Snap (NYSE:SNAP) recently reported its Q2 results, with the social media company’s numbers raising serious concerns, in my view. Not only was this Snap’s second-consecutive quarter of declining revenues, but operating losses once again widened compared to last year. In fact, Snap’s cash position is declining at an alarming rate. In the meantime, management continues to dilute shareholders through excessive stock-based compensation despite the ongoing issues. Hence, I am extremely bearish on Snap stock.

Snap’s Struggle to Find Its Foothold: A Look at Declining Revenues

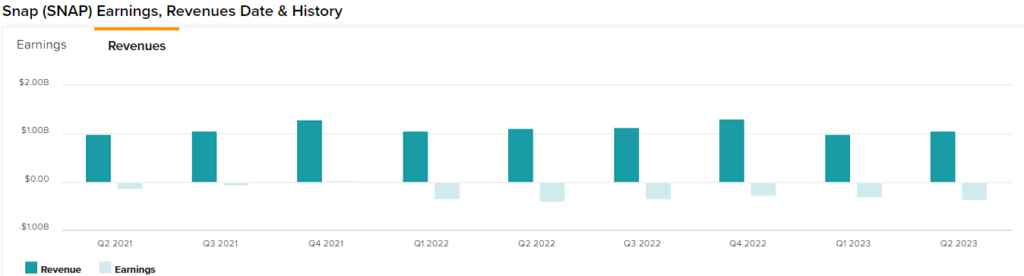

Snap has had a hard time finding its foothold in the social media landscape lately. Evidently, the company posted its second-consecutive quarter of declining revenues in Q2, which came in at $1.07 billion, down 3.6% compared to last year. Undoubtedly, Snap’s challenges stem from the intensifying competitive landscape.

A striking example lies in Meta’s recent quarterly report, where its app suite exhibited remarkable user engagement. Further, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) highlighted the mounting success of YouTube, which is progressively transforming into a formidable social media hub. Meanwhile, TikTok continues to thrive.

Thus, it’s hardly surprising that Snap finds itself languishing as a dated option for advertisers, even with the company touting a seemingly impressive 14% year-over-year surge in daily active users.

It’s important to highlight that Snap has exhibited a consistent pattern of revenue growth deceleration, followed by declines, indicating a diminishing appeal to advertisers. To put things in perspective, Snap achieved remarkable revenue growth of 589.5%, 103.6%, and 43.1% in 2016, 2017, and 2018, respectively. While there was a temporary resurgence in 2020 and 2021, driven by increased user activity during the pandemic, this growth momentum has since been disrupted, returning to the downward trend.

Notably, last year’s revenue growth was a lackluster 11.8%, and based on Snap’s performance in the first half of fiscal 2023, analysts are projecting the company’s first annual revenue decline, which is projected to be 2.2% to a total of $4.50 billion.

Snap’s management is making efforts to boost the platform and stock by introducing attention-grabbing features like My AI, its AI-powered chatbot. My AI has garnered significant usage, with over 150 million users sending 10 billion messages in Q2. Still, as long as such developments don’t translate to growing revenues, Snap is doomed. If anything, investing in such technologies against a struggling top line is only widening operating losses.

Widening Losses Erode Cash Position, Destroy Shareholder Value

Speaking of Snap’s operating losses, they have sadly been widening due to the decline in revenues and expenses remaining elevated. Specifically, operating losses in Q2 amounted to $404.4 million, up from $400.9 million last year. Accordingly, this was another money-losing quarter for Snap, with net losses coming in at a disturbing $377.3 million. At its current trajectory, it’s almost impossible for Snap to stop destroying shareholder value, as its money-losing business constantly needs fresh cash to stay afloat.

Specifically, Snap reported $1.23 billion of cash and equivalents on its balance sheet, which, based on the most recent quarter’s loss run rate, implies that it will barely last the company a year’s worth of losses before going to $0. Hence, Snap will eventually have to raise more to remain in business. The problem, however, is that any financing avenue will end up eroding shareholders’ wealth.

Should Snap opt to issue additional shares at its present price points, there’s a likelihood of a significant surge in the company’s share count, particularly if a substantial cash infusion is the objective. This has the potential to adversely impact the stock, as an excessive dilution might deter even the most dedicated Snap shareholders.

Furthermore, taking on more debt is also an unattractive option, given that Snap has already accumulated a substantial $4.16 billion in total debt. Considering the current trend of rising interest rates, the escalation of debt levels will only amplify Snap’s interest expenditures, further impeding the company’s path to profitability.

Based on this setup, I believe the company has found itself in an impossible situation. In an attempt to delay (the possibly inevitable) further shareholder value destruction, management has been essentially financing part of its operations by maintaining high stock-based compensation (SBC) levels. SBC was $318 million in Q2, more or less in line with last year. That said, this only delays the inevitable, as such high levels of SBC still massively dilute shareholders over time, but in a more subtle way.

Is SNAP Stock a Buy, According to Analysts?

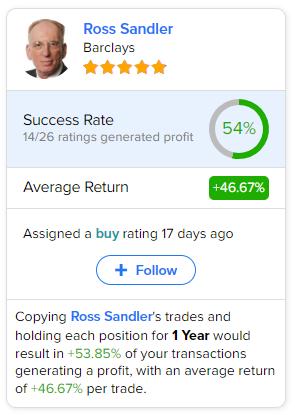

Surprisingly, despite Snap continuously disappointing Wall Street, the stock has managed to retain some bulls, featuring a Hold consensus rating based on four Buys, 16 Holds, and one Sell rating assigned in the past three months. At $10.56 per share, the average Snap stock price target suggests 3.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell SNAP stock, the most accurate analyst following the stock (on a one-year timeframe) is Ross Sandler from Barclays, boasting an average return of 46.67% per rating and a 54% success rate.

The Takeaway

In conclusion, Snap’s recent Q2 results reveal a company struggling to compete in the rapidly-evolving social media landscape. Declining revenues, widening losses, and a shrinking cash position paint a grim picture. While management introduces attention-grabbing features, these efforts must translate into revenue growth to save the company from eroding shareholder value.

Snap’s current trajectory suggests it’s running out of time, facing difficult choices that risk diluting current investors further and deteriorating its balance sheet. The challenges ahead for Snap are daunting, and the path to recovery seems increasingly elusive. Thus, I remain highly bearish on Snap’s investment case.