Coinbase (COIN) is the leading global cryptocurrency trading platform, boasting of 50 million current members and numerous cutting-edge cryptocurrency products, with many more powerful new innovations on the way.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The main value for COIN currently comes from its massive member network, through which it generates fees from cryptocurrency transactions. Additionally, it offers ancillary services, including a credit card and storage fees.

In the future, management expects to generate most of its profits outside of its crypto brokerage business, by significantly growing several aspects of its business. Those include the company’s institutional crypto cybersecurity business, crypto loan and deposit accounts, credit card offering, as well as its stakes in several different crypto-focused start-ups. Those start-ups each work on innovative new crypto products, which Coinbase expects to become massive growth engines in the future. (See Coinbase stock analysis on TipRanks)

Given its diversified exposure across the cryptocurrency space, COIN is essentially a leveraged bet on the continued growth of cryptocurrency and blockchain technology. Therefore, it is an attractive option for crypto bulls who are looking for a way to generate cash flow and long-term growth in the sector.

Something else to like about COIN is that the company is already highly profitable, despite its being a very young company in an immature industry. In fact, it directly listed its shares for public exchange only a few weeks ago.

That being said, the company does face stiff competition from numerous rapidly-growing rival crypto exchange businesses such as Voyager (VYGVF) and Gemini, each of which claims its own unique competitive advantages against COIN. Ultimately, it is widely expected that such plentiful competition will cause profit margins on cryptocurrency exchange fees to compress to very low levels, similar to what is seen on other investment exchanges.

As a result, COIN’s management is aggressively pushing to grow revenues and profits in its ancillary businesses, and fully expects to generate most of its revenue from other businesses within 5 years.

Valuation Metrics

Despite the heavy competition, COIN still has a good chance to emerge a winner in the crypto space. Thanks to its massive existing customer base and strong positioning in ancillary businesses, as well as its crypto technology that is bolstered by its small army of talented and seasoned tech employees, COIN is going strong.

Furthermore, the valuation is reasonable, as the company is expected to generate $8.68 in normalized earnings per share in 2021. That puts the company’s price-to-forward normalized earnings ratio at a very compelling 27.9x for a company with such strong growth potential.

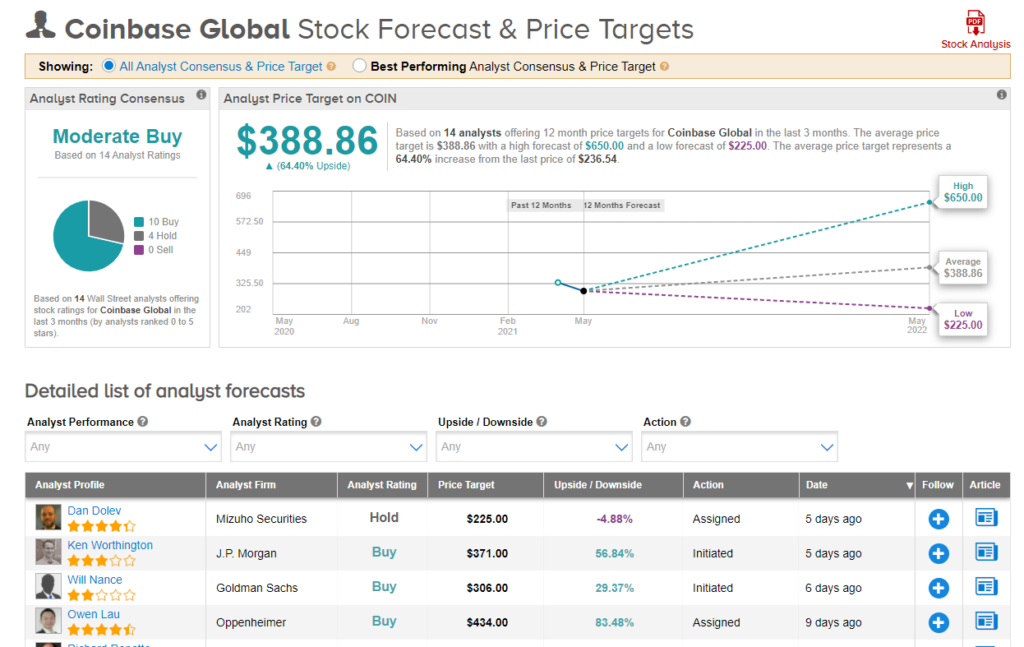

Wall Street’s Take

From Wall Street analysts, COIN earns an analyst consensus of Moderate Buy, based on 10 Buy ratings and 4 Hold ratings in the past 3 months. Additionally, the average analyst price target of $388.86 puts the upside potential at a whopping 64.4%.

Summary and Conclusions

COIN has tremendous upside potential and is well-positioned to emerge a winner in the cryptocurrency space, assuming cryptocurrency can overcome its current regulatory and mainstream adoption risks.

The business is likely to continue growing in line with, or even faster than, the broader cryptocurrency space, and analysts remain bullish on the shares overall. Given that the valuation remains reasonable, it could be an attractive way to invest in the continued growth of the up-and-coming cryptocurrency industry.

Disclosure: On the date of publication, Samuel Smith had a long position in COIN.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.