT invests in a broad index of 2,589 U.S. stocks (the S&P Total Market Index) and features a negligible expense ratio of just 0.03%. BlackRock says that ITOT can be “used at the core of your portfolio to seek long-term growth.”

While there’s nothing complicated about this approach, it has produced great results for investors over the years, as discussed below.

Double-Digit Annualized Returns Over the Long Term

ITOT has generated nice returns for its investors over the years. As of December 31, the fund has an annualized five-year return of 15.0%, and over the past decade, it has an annualized return of 11.5%. Zooming further out to the fund’s inception in 2004, it has produced a still-impressive 9.4% annualized return. It’s hard to argue with those types of results.

Looking at it another way, as of December 31, the fund has returned 101.5% on a cumulative basis over the past five years and 197.3% over the past decade. A holder of ITOT saw their investment double over the past five years and nearly triple over the past 10.

Going all the way back to the fund’s inception in 2004, it has returned 502% on a cumulative basis, showing that investors can build significant wealth by investing in inexpensive, diversified, and effective index funds like this.

One of the Cheapest Expense Ratios You Will Find

It’s difficult to overstate just how cost-effective ITOT is. In fact, with an expense ratio of just 0.03%, it is one of the cheapest ETFs you will find out there in today’s market.

This 0.03% expense ratio means an investor will pay just $3 annually on a $10,000 investment. If the fund returns 5% per year going forward, this investor will pay just $39 in fees over the course of the next 10 years. Investing in low-cost ETFs like this helps investors preserve more of their portfolio’s principal over the long run.

What Stocks Does ITOT Own?

When it comes to ITOT’s holdings, perhaps the better question to ask is, “What stocks doesn’t ITOT own?” As discussed above, ITOT owns an incredible 2,589 stocks. This portfolio gives investors access to about 90% of the total U.S. stock market.

Below is an overview of ITOT’s top 10 holdings from TipRanks’ holdings tool.

One thing I like about ITOT is that its top 10 holdings account for just 28% of the fund. This means there is very little concentration risk in the fund. Consequently, ITOT is actually more diversified and a bit less concentrated than the typical broad-market S&P 500 (SPX) fund. For example, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) holds 503 stocks, and its top 10 holdings make up 31.3% of assets.

ITOT’s top 10 holdings feature all of the dominant, mega-cap tech stocks that have become household names in today’s market, such as top holding Microsoft (NASDAQ:MSFT), plus Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), and Broadcom (NASDAQ:AVGO), which recently passed Tesla to move into the fund’s top 10 holdings.

While ITOT shares these same top holdings with S&P 500 ETFs like SPY, it also gives investors exposure to thousands of mid-cap and small-cap stocks not included in the S&P 500 Index, giving investors exposure to some additional potential upside if one or more of these smaller stocks goes on a tear.

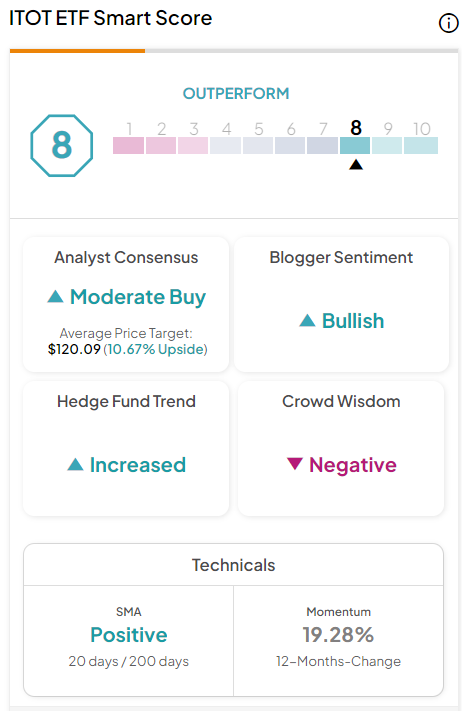

ITOT’s top holdings collectively feature strong Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Nine of ITOT’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above. Meta Platforms, Amazon, and Eli Lilly (NYSE:LLY) feature ‘Perfect 10’ Smart Scores. ITOT itself features an Outperform-equivalent ETF Smart Score of 8.

Overall, the fund is fairly well diversified by industry, although it should be noted that technology makes up 28.1% of the fund. This is unsurprising, as tech stocks have surged over the past year or so and account for many of the market’s largest market caps. Beyond technology, financials have the second-largest weighting in the fund (13.5%), followed by healthcare (12.6%) and consumer discretionary (10.5%). No other sector has a double-digit weighting within the fund.

Does ITOT Pay a Dividend?

While it doesn’t feature a huge yield, ITOT is a dividend payer. ITOT currently yields 1.4% and has paid out dividends to its holders for 20 years in a row.

Is ITOT Stock a Buy, According to Analysts?

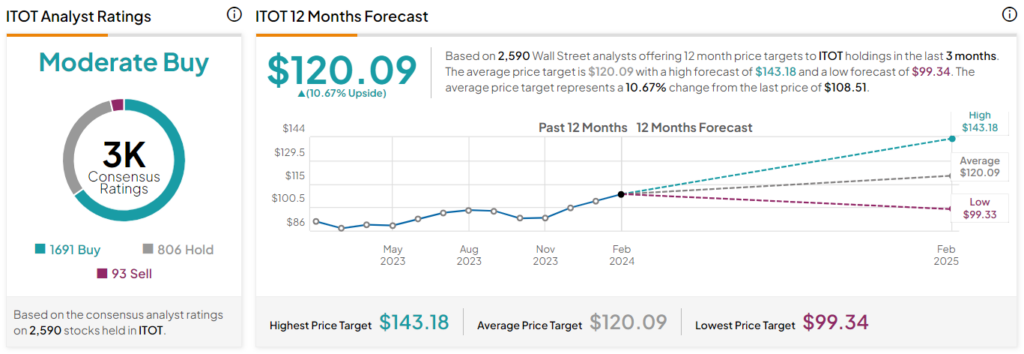

Turning to Wall Street, ITOT earns a Moderate Buy consensus rating based on 1,691 Buys, 806 Holds, and 93 Sell ratings assigned in the past three months. The average ITOT stock price target of $120.09 implies 10.7% upside potential from current levels.

The Takeaway: A Straightforward Portfolio Building Block

ITOT doesn’t do anything fancy. It simply invests in about 90% of the domestic U.S. stock market and does so for a very minimal fee. But it has worked out well for investors over the years, and I expect it to continue to do so in the future.

I’m bullish on ITOT as a long-term holding that investors can treat as a cornerstone of their portfolios based on its excellent diversification, track record of double-digit annualized returns over the past decade, and 0.03% expense ratio.