Shares of dating platform service provider Match Group (NASDAQ:MTCH) have been under considerable selling pressure for nearly a year now, down more than 66% from its peak just shy of $170 per share. At $56 and change, Match Group seems like it could be a great match for dip buyers. Still, with weak Q2 results in the books, a lack of catalysts, and a suspect valuation, I’d much rather side on the sidelines. Though the portfolio of dating sites is well-established, with a bit of a moat, I remain neutral on the stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Match Group Falls Short of Analysts’ Estimates for Q2

Match Group fell flat in its second-quarter earnings, with per-share losses coming in at $0.11, well below analyst estimations that called for positive earnings per share of $0.57. A surprise loss is never a good thing, especially of such a magnitude. Alongside the weak earnings was weaker revenue guidance for the second half of 2022. The firm now sees flat sales coming in the $790-800 million range.

Tinder, one of Match’s hottest apps, helped Match to 12.3% revenue growth. Still, the once scorching-hot app seems to be losing its appeal among the general population. Recent studies touted Tinder as the most hated popular app in Canada and many U.S. states. It’s also a much-hated app in many other parts of the world.

Indeed, Tinder makes dating all too convenient. Still, many users are clearly fed up with something. In any case, users continue using the platform. However, its “hated” status may leave it vulnerable to competitive threats once a better alternative comes rolling in.

Fortunately for Match, it’s been slowly building upon its moat. Name a dating app or service; odds are, it’s under the Match Group umbrella. While Match is no monopoly, its market dominance in the dating scene is unmatched (forgive the pun, please!).

Match Stock May One Day Meet Its Match

Though Match Group is a standout behemoth in the dating game, it’s not immune from potential competition. Meta Platforms (NASDAQ:META) and Bumble (NASDAQ:BMBL) are just two firms that could put a dent in the Match Group’s growth prospects at some point over the next decade.

Meta has had minimal success with its dating ambitions since getting into the space back in 2020. Recently, the firm announced it’s taking a step back from dating with the shutdown of Tuned.

Though it may seem like Meta is throwing in the towel on dating, I think it’s just a matter of time before the FAANG giant returns to the scene with a different angle. Meta’s goal is about connecting people, after all. It has the network; it needs to find the right platform to disrupt Match’s massive moat.

With Meta betting big on the metaverse, I do view the rise of metaverse dating as a potential threat to Match Group’s dominance. The metaverse remains abstract, and though virtual worlds exist where people can meet up, it’s clear that it is not yet ready for prime time. As new headsets roll out over the coming years, this could change.

The major problem with today’s slate of dating apps is that it lacks the element of presence. Sure, dating profiles give you a hint of what a person is all about.

Still, until you sit down with them over dinner or a movie, it’s really tough to gauge if there’s a connection. In short, dating apps as we know them today may not make the process of finding love very time efficient.

It can be pretty time-consuming to have to swipe left and right all day, only to have few, if any, meaningful leads. As such, I don’t think it’s a mystery why Tinder isn’t too loved of an app despite its popularity.

Though metaverse dating sounds abstract, meeting someone’s avatar and interacting with them on a digital date can be far more efficient than meeting someone in person. Further, you’ll be able to tell right away whether there’s chemistry and will be less likely to stick it out through a date that’s not going anywhere.

While the metaverse may be a decade or more away, Match Group’s competition could rise considerably once it lands.

Is Match Stock a Buy or Sell?

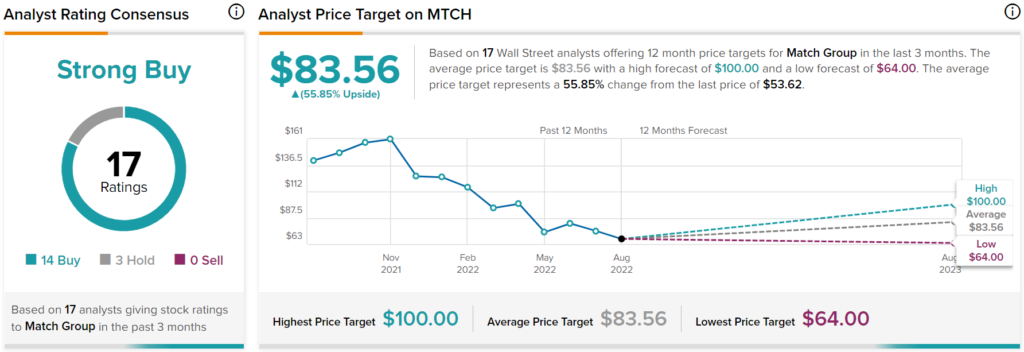

Match Group has a Strong Buy consensus rating based on 14 Buys and three Holds assigned in the past three months. The average MTCH stock price target of $83.56 implies 55.9% upside potential. Analyst price targets range from a low of $64.00 per share to a high of $100.00 per share.

Takeaway – MTCH Stock’s Moat May Dry Up Someday

Match Group is an incredibly wide-moat firm with considerable year-ahead upside potential. Despite this, it’s endured bumps in the road expected to drag through the year’s end. Further, as the metaverse arrives, it’s difficult to tell how Match Group will pivot. For these reasons, I’m falling out of love with MTCH stock, even at a modest 5.3 times sales.