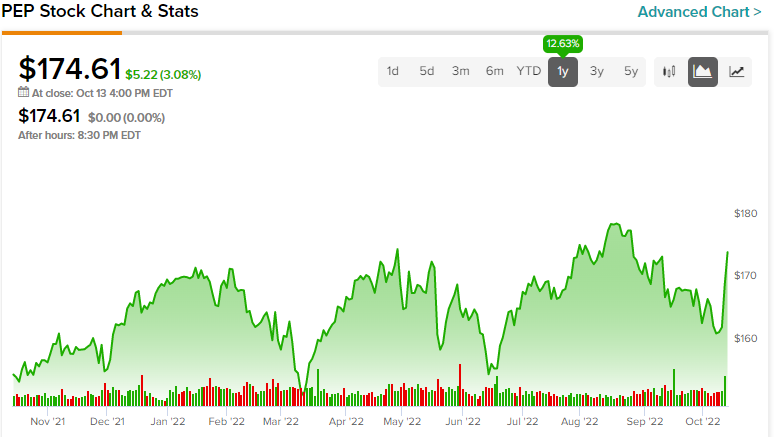

PepsiCo (NASDAQ: PEP) shares have been able to avoid the gravitational pull of the market pullback for the most part and are only 3% off their August high. Undoubtedly, the defensive dividend stock is a prime target for investors looking to dampen market volatility. Though Pepsi stock and other consumer staples may still feel some of the shockwaves, it’s likely that they’ll continue to do a better job of holding their own than the market averages. Despite its relatively rich valuation multiple, I remain bullish on PEP stock since few firms can offer a comparable degree of certainty these days.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Still, after a 23% plunge in the S&P 500 (SPX), there are many better deals than Pepsi. At writing, Pepsi stock trades at a hefty 26.3x trailing earnings multiple. The 2.63% dividend yield may seem attractive, but with certain battered telecom stocks offering more than 7% yields, Pepsi is fairly valued at best and a likely candidate to fizzle out once the rest of the market finds its footing. Nonetheless, it’s a prime candidate for current market conditions.

Pepsi Stock: Not Cheap, but Still Worth the Price of Admission

Though you can find cheaper stocks elsewhere, few stocks can offer the same magnitude of stability as Pepsi. With a portfolio of some of the best-known consumer-packaged goods that tend to experience stable demand in dire economic conditions, Pepsi is one of few firms that can offer anxious investors true peace of mind in the face of the unknown. For the type of exposure Pepsi will grant, the price of admission seems worth paying for those looking to batten down the hatches.

Undoubtedly, we’ve heard a lot of bearish news surrounding the Fed and the recession to come. With analyst price target downgrades and falling earnings estimates coming across the board, it’s becoming tougher to evaluate companies according to traditional valuation metrics like the price-to-earnings (P/E) multiple.

Seemingly cheap stocks (think discretionary firms whose shares boast single-digit P/E multiples) can suddenly become more expensive if earnings sink faster than expected. That’s why chasing low P/E multiples may not be the best strategy to stabilize your portfolio in the face of a market down cycle.

Indeed, the odds of a hard landing type of recession seem to be increasing by the day. With that, demand for the utmost quality defensives could continue to rise. In that regard, Pepsi could possibly even prove cheap today, given its earnings are less likely to take a hit once the recession arrives.

Navigating Through Inflation Quite Well (So Far)

Pepsi has shown that it’s a pretty good inflation fighter in recent quarters. The company has raised the bar on price increases without drastically decreasing sales. Undoubtedly, many consumers are catching on to the dreaded “shrinkflation” (less product for 2019-esque prices) at the potato chip aisle. That said, Pepsi has been able to dodge and weave past inflation far better than most other firms, and that’s partly thanks to its nature and the strength of its brands.

In 2023, inflation could persist, and Pepsi may encounter competitive pressures that challenge the firm’s pricing power. Indeed, Pepsi has all the brands we reach at the grocery aisle without thinking twice. That said, the rise of private-label brands could pose a greater risk to Pepsi’s inflation resilience, moving forward.

Almost every major retailer has hopped aboard the private-label bandwagon. Consumers have shown a willingness to embrace cheaper private labels (think Kirkland Signature or Great Value) to resist inflation.

Many consumers who would have never bought into private-label goods may discover that they’re not so much different from their branded counterparts.

Some consumers may prefer private labels to big brands. As retailers beef up their capacity to deliver better quality private-label goods, Pepsi may need to be more cautious with price increases moving forward or risk losing a bit of share to off-brand products that just seem to get better with time.

Is PEP Stock a Buy, According to Analysts?

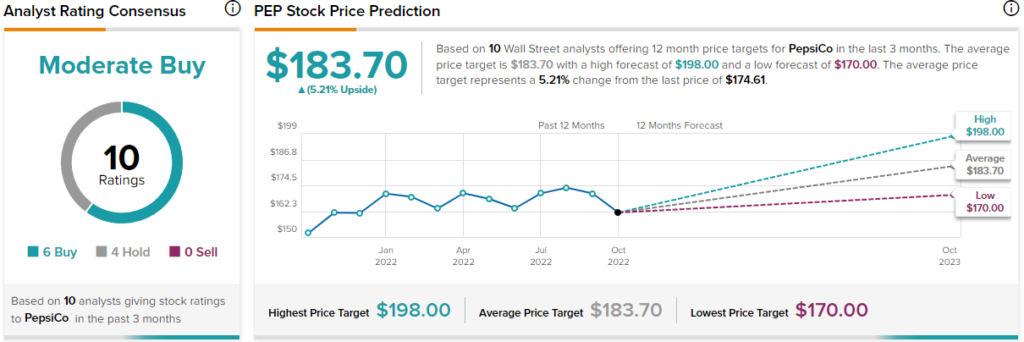

Turning to Wall Street, PEP stock comes in as a Moderate Buy. Out of 10 analyst ratings, there are six Buys and four Holds.

The average Pepsi price target is $183.70, implying upside potential of 12.1%. Analyst price targets range from a low of $170.00 per share to a high of $198.00 per share.

Conclusion: PEP is Richly Valued for a Reason

PEP stock is a tad rich, but it’s rich for a reason. The company is a recession and inflation-resilient company that can continue to grow earnings in a recession year.

Looking ahead, expect Pepsi to continue investing in initiatives to achieve greater growth. Undoubtedly, it’s hard to grow when you’re a $241 billion snacking behemoth. Still, with investments in manufacturing capacity and tech-leveraging efforts (think automation) to beef margins, it seems like Pepsi has the means to add some fizz to its bottom line, as most other companies see their earnings sink.