As geopolitical tensions heat up around the world, it’s a good time for investors to compare three of the top defense ETFs — the iShares U.S. Aerospace & Defense ETF (BATS:ITA), the SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR), and the Invesco Aerospace & Defense ETF (NYSEARCA:PPA).

I’m bullish on the defense sector as a whole for several reasons. Unfortunately, geopolitical tensions are escalating in several hotspots worldwide, as illustrated by the ongoing clashes in the Red Sea.

Furthermore, the aerospace and defense sector is attractive because these are excellent businesses that enjoy significant strategic moats. They have longstanding relationships with their customers (governments), and this industry features significant regulatory barriers to entry. Furthermore, building these types of products requires substantial technological expertise and investment in R&D. Because of these factors, it is difficult for newcomers to disrupt these companies.

With this in mind, which is the best defense ETF? Read on to find out.

iShares U.S. Aerospace & Defense ETF (BATS:ITA)

According to BlackRock (NYSE:BLK), the “iShares U.S. Aerospace & Defense ETF seeks to track the investment results of an index composed of U.S. equities in the aerospace and defense sector.”

The fund invests in U.S. companies that manufacture commercial and military aircraft and other defense equipment.

ITA has been around since 2006, and it is the largest aerospace and defense ETF with $5.9 billion in assets under management.

ITA has provided investors with solid returns over the years. As of December 31, 2023, the fund has generated an annualized three-year return of 11.2%, an annualized five-year return of 9.2%, and an annualized 10-year return of 10.3%.

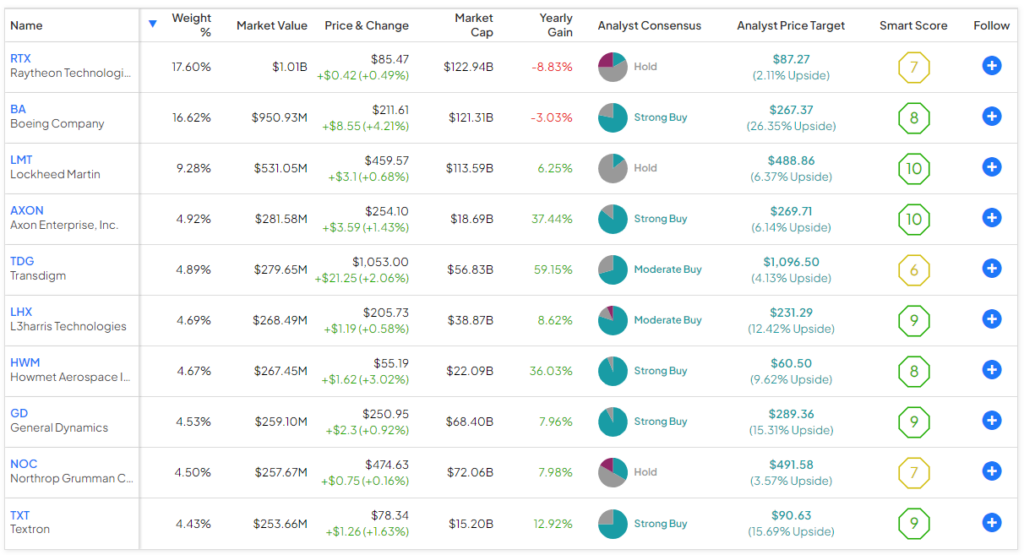

The fund owns 36 stocks, and its top 10 holdings account for 76.15% of assets. Below is an overview of ITA’s top 10 holdings using TipRanks’ holdings tool.

As you can see, it’s very concentrated in its top holdings, like Raytheon (NYSE:RTX) and Boeing (NYSE:BA), which have massive weightings of 17.6% and 16.6%, respectively.

Overall, this has been a good ETF over the years, but this outsized position in Boeing may be cause for concern at this point, as the aircraft manufacturer has become embroiled in a number of mishaps early in 2024. These include the highly-publicized incident in which the door plug came off of a Boeing 737 midflight, causing an emergency landing, and a collision involving two Boeing airplanes at Chicago’s O’Hare airport.

Boeing clearly faces significant questions going forward, and the issues led several sell-side analysts to downgrade the stock. ITA gives investors a lot of exposure to the troubled stock, which is cause for concern.

Is ITA Stock a Buy, According to Analysts?

