Shares of Intuitive Surgical (NYSE:ISRG) have undergone a massive rally over the past year, gaining about 43% during this period. Investors seem overly excited about the robotic surgery market leader, setting the stock on a trajectory toward reaching new all-time highs if its current momentum lasts.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

On the one hand, Intuitive Surgical has been on a roll for years, exhibiting impressive momentum. More and more hospitals worldwide are embracing the company’s cutting-edge systems, driven by the increasing demand for minimally-invasive procedures among patients. As a result, Intuitive’s installed base is expanding at a rapid pace, leading to a surge in both revenue and profits.

On the other hand, it appears that Intuitive Surgical stock might have run ahead of itself. Recent stock price gains have more than accounted for the company’s underlying growth, likely pushing Intuitive toward overvalued territory. In the meantime, I am skeptical whether Intuitive’s ongoing capital return progress is beneficial for shareholders. Accordingly, I am neutral on the stock.

Growth Momentum Remains Robust

Intuitive Surgical’s growth momentum continues to impress, fueled by the growing popularity of robotic-assisted surgeries. The trend towards minimally-invasive procedures has gained significant traction, drawing a greater number of patients seeking a more comfortable and efficient surgical experience. Meanwhile, hospitals are eager to incorporate these cutting-edge techniques as they can potentially generate greater surgical revenues while also reducing expenses due to fewer complications and shorter hospital stays.

Intuitive has capitalized on the ideal blend of hospitals and patients eagerly accommodating their state-of-the-art technologies, resulting in tremendous success over the years. Despite not having the most eye-popping growth figures, with revenues and EBITDA growing at a compound annual rate of 10.8% and 6.0% (respectively, over the past decade), the sustained growth over more than two decades is a remarkable achievement for a company in growth mode since the late 90s.

Intuitive’s recent performance in Q1 exemplifies the company’s continued dominance in a burgeoning market. The company expanded its installed base of da Vinci Surgical Systems by an impressive 12% year-over-year, bringing the total to 7,779 systems. The growing demand for these systems from hospitals shows no signs of slowing down, as evidenced by the placement of 312 systems compared to 311 in the previous year.

With more systems online than ever and an increasing number of patients opting for minimally invasive procedures, as previously mentioned, da Vinci procedures grew by roughly 26% globally. Thus, Intuitive Surgical was able to post revenue growth of 14% to a new quarterly record of $1.70 billion.

Regarding its profitability, Intuitive’s net income for the quarter came in at $355 million (down 3% year-over-year), or $1.00 per diluted share (flat year-over-year). This was primarily attributed to operating expenses rising in tandem with revenues. Still, the company remains highly profitable, with its gross and net income margins landing at 65.6% and 21.0%, respectively.

With high-margin service revenues expected to make up an increasingly significant portion of the company’s total revenue, I anticipate that Intuitive’s margins will continue to expand, leading to a re-acceleration of earnings growth in the short-to-medium term.

Examining Intuitive Surgical’s Valuation: Reasonable or Overvalued?

Intuitive Surgical has historically traded at a premium valuation, which makes sense due to a number of reasons. The most important one is that Intuitive’s unique and unparalleled expertise in the field sets it apart from its competitors. With its cutting-edge systems and technology, the company remains far ahead of the curve. Investors and analysts obviously highly regard this, as this essentially guarantees the company’s dominance in the market, at least in the foreseeable future.

The issue here, however, is that Intuitive’s valuation multiple has continued to expand, surpassing its prior levels, despite the company’s growth gradually decelerating. Sure, revenue growth remains robust, as mentioned earlier, but it’s nowhere near the 20%+ rates the company used to post in the early 2010s. In the meantime, Intuitive’s forward P/E has expanded from the high 20s and low 30s it used to attract back in the early 2010s to over 52 currently. This is a rather irrational development that is quite hard to explain.

On top of that, management has been accelerating capital returns to shareholders in the form of share buybacks. Repurchases over the past 12 months have amounted to a record $3 billion. Growing capital returns is generally great. That said, at the stock’s current valuation levels, growing buybacks could be a cause for concern, as there is a good chance management is overpaying for its own stock. This can surely have a negative impact in terms of creating value for shareholders.

Is ISRG Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Intuitive Surgucal features a Moderate Buy consensus rating based on 14 Buys and six Holds assigned in the past three months. At $313.89, the average ISRG stock price target implies 4.2% upside potential.

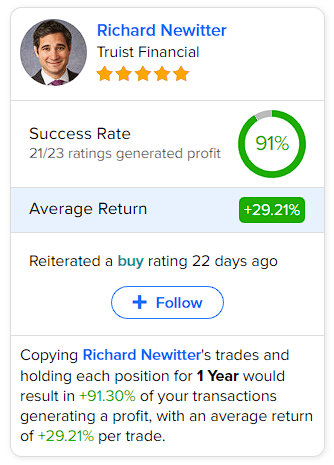

If you’re wondering which analyst you should follow if you want to buy and sell ISRG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Richard Newitter from Truist Financial, with an average return of 29.21% per rating. See below.

The Takeaway

Intuitive Surgical’s investment prospects appear divisive. Nobody can deny that the company dominates the robotic-assisted surgery industry with an expanding number of systems installed. The demand for minimally-invasive procedures is on the rise, which bodes well for recurring revenue from procedures and services. Additionally, it is worth noting that ISRG’s balance sheet boasts a rare and desirable characteristic in today’s rising-rate environment — no long-term debt.

Nevertheless, the potential risks of the company’s current valuation levels cannot be ignored. Despite analysts forecasting mid-teens growth in earnings per share over the medium term, the stock appears to be notably overvalued at a forward P/E of 52. Given the lack of a margin of safety against a potential heavy valuation multiple compression, investors should be wary of Intuitive Surgical’s investment case.