Streaming giant Netflix (NFLX) is set to report its Q3 earnings on October 17th. While concerns about subscriber growth may be affecting Wall Street’s consensus on Netflix shares this quarter, the company is projecting double-digit revenue growth and an increase in margins as it moves toward advertising for monetization. Although option chains suggest that Q3 may be characterized by high volatility, I still view NFLX as a Buy ahead of its earnings report, particularly with a long-term investment horizon in mind, as its valuation remains de-risked compared to historical averages.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Netflix’s Q2 Performance Recap

In line with my bullish outlook on Netflix, the company provided strong reasons for long-term optimism in Q2. Netflix reported a 17% year-over-year revenue increase, reaching $9.55 billion, which surpassed estimates. This growth was fueled by successful titles such as Baby Reindeer and Bridgerton, alongside a 16% rise in average paid memberships, totaling 277.65 million. This was an increase of about 8 million subscribers, exceeding analyst expectations of five to six million new additions.

While the market’s initial reaction to Q2 results was moderate due to high expectations, Netflix has consistently outperformed in key metrics such as operating margins and subscriber growth. In the latest quarter, the company achieved a 27.2% operating margin, up from 22.3% the previous year. Additionally, Netflix generated $3.35 billion in free cash flow for the first half of the year, putting it on track to meet its annual guidance of $6 billion. This was a positive development, especially as Netflix continues its substantial content investment while maintaining strong cash flow.

Furthermore, Netflix raised its Fiscal Year 2024 revenue growth forecast to 15%, up from 14%. The company also increased its expected annual operating profit margin to 26%, up from the previous estimate of 25%.

What to Expect from Netflix in Q3

For Q3, my Buy stance on Netflix remains strong, as the company is forecasting a revenue growth rate of 14% and an operating profit margin of 28.1%. This would mark a significant increase from the 22.4% margin in Q3 2023. The boost in margin is primarily driven by incremental subscriber growth and rising revenue, both of which have a positive impact on profitability.

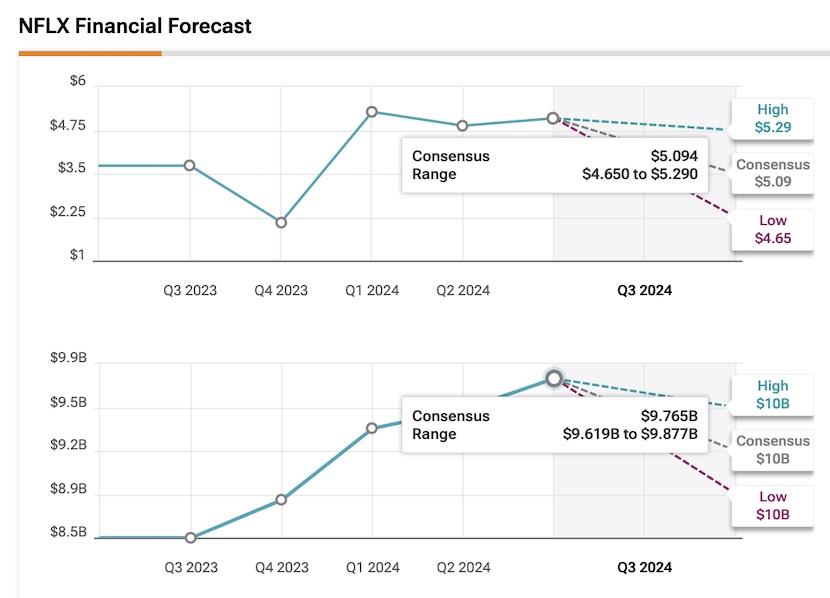

To exceed market estimates, Netflix will need to report earnings per share (EPS) above $5.09, implying a 36.5% year-over-year increase, and revenues above $9.765 billion, representing a 14.3% increase. Analysts, however, have mixed expectations for Q3, with 29 out of 31 analysts revising their EPS targets upward in the past three months. However, only 11 out of 32 analysts have raised their revenue projections for the quarter.

Netflix Is a Growth Stock Again, but in a Different Way

A key element supporting a bullish investment thesis for Netflix extends beyond merely beating Wall Street’s top and bottom-line estimates. I believe that the significant rebound in Netflix’s stock, which fell below $170 per share in mid-2022 after experiencing its first-ever failure to grow its subscriber base, signals that the market now views Netflix as a growth stock again, albeit in a different way than before.

Subscriber growth remains a key metric that could influence the market’s reaction to Netflix’s Q3 results. However, as the business matures, I believe the company is shifting from the “growth in numbers” phase to a “monetization growth” phase, with advertising playing a significant role.

By eliminating its basic plan, Netflix is nudging users toward its ad-tier option, which is a smart long-term strategy that expands potential ad revenue. Therefore, Netflix’s progress in advertising may be as crucial, if not more so, than subscriber growth in Q3.