Turning to Wall Street, ITA earns a Moderate Buy consensus rating based on 27 Buys, nine Holds, and one Sell rating assigned in the past three months. The average ITA stock price target of $134.24 implies 10.75% upside potential.

Lastly, ITA features an expense ratio of 0.40%, meaning that an investor in the fund will pay $40 on a $10,000 investment annually. ITA has been a strong performer over the years, but its large position in Boeing could be a headwind in the short-to-intermediate term.

SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR)

This brings us to the SPDR S&P Aerospace & Defense ETF. State Street’s XAR launched in 2011 and has $1.9 billion in assets under management.

According to fund sponsor State Street, XAR “seeks to provide investment results that, before fees and expenses, generally correspond to the total return performance of the S&P Aerospace & Defense Select Industry Index.” This is a “modified equal-weighted index which provides the potential for unconcentrated industry exposure across large-, mid-, and small-cap stocks.”

This modified equal-weighted approach is appealing because it means that, unlike ITA, XAR doesn’t have massive exposure to Boeing. While Boeing makes up 16.6% of ITA, XAR has a more manageable 3.5% weighting towards Boeing. In fact, it isn’t even one of XAR’s top 10 positions.

In total, XAR owns 35 stocks, and its top 10 holdings make up 41.6% of the fund, so it is far less concentrated than ITA. Below is an overview of XAR’s top 10 holdings using TipRanks’ holdings tool.

As you can see, XAR is more diversified than ITA, as its top holdings like Axon Enterprise (NASDAQ:AXON), L3Harris Technologies (NYSE:LHX), and Raytheon (NYSE:RTX) each have weightings of just 4.2%.

As of December 31, 2023, XAR generated a fairly underwhelming three-year annualized return of 6.3% but much more impressive five- and 10-year annualized returns of 12.2% and 11.7%, respectively. This three-year return was worse than ITA’s, but its five- and 10-year returns were slightly better.

Like ITA, XAR earns a Moderate Buy consensus rating based on 25 Buys, 10 Holds, and one Sell rating assigned in the past three months. The average XAR stock price target of $148.13 implies 14.75% upside potential.

Finally, XAR’s expense ratio of 0.35% is the cheapest of the group. I’m constructive on XAR, given its strong long-term five- and 10-year performance, its lower exposure to Boeing, and the fact that it has the most cost-effective expense ratio of these three major defense ETFs.

Invesco Aerospace & Defense ETF (NYSEARCA:PPA)

Invesco’s PPA launched in 2005 and has $2.6 billion in AUM. According to Invesco (NYSE:IVZ), PPA invests at least 90% of its assets in the SPADE Defense Index, an index that is comprised of the stocks of companies that are “involved in the development, manufacturing, operations and support of US defense, homeland security and aerospace operations.”

PPA has outperformed both ITA and XAR in recent years. As of December 31, the fund has an annualized three-year return of 12.1%, an annualized five-year return of 14.8%, and an annualized 10-year return of 13.3%.

PPA holds 52 stocks, and its top 10 holdings account for 52.2% of assets. Below is an overview of PPA’s top 10 holdings using TipRanks’ holdings tool.

As you can see, like XAR, PPA has a more manageable position in Boeing (accounting for 5.05% of the fund). On the downside, PPA is the most expensive of these three funds, with an expense ratio of 0.58%.

PPA earns a Moderate Buy consensus rating based on 40 Buys, 12 Holds, and one Sell rating assigned in the past three months. The average PPA stock price target of $99.14 implies 9.7% upside potential.

The Takeaway: XAR Looks Like the Best ETF

In conclusion, I’m optimistic about all three of these ETFs as the aerospace and defense sector looks well-positioned for the short term based on escalating tensions worldwide and for the long term based on the strong moats these businesses enjoy.

All three are good ETFs, and they all invest in similar businesses. One key difference is that ITA is much more exposed to Boeing than the other two ETFs discussed here. Given the considerable issues that Boeing is dealing with right now, this could be a detriment to ITA, going forward. Based on that, I am ranking XAR and PPA ahead of ITA at this point in time.

PPA and XAR have a lot in common, and both feature lower exposure to Boeing. PPA has generated slightly better returns, but I view XAR as the best choice at the moment because its expense ratio is significantly lower than PPA’s, making it the winner here.