Caterpillar (NYSE:CAT) is known the world over for its heavy industrial equipment and earthmover systems. It is generally in its element if either mining or construction is going on. This gives Caterpillar versatility that lets it endure many difficult conditions and thrive in boom times. That being said, right now, I’m neutral on Caterpillar. If you’ve already got it, hold it. Adding to the position now may not be a hot idea due to a range of factors outside the company’s control.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The stock took a small upward tick this morning, though it reversed course later on in the day. The temporary uptick was due to the company waiving its rules on mandatory retirement, which requires employees to walk away at age 65. The waiver targets current CEO Jim Umpleby, who can now remain as CEO for the foreseeable future.

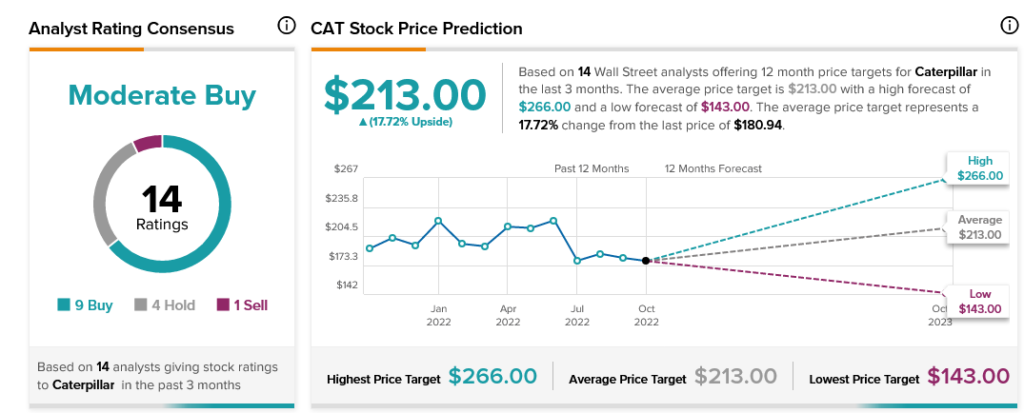

The last 12 months for Caterpillar shares have been somewhat volatile. Share prices have fluctuated in an approximate $80 range for the last year. The company has seen a 52-week low that threatened $160 and a high that briefly topped $235 per share.

Caterpillar’s Investor Sentiment is at Odds with Itself

Seeing investor sentiment somewhat conflicted is nothing new. Just look at Caterpillar. Currently, Caterpillar has a Smart Score of 9 out of 10 on TipRanks. That’s the second-highest level of “outperform” and the second-highest score on the scale. That represents a high degree of certainty that Caterpillar will ultimately outperform the broader market.

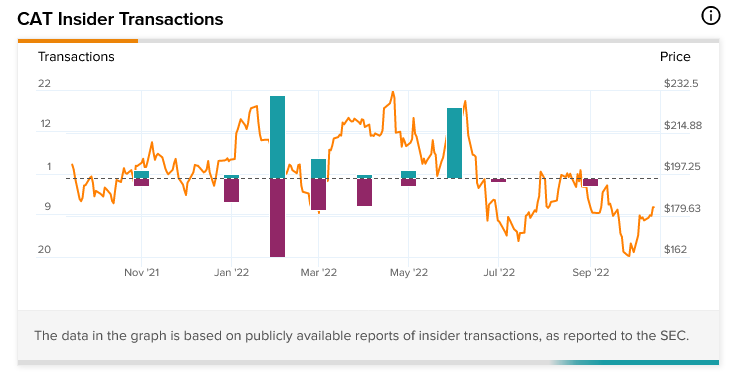

Despite this high, though, Caterpillar insiders are much less certain about the company’s success. Insider trading at Caterpillar trended negative in recent months. There have been two informative sales in the last three months.

The company’s Chief Accounting Officer, William Schaupp, sold $52,500 worth of stock in one sale. He sold the exact same amount in a sale considered uninformative as well. Additionally, Debra Lynelle Fischer sold an undisclosed quantity of stock three months ago.

The aggregate doesn’t help matters. The sell transactions of the last three months were the only insider transactions the company saw. There was no buying activity from insiders at any point in that time. The last purchase goes back to May 2022, when 18 purchases were made.

The aggregate for the last 12 months is a bit less pessimistic. Insiders bought shares of Caterpillar on 50 separate occasions. Yet insiders sold shares on 47 occasions, which yields a slight positive edge overall.

Potential Wins and Losses Ahead for CAT Stock

The problem with Caterpillar, in a nutshell, is that it’s Caterpillar. It’s fairly well diversified, but only across a comparatively narrow field. It has a branch for boom times, with its construction equipment, and a branch for bust times in its mining operations.

When the economy turns south, assets often take on a new value, particularly precious metals. Gold is often regarded as a hedge against economic downturn, though this time, that’s proving less the case than normal.

Here, though, things are somewhat different. With the supply chain in tatters thanks to COVID-19 lockdowns, the ability for gold to shine dims. Gold and the dollar are usually negatively correlated.

As the dollar’s value improves, gold falters. The strength of the U.S dollar right now is keeping a lid on gold, which is unusual going into a recessionary environment.

Thus, Caterpillar’s traditional hedge against a downturn (metals mining) takes a bit of a hit, given the conditions.

However, things aren’t all bad for Caterpillar right now. By working to secure its CEO for the foreseeable future, Caterpillar can make a case to investors that it’s securing the company’s future as well. Umpleby has served since 2017, reports note, so he’s been on hand before, during, and after a pandemic. Having a seasoned professional’s hand at the tiller can’t hurt.

Plus, Caterpillar is working to embrace a future pathway as well. Just last week, Caterpillar showed off four new electric-powered prototypes. The new models, set for an exhibition in Munich, feature two excavators as well as two front-end loaders.

Caterpillar offered no specs on the new designs. However, Caterpillar revealed it would design the battery packs entirely in-house.

Further, the company announced that it would maintain its quarterly dividend of $1.20 per share, which is undoubtedly welcome for Caterpillar investors with a focus on income investing.

Is CAT a Good Stock to Buy?

Turning to Wall Street, Caterpillar has a Moderate Buy consensus rating. That’s based on nine Buys, four Holds, and one Sell assigned in the past three months. The average Caterpillar price target of $213 implies 17.72% upside potential. Analyst price targets range from a low of $143 per share to a high of $266 per share.

Conclusion: Caterpillar is Solid, but the Environment is Troubled

The good news for Caterpillar is that it’s dynamic. It’s holding ground where it needs to, particularly in its dividend. It’s making changes where it needs to, especially in bringing out new vehicles with a little extra commitment to a green lifestyle for those who want it. Furthermore, Caterpillar is currently trading closer to its lowest price targets than its average or highest targets. That might make for an attractive buy-in point for some, but considering the rest of the picture, I wouldn’t suggest it.

Caterpillar is an excellent company, and that’s why I certainly don’t suggest selling. However, it is also going into an environment that’s largely unlike any we’ve ever seen. Caterpillar will only have so many options to respond. That’s why I’m neutral on Caterpillar. It’s the only sane response to a market gone mad and a company that’s one of the most stable around.