The iShares Aerospace & Defense ETF (BATS:ITA) has been a reliable ETF over time, but it has a 737-sized red flag to deal with.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The $6.0 billion ETF from BlackRock’s (NYSE:BLK) iShares has returned a solid 10.1% on an annualized basis over the past decade. While these returns are nothing to sneeze at, I view the fund less favorably for the future because of one significant issue—its outsized exposure to beleaguered Boeing stock (NYSE:BA), which has many problems to sort out and can’t seem to get out of its own way.

While ITA has been a solid performer, I’m bearish at this point in time, given the fact that the troubled aircraft manufacturer has a large 14.1% weighting within the fund.

What Is the ITA ETF’s Strategy?

According to iShares, ITA gives investors “targeted access to domestic aerospace and defense stocks” by investing in “companies that manufacture commercial and military aircrafts and other defense equipment.”

This is typically a good industry to invest in, given the durable streams of revenue these companies have and their close relationships with large customers like the U.S. Government. This focus on aerospace and defense stocks has served ITA well over the years, and it has delivered double-digit annualized returns over the past decade. However, the fund’s large position in Boeing could be a serious headwind, going forward.

Too Much Boeing Exposure

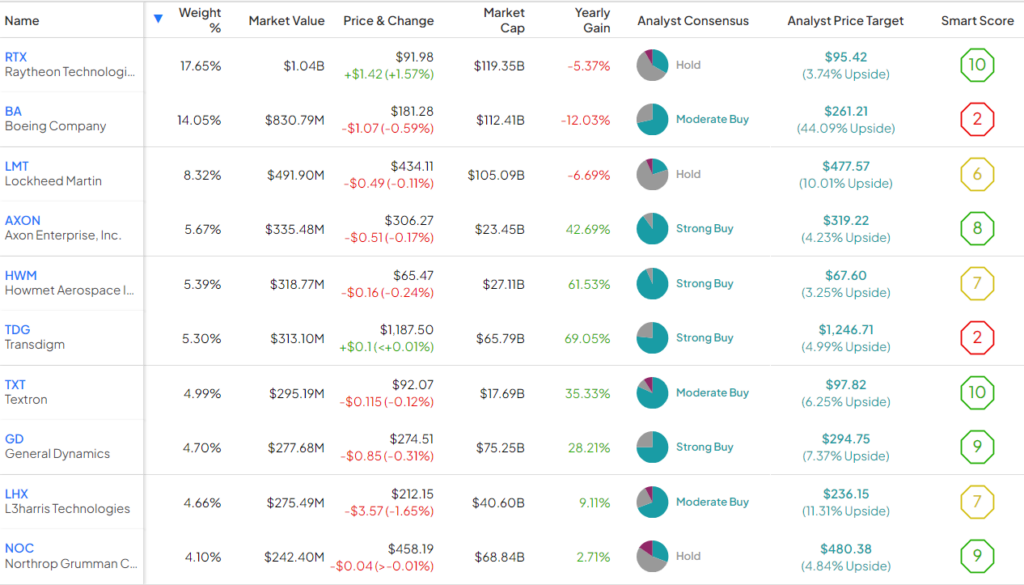

ITA owns 36 stocks, and its top 10 holdings make up 74.9% of the fund. Below, you’ll find an overview of ITA’s top 10 holdings using TipRanks’ holdings tool.

As you can see, Boeing accounts for an alarming 14.1% weighting within ITA. Boeing has had many recent issues, and unsurprisingly, the stock is down 30.4% year-to-date in 2024.

As if January’s high-profile incident in which a door plug blew off of a Boeing 737 MAX 9 flown by Alaska Airlines (NYSE:ALK) in midair wasn’t enough, the company was again the recipient of negative headlines when roughly 50 passengers on a Boeing 787 Dreamliner flown by Latam Airlines (OTC:LTMAY) were injured when the plane reportedly “nosedived.”

Thankfully, there were no fatalities, but this is a serious matter, and given that Boeing’s previous mishaps were still very much in focus, it doesn’t inspire much confidence in the company right now.

It’s also concerning that the company reportedly hasn’t yet provided satisfactory answers on the Alaska Airlines incident to the National Transportation Safety Board (NTSB), as Chair Jennifer Homendy stated, “We don’t have the records. It’s absurd that two months later, we don’t have it.”