Expect Volatility after the Earnings Report

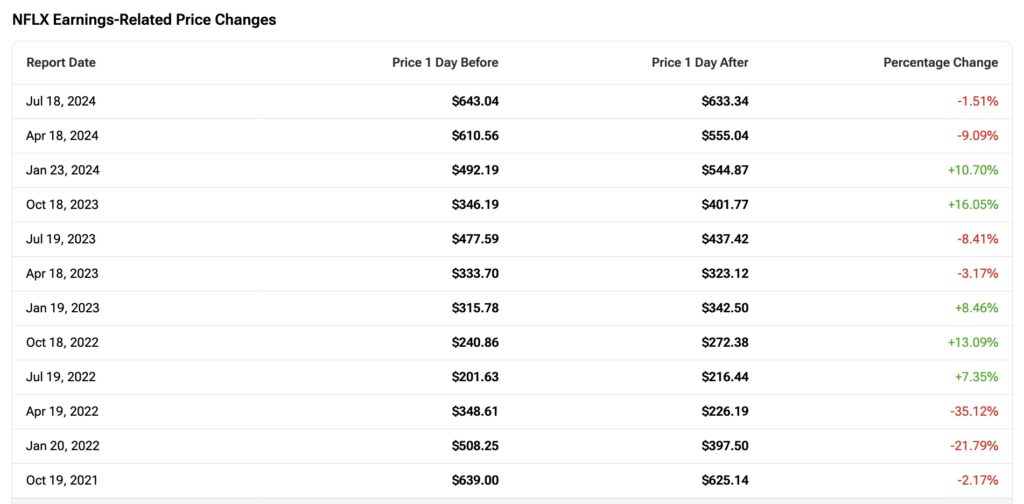

Regardless of whether Netflix beats or misses expectations, its stock has historically exhibited significant volatility following its earnings reports, often driven by conflicting perceptions of the company as either a value or growth stock. This is evident from the volatile price reactions in most of the last 12 earnings reports. Still, I maintain a bullish long-term outlook, as short-term fluctuations in Q3 results are unlikely to affect long-term investors.

One of the key contributors to volatility in Q3 could be valuation. Currently, Netflix trades at a forward price-to-earnings (P/E) ratio of 37.7x, the highest it has been since 2022. Although this indicates an increasing valuation, I still believe it remains relatively inexpensive compared to the stock’s five-year average P/E of 46.8x.

In addition, given that EPS is projected to grow by 59% in 2024 and another 20% in 2025, Netflix could trade at a forward P/E ratio of 30.4x by then. While not a bargain, this presents a de-risked growth opportunity.

What Option Chains Reveal About Netflix’s Q3 Earnings Expectations

Although I believe Netflix is well-positioned to continue its growth trajectory in Q3, the option chains confirm the high probability of a volatile scenario ahead. There is an expected earnings move of 8.33% in either direction, based on the at-the-money straddle for options expiring on October 18th, the day after the earnings announcement. This estimate uses the $720 strike price, with call options priced at $31.25 and put options priced at $28.76.

Is NFLX a Buy, According to Wall Street Analysts?

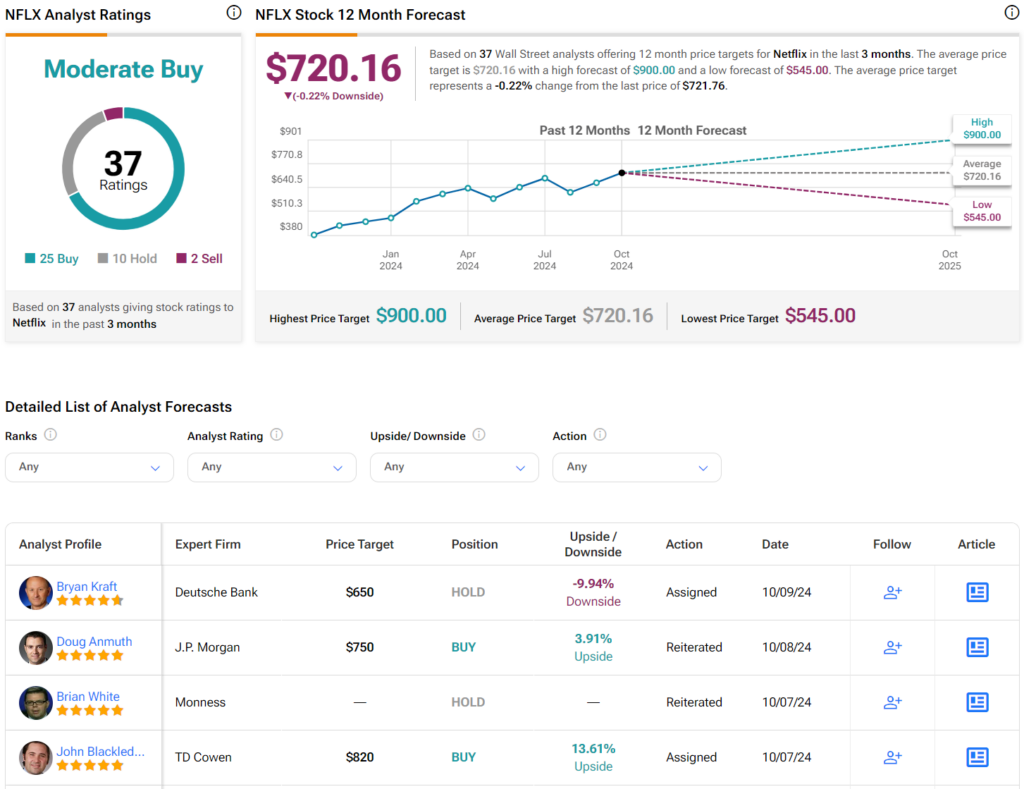

Using TipRanks’ data, the Wall Street consensus for NFLX is a Moderate Buy. Out of the 37 analysts covering the stock, 10 have a Hold recommendation and two recommend selling. Meanwhile, the remaining analysts recommend a Buy. Furthermore, the average price target for NFLX is $720.16, indicating little to no upside potential.

Conclusion

In conclusion, I believe that despite the anticipated volatility, Netflix is well-positioned for continued growth in Q3. The shift toward advertising and a focus on monetization over subscriber growth could become evident this quarter and strengthen in the following ones.

Although the stock is trading at all-time highs as the earnings date approaches, short-term volatility may lean bearish. Nevertheless, I believe that investors who buy NFLX stock, even at current valuations, will ultimately reap the rewards. Therefore, I consider Netflix a Buy ahead of earnings, and even more so if there is a pullback.