Rising interest rates and macro uncertainty have dragged down tech stocks, including software giant Microsoft (NASDAQ:MSFT). Clearly, Microsoft’s business is not immune to the ongoing macro challenges. Currency headwinds, production disruptions in China, scaled-down operations in Russia, and the decline in personal computer shipments have weighed on the company’s recent performance. However, most Wall Street analysts remain bullish on Microsoft given the company’s strong fundamentals and growth potential in cloud computing.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Microsoft is Capable of Thriving Despite Near-Term Pressures

Microsoft’s revenue increased 12% to $51.9 billion in the fourth quarter of Fiscal 2022 (ended June 30, 2022) while EPS rose 3% to $2.23. However, the company lagged behind analysts’ expectations. Unfavorable foreign currency movements adversely impacted the company’s revenue by $595 million.

Also, production shutdowns in China due to the resurgence of COVID-19 and a weak PC market negatively impacted the company’s Windows OEM (original equipment manufacturer) revenue by over $300 million. Additionally, lower advertising spending on LinkedIn, Search, and news hit the top line.

Looking ahead, Microsoft expects double-digit revenue and operating income growth in Fiscal 2023, driven by continued momentum in its commercial business.

The company is optimistic about the prospects of its cloud business, which includes Azure and other cloud services. In Q4 Fiscal 2022, Microsoft Cloud revenue increased 28% and surpassed the $25 billion quarterly revenue mark for the first time. Revenue from Azure and other cloud services grew 40% in Q4 but slowed down compared to the 46% growth seen in the prior quarter.

Is Microsoft Stock Expected to Rise?

On September 20, Microsoft announced a 10% hike in its dividend to $0.68 per share. In reaction to the dividend announcement, Morgan Stanley analyst Keith Weiss stated that the hike was in line with the percentage rise over the past several years. The analyst also expects the company to repurchase shares worth nearly $9 billion per quarter in the current fiscal year.

Weiss added, “The dividend represents a consistent source of income and one component of the durable high-teens total return profile we forecast for Microsoft. We forecast mid-teens revenue growth, outpacing cost of goods sold, with gross profit growth also outpacing Opex growth.”

Overall, Weiss expects an 18% EPS CAGR (compound annual growth rate) through Fiscal 2025. He reiterated a Buy rating on MSFT stock with a price target of $354.

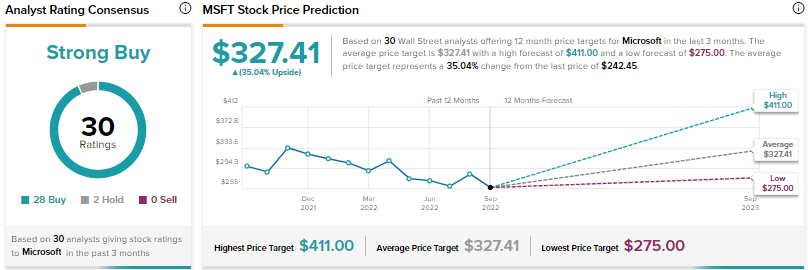

On TipRanks, Microsoft scores the Street’s Strong Buy consensus rating based on 28 Buys versus only two Holds. The average Microsoft target price of $327.41 implies 35% upside potential.

Conclusion

While Microsoft might continue to face near-term pressures, Wall Street analysts remain optimistic based on the company’s solid fundamentals and long-term growth potential in cloud and other growth areas amid increasing digitization. Also, Microsoft’s position in the gaming industry will be boosted if the company’s proposed acquisition of Activision Blizzard (ATVI) gets the green signal from regulators.

As per TipRanks’ Smart Score System, Microsoft scores a nine out of 10, which implies that the stock could outperform the market averages.