Canadian National Railway (TSE:CNR) (NYSE:CNI), Canada’s largest railroad company, has seen its stock outperform the market all year. It’s currently near all-time highs, and it’s a high-quality company. However, closer analysis suggests that the stock is probably not worth buying at its current levels, but it may be worth buying on a dip.

What Makes CNR a High-Quality Company?

There are several qualities that make Canadian National Railway a solid stock. To keep things simple, it can be summarized very shortly. The company is able to grow over time while maintaining high profitability.

For example, in the past 10 years, it has grown its revenue at a compound annual growth rate (CAGR) of about 5.3%. More impressively, its diluted earnings per share (EPS) have grown at an 8.8% and 6.6% CAGR over the past 10 and five years, respectively. Free cash flow has grown at a slightly faster pace. During the past seven years, CNR has managed to maintain a steady gross profit margin, ranging from about 53% to 57%. This implies that competitors aren’t chipping away at CNR’s profits.

After all, it’s one of the biggest railroad companies in the world, and it wouldn’t have gotten to that level without a so-called “moat.”

It’s not just its past performance that has been impressive. Canadian National Railway’s recent results beat expectations (revenue and earnings grew by 26% and 40%, respectively), and the company raised its 2022 outlook. The company is firing on all cylinders. It provides the stability that investors look for in an unstable market, especially with its beta of 0.71.

Looking forward, CNR’s EPS growth is expected to be 26.3%, 7.9%, and 9.71% for 2022, 2023, and 2024, respectively. These are respectable growth rates for such a mature company.

Why is CNR Stock Likely Not a Great Buy Right Now?

Despite Canadian National Railway’s excellent characteristics, the stock may not be good to purchase right now, relatively speaking. Simply put, its valuation isn’t compelling, and technical analysis suggests that a pullback is likely.

Assuming CNR meets its 2023 and 2024 estimates, they imply forward multiples of 20.2x and 18.4x. While these are not sky-high multiples, they’re also not compelling. We would call them fair, at best. In a bear market like this, you’ll surely be able to find better deals out there.

Also, pre-pandemic, before the market got into bubble territory, CNR’s forward P/E ratio (on a next-12-months basis) was about 19x on average. This implies that CNR is trading at a slight premium.

Finally, if you look at its long-term stock chart, you’ll see that it’s a bit overextended and can eventually revert to its 30-month moving average (the red line), which has acted as a support level in the past.

Is CNR Stock a Buy, According to Analysts?

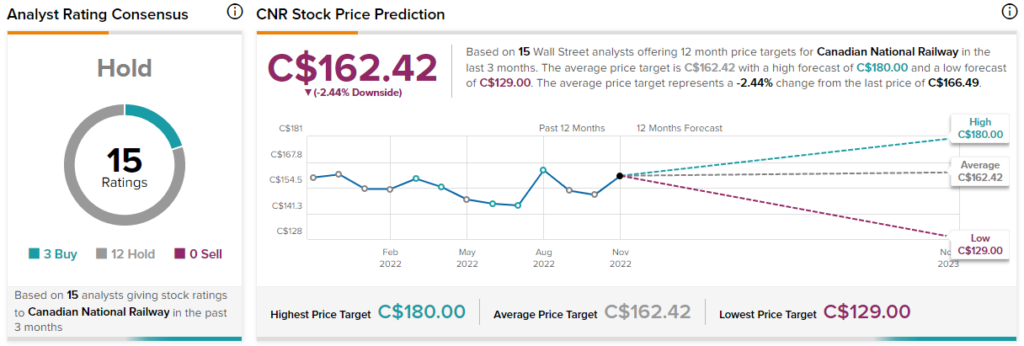

Analysts seem to agree with us that the stock is near its fair value, giving it a Hold consensus rating based on three Buys and 12 Holds assigned in the past three months. At C$162.42, the average CNR stock price target implies 2.4% downside potential.

Nonetheless, Canadian National Rail has a ‘Perfect 10’ Smart Score rating, indicating that it can outperform the market from here. We believe this is possible in the current environment, as investors are still seeking safety. However, if investors start taking more risks again, say, in 2023, then CNR stock will likely underperform.

Conclusion: CNR Stock is Not Too Attractive Currently

While CNR is a high-quality company, we believe that there are better deals in the market right now, and analysts agree. Even from a technical standpoint, it may be better to wait for a dip before purchasing the stock.