Who initiated coverage of Plug Power (PLUG) ahead of its earnings results? Northland analyst Abhishek Sinha, that’s who, beginning coverage of the stock with a Market Perform (i.e. Neutral) rating, and a $25 price target, just ahead of the company’s Q2 2022 financial results next Tuesday, August 9.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tl;dr? He wasn’t entirely thrilled with what he found.

“PLUG is diving deep into the hydrogen market and has a strong balance sheet to support its envisioned growth,” began Sinha. However, while this sounds good in theory, “the hydrogen market is fraught with uncertainties.” Plug will face the risk of failing to execute its lofty plans well as it attempts to develop this market — and even if it executes well, there’s no guarantee that the company will succeed in generating good free cash flow from the business.

While that may sound harsh, the fact is that Plug has never managed to produce positive free cash flow in the past, despite having spent an entire quarter-century already, trying to make a go of the hydrogen power business — and despite having sold more than 50,000 fuel cell systems for industrial forklifts to big customers including Walmart (WMT), Amazon (AMZN), and Home Depot (HD), and despite built more than 150 fueling stations to refuel those forklifts. If 25 years wasn’t enough time — nor 50,000 vehicles sufficient scale — for Plug to start producing profits, it’s hard to imagine what would suffice.

Indeed, one almost suspects that Plug has come to the same conclusion itself, inasmuch as it has lately shifted its strategy away from a forklifts-focus and towards what Sinha calls “growth in every direction” in a vain attempt to find something (anything?) fuel cell related that can deliver a profit.

“PLUG is attempting to build a complete green hydrogen ecosystem: from green hydrogen production, storage and delivery to energy generation through mobile or stationary applications,” explains the analyst. And again — this sounds good in theory. In practice, however, all these big plans are going to require Plug to spend big money implementing them. Yet even taking “all of PLUG’s revenue growth and margin assumptions” as given, Sinha still isn’t convinced that the company will have any free cash flow left over after making the capital investments it will need to make.

When you get right down to it, therefore, the analyst is forced to conclude: “We feel investors could find other opportunities more attractive where risk/reward proposition is more compelling than what PLUG has to currently offer.” And this, in a nutshell, is why he’s ultimately unable to recommend buying Plug stock. (To watch Sinha’s track record, click here)

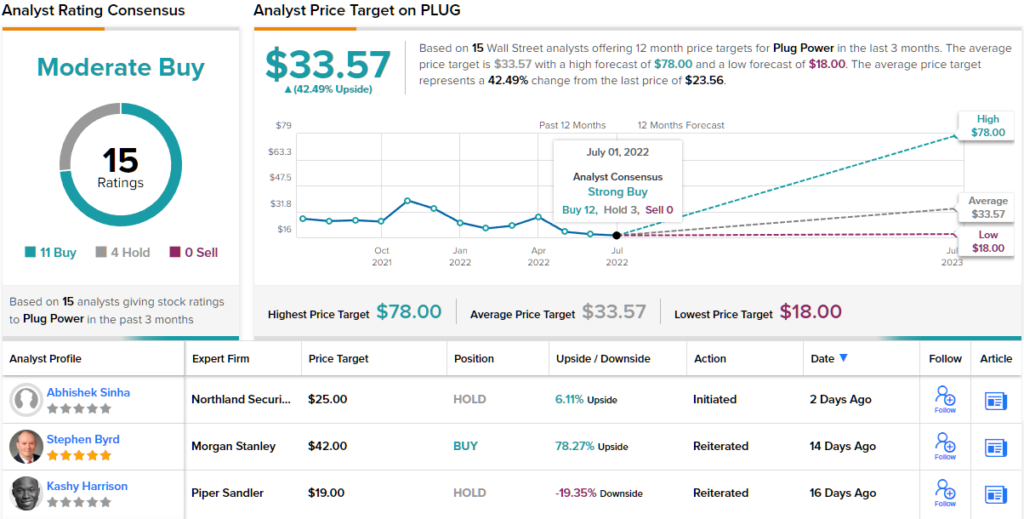

Turning now to the rest of the Street, PLUG earns a Moderate Buy analyst consensus based on the 11 Buys and 4 Holds assigned in the last three months. If shares can reach the average price target of $33.57, a 42% twelve-month gain is on the horizon. (See PLUG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.