Now, major customers like United Airlines (NYSE:UAL) are asking Boeing to halt production of its 737 Max 10 because, as United CEO Scott Kirby said, “It’s impossible to say when Max 10 is going to get certified.”

The company just has too many problems piling up, and this is not the type of stock I would want to get involved in at this point in time.

Now, I’m all for value investing and looking to pick up bargains among beaten-down stocks. The problem is, despite the steep decline in its share price, Boeing stock still trades at 54.3 times consensus 2024 earnings estimates, so the stock can hardly be described as a “bargain” or a “value stock.” And it could fall further, given this unfavorable combination of bad news and expensive valuation.

In fairness, Boeing trades at a much more reasonable 22.9 times consensus 2025 earnings estimates, but this still can’t be described as cheap.

TipRanks’ Smart Score System seems to agree that Boeing is likely a stock to avoid, giving it an unenviable 2 out of 10 rating.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. However, a Smart Score of 3 or lower is considered an Underperform-equivalent rating.

There are some attractive holdings here, like top holdings Raytheon (NYSE:RTX) and Textron (NYSE:TXT), to which Smart Score gives ‘Perfect 10’ ratings, but unfortunately, the outsized Boeing position muddies the water for them.

What Is ITA’s Expense Ratio?

ITA features an expense ratio of 0.40%, meaning that an investor will pay $40 in fees on a $10,000 investment annually. While this isn’t cheap, it isn’t overly expensive either, putting ITA in the middle of the road when it comes to cost. For comparison sake, the SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR) charges a slightly cheaper fee of 0.35%, while the Invesco Aerospace & Defense ETF (NYSEARCA:PPA) is more expensive, with an expense ratio of 0.58%.

Is ITA Stock a Buy, According to Analysts?

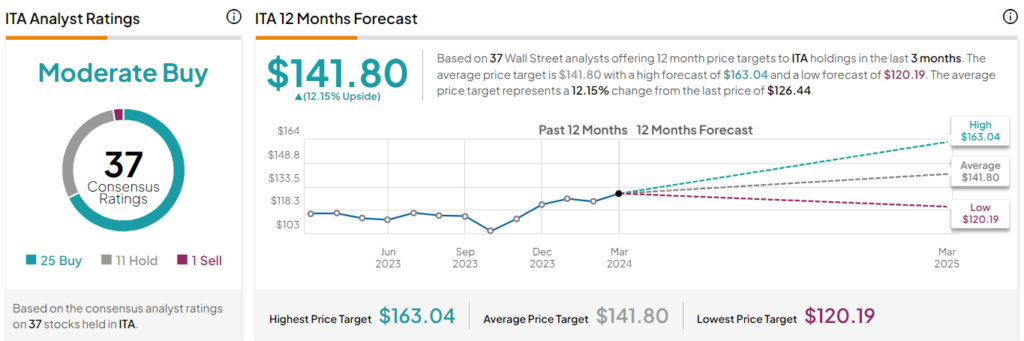

Turning to Wall Street, ITA earns a Moderate Buy consensus rating based on 25 Buys, 11 Holds, and one Sell rating assigned in the past three months. The average ITA stock price target of $141.80 implies 12.15% upside potential.

Alternatives Are Out There

ITA has been a solid performer for a long time, delivering annualized returns of 10.1% over the past 10 years (as of February 29). But the fund’s massive Boeing position unfortunately gives investors too much exposure to problems that they probably don’t want any part of.

Furthermore, for all of its issues, shares of Boeing are by no means cheap from a valuation perspective, so it’s hard to make a case for it as a contrarian idea or value play. At some point, Boeing may turn things around, but there is no visibility into that right now, so I am bearish on the ITA fund for the time being.

The good news for investors is that there are other ways to gain exposure to the aerospace and defense industry as a whole without taking on as much exposure to Boeing.

For example, the aforementioned XAR is a great defense ETF that has returned 11.4% on an annualized basis over the past decade (as of February 29) and has a much smaller 2.8% weighting toward Boeing. Meanwhile, the aforementioned PPA ETF is another option that has returned 12.7% on an annualized basis over the past 10 years and has a 4.1% weighting towards Boeing.

Currently, both of these ETFs are probably safer ways to gain exposure to the aerospace and defense sector, given their much more manageable exposure to Boeing stock.