Even the most risk tolerant investor might wonder if now is the time to invest in cruise line stocks. As you would expect, the industry has been floored by COVID-19, and stocks across the sector have consequentially nosedived. Case in point: shares of Royal Caribbean Cruises (RCL) have sunk 70% year-to-date.

But Nomura analyst Harry Curtis thinks there’s plenty of upside when considering RCL as long-term investment. Curtis rates RCL stock a Buy along with a $62 price target. Should Curtis’ thesis play out, investors could be taking home a 79% gain. (To watch Curtis’s track record, click here)

Curtis noted, ”We continue to recommend RCL, as we believe it is among the best-positioned lines to emerge from the Great Lockdown. We continue to wait on two key catalysts for the group: 1) an agreement with the CDC on health protocols to restart operations and 2) the establishment of a restart date that gives operators time to market itineraries and begin rebuilding cash positions.”

But first of all, the embattled cruise operator must sail through more choppy waters. Well, metaphorically at least.

As expected, bookings have “meaningfully” dropped so far this year, although prices are down only single digits. Curtis argues this is because reducing prices now for 2H “will not stimulate demand in the current environment.” Looking ahead to next year, bookings remain relatively healthy, although with RCL reporting the figure is within “historical ranges,” Curtis believes the phrase indicates them to be “at the low end of normal ranges.” Nevertheless, the analyst thinks demand should increase with the loosening of travel restrictions.

“We believe that core consumers (~75% of guests) who see the product as a lifestyle choice will return to cruising within the next six to nine months. However, “new to cruise” consumer demand could take longer to materialize,” Curtis concludes.

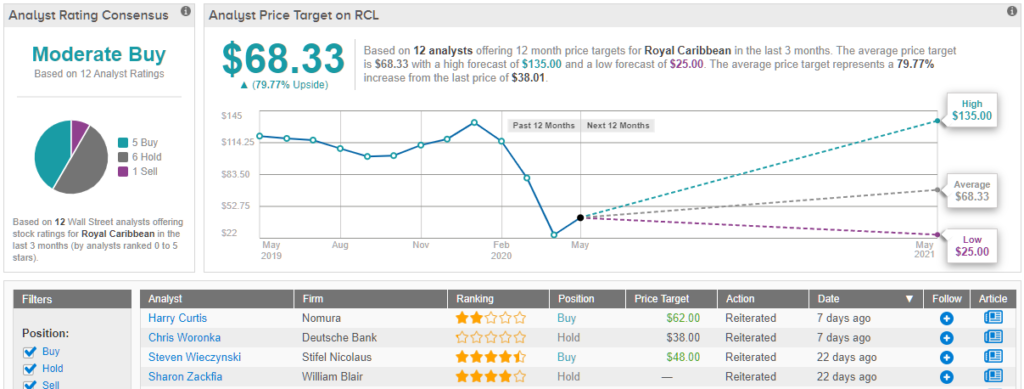

So, that’s Nomura’s view, let’s turn our attention now to rest of the Street: RCL’s 5 Buys, 6 Holds and 1 Sell coalesce into a Moderate Buy rating. There’s plenty of upside – 79.77% to be exact – should the $68.33 average price target be met in the next 12 months. (See Royal Caribbean stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.