Oil major Exxon Mobil (NYSE: XOM) is set to report earnings later this week. With macroeconomic and political pressures sustaining elevated oil prices, the company is currently enjoying fantastic trading tailwinds. That said, some investors are worried that the stock might have already run ahead of itself following its prolonged rally over the past year. In my view, Exxon should continue printing cash at the current commodity prices. That said, at their current valuation, shares might have indeed priced in much of the forthcoming profits, leaving limited upside for current investors.

Accordingly, I am neutral on the stock.

Q3 Results: What to Expect

The energy sector has undergone a wild roller coaster ride over the past couple of years. During such an uncertain economic environment, companies in the space, such as Exxon, are generating record free cash flows. Based on where oil and gas prices hovered during Q3, consensus earnings-per-share estimates point toward $3.81, implying a massive ~141% increase compared to last year, though slightly lower quarter-over-quarter as commodity prices did ease sequentially. Still, Q3 should be a massive quarter for Exxon.

Free cash flow is also expected to land close to $12.7 billion, which, again, while lower than Q2’s $16.1 billion, is still massive. It’s enough to cover the dividend, help the company deleverage further, and lead to additional cash accumulation. Note that Exxon’s cash position already stands at a 13-year high of $18.9 billion. This should ease investors’ previous worries regarding the health of the company’s balance sheet.

As a reminder, in its Q2 results, Exxon grew its production by 4% sequentially, while the oil giant benefited significantly from the rally of the prices of oil and gas, reaching 13-year highs, leading to refining margins also reaching record levels. Consequently, Exxon doubled its adjusted earnings per share quarter-over-quarter, from $2.07 to $4.14.

It’s worth noting that relative to past oil price rallies, producers such as Exxon have increased their production prudently, worrying that the current euphoria may end up being rather short-lived. These worries are sourced from the ongoing transformation most countries have targeted regarding gradually switching from fossil fuel dependence to clean energy sources.

By combining such conservative production increases by Western producers, the recent decision by OPEC and OPEC+ to cut oil production by 2 million barrels per day, and the ongoing geopolitical tensions only escalating over the past several weeks, oil prices have remained high and are likely to remain quite high.

What about Exxon’s Dividend?

Income-oriented investors have placed Exxon on a pedestal, and for a good reason. The company holds the title of Dividend Aristocrat, having increased its dividend for 39 consecutive years. Through the roughest economic environments and toughest trading conditions in the energy sector, the company has kept rewarding its shareholder with growing payouts.

In 2020, if you had asked Exxon investors whether they expect a dividend cut anytime soon, I bet most of them would have replied positively. The stock’s yield had advanced north of 10%, with Exxon’s payouts not really being covered by the underlying profits at the time.

Following the extreme transition to record oil prices and profits for Exxon over the past couple of years, the stock’s rally has now pushed the yield to a relatively humble 3.3%.

It makes sense, after all, as investors’ confidence in the dividend has improved greatly. The company is expected to record earnings per share of $13.04 this year, implying a payout ratio of just 27%. Even if profits were to fall notably amid commodity prices easing, the dividend should remain very well covered.

Is Exxon Worth Buying at Its Current Valuation?

In my view, Exxon should be bought either because it offers an attractive dividend opportunity or because its shares offer significant upside from a valuation expansion potential perspective.

When it comes to its dividend, it should remain reliable and well covered at current commodity prices. However, the 3.3% yield is hardly exciting these days. I would argue there are several opportunities out there that offer higher yields and much more vigorous dividend-growth prospects – from companies that operate in non-cyclical industries as well.

The possibility of shares attracting a higher valuation also appears bleak. Indeed, at the stock’s current price levels and consensus earnings-per-shares estimate, shares are currently trading at what appears to be a forward P/E of around 8.1. However, if commodity prices were to somewhat normalize, Exxon’s profits could easily be reduced following inferior margins, exposing a much higher P/E ratio at the stock’s current price levels.

As I mentioned, elevated oil prices are likely to be sustained. If they can remain high for three, four, or five years, then yes, Exxon is still cheap. However, if anything were to lead to notably lower oil price levels, then current investors are likely to find themselves exposed to a much heftier multiple.

Is XOM a Good Stock to Buy, According to Analysts?

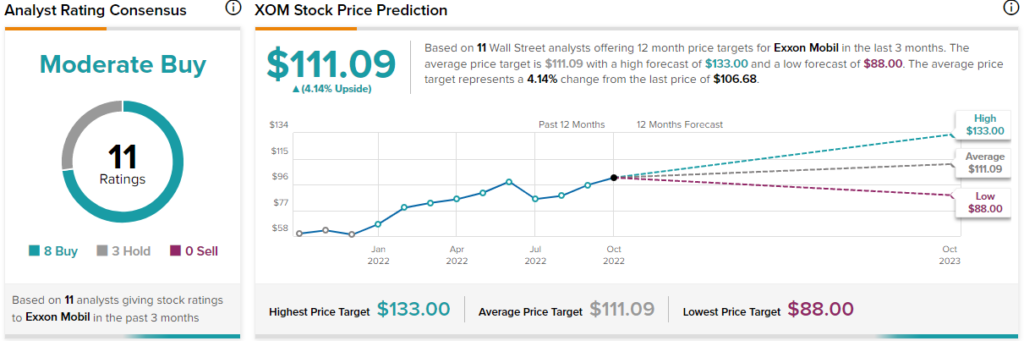

Wall Street analysts appear to agree with the idea that there should be minimal upside at the stock’s current price levels. Specifically, Exxon Mobil has attracted a Moderate Buy consensus rating based on eight Buys and three Holds assigned in the past three months.

At $111.09, the average Exxon Mobil stock forecast implies upside potential of just over 4%.

Conclusion: XOM Set to Generate Record Profits, but It’s Risky

Undoubtedly, Exxon is currently riding a fortunate wave comprising favorable commodity prices and fantastic supply/demand dynamics in the energy sector following Western Allies’ sanctions on Russia.

The company is presently a cash cow, and profits should hit record levels this year. Its previously-risky dividend now appears quite safe as well.

However, the stock can only continue to be a great investment at its present price levels only if the current setup is going to last over the medium term – which it could.

In any other less-favorable scenario, however, investors could quickly find themselves holding shares that will be trading at a much higher valuation multiple, which could, in turn, trigger a reversal in sentiment toward a multiple compression. Thus, make sure you retain an adequate margin of safety before considering buying Exxon stock.

Questions or Comments about the article? Write to editor@tipranks.